OPEC Cuts Demand Forecast

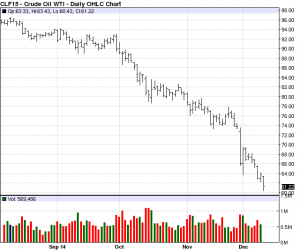

OPEC cut demand forecast for its crude oil to a 12-year low, sending oil prices, energy shares and the overall stock market into a dive on Wednesday. West Texas Intermediate (WTI) traded at a day low of $60.43. On top of the OPEC demand cut, U.S. inventories increased on a day when expectations were for a decrease. The TSX fell 342.78 with energy stocks leading the crush. The Dow Jones Industrials, which has been flirting with 18,000, dropped 268 on Wednesday.

OPEC reduced its projection for 2015 by about 300,000 barrels a day to 28.9 million in its monthly report today, Bloomberg reported. Inventories of U.S. crude oil rose to the highest seasonal level in weekly data that started in 1982, the Energy Information Administration reported.

“We are still searching for the bottom, and may not find it until OPEC changes policy or low prices begin to eat into production,” Eugen Weinberg, head of commodities research at Commerzbank AG, told Bloomberg.

Saudi oil minister Ali Al Naimi told reporters at a UN global warming conference, “Why should I cut production?” A number of analysts believe Saudi is testing the sustainability of the U.S. shale boom by not being willing to cut its production, even under pressure from fellow OPEC members. “They are willing to let this thing crash and see what it does to U.S. shale producers,” one analyst said about the Saudi minister’s statement. Many traders and energy analysts have expressed similar sentiment in recent weeks, saying OPEC has lost its power, with Saudi calling the shots.

In spite of falling prices, U.S. oil output is forecast at the highest level since 1972, EIA Administrator Adam Sieminski said in a statement.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

Raymond James Equity Research

DOE Petroleum Inventories Update

This week's petroleum inventories update was extremely bearish relative to consensus. "Big Three" petroleum inventories (crude, gasoline, distillates) rose by 15.2 MMBbls, 10 times higher compared to consensus estimates for a build of 1.5 MMBbls. Of note, this represents the second biggest "Big Three" build since 1996. Crude inventories increased by 1.5 MMBbls, versus consensus calling for a draw of 2.7 MMBbls. Cushing crude inventories rose by 1.0 MMBbls, while Gulf Coast inventories rose by 0.5 MMBbls. Total petroleum inventories were up 7.5 MMBbls from the previous week.

Refinery utilization rate was 95.4%, up from 93.4% last week. Total petroleum imports were 9.2 MMBbls per day, up from 9.1 MMBbls per day last week. On a four-week moving average basis, imports are down 0.2 MMBbls per day versus last year. Total petroleum product demand fell 1.9% after last week's 3.2% decline.

Amid a rapidly shifting macroeconomic and geopolitical backdrop, there has been plenty of volatility in oil prices over the past year - including an exceedingly sharp correction from August through the present, taking prices to five-year lows following OPEC's Nov. 27 decision not to cut production. The bounce in the first half of 2014 was mainly driven by improved economic data as well as geopolitical instability (Libya, Syria, South Sudan, Iraq). More recently, negative datapoints have come out of several key economies: China, Japan, and the eurozone. Demand continues to decline for OECD countries in aggregate, and demand growth in China and other emerging markets is slow, in part due to declining oil intensity. On the supply side, non-OPEC supply is trending up, driven largely (though not exclusively) by robust growth in the U.S. Of course, the wildcard remains the possibility of supply disruptions (above and beyond the lingering outages in Libya), as evidenced by the crisis in northern Iraq (although it has had virtually no impact on oil production thus far). The geopolitical risk premium in oil prices has clearly subsided, and concurrently, strength in the U.S. dollar has further pressured oil prices. Balancing all of the above variables, in October we lowered our 2015 Brent forecast to $90/Bbl (vs. $110/Bbl previously). For WTI, our 2015 forecast as of October has been $75/Bbl (vs. $85/Bbl previously). For some context, the 12-month futures curve is currently at $67.68/Bbl for Brent and $62.28/Bbl for WTI.