The Energy Information Administration reported a draw of 7.525 million barrels in crude oil inventories in its Weekly Petroleum Status Report for the period ended July 11, 2014. The drop is the largest since a January 11, 2014 draw of 7.628 million barrels and far exceeded the estimates of ten economists polled by Bloomberg.

The current reduction is more than three times the average economist estimate of -2,100 and nearly twice the highest estimate of -3,600.

Click here for EnerCom’s Crude Oil Cuttings Inventory Report.

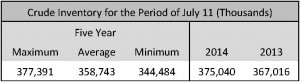

Despite the reduction, current inventories are still 4.5% (16.2 million barrels) above the average mark for the last five years. It is currently less than 1% (just 2.351 million barrels) below the five year high.

Following the release, KLR Group issued a note that maintained its long term spot prices for Brent and NYMEX at $105 and $97.50, respectively. However, the Brent/WTI spread shifted to the $5 to $10 range as opposed to a previous estimate of $7.50.

According to The Wall Street Journal, Morgan Stanley said: “The physical market appears oversupplied for now as crude supplies rebound at a time of poor refining margins. The issue is further compounded by the reopening of Libyan ports.”

According to The Wall Street Journal, Morgan Stanley said: “The physical market appears oversupplied for now as crude supplies rebound at a time of poor refining margins. The issue is further compounded by the reopening of Libyan ports.”

Phil Flynn, an executive at Price Futures Group, added: “We definitely have a bullish tilt to the market. Based on these strong demand numbers, we may have hit a short-term bottom on oil prices. It’s not piling up in storage. If they can produce that much product and not build inventories then it’s obvious that there’s demand somewhere.”

Refinery rates also rose by 2.2% and operated at 93.8% capacity for the week, according to the EIA. Specifically, Midwest refineries operated at 100.3% capacity and received the second most crude input, trailing only the Gulf Coast. Total refinery output is the highest since 1989, according to Bloomberg.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.