Plains All American Pipeline (ticker: PAA) and its general partner, Plains GP Holdings (ticker: PAGP), held their 2015 Analyst Day in New York on June 4. The consortium began its presentation by reflecting on a section from its 2014 Analyst Day, titled “Planning for Continued Industry Growth; Preparing for Periodic Disruptions; Positioned to Deliver Solid Results in Either Environment.”

Disruptions certainly occurred in the time between its respective meetings, but PAA believes its existing network, organic growth projects and stable balance sheet insulates itself from the recent downturn. PAA mentioned it is one of four Master Limited Partnerships (MLPs) to hold a BBB+ investment grade rating from Standard & Poor. The rating agency conducts reviews on a total of 122 MLPs.

PAA’s Crude Perspective

PAA’s expansive network of more than 18,000 miles of pipeline provides the company with a firsthand view of North America’s oil and gas environment. Management said it is “encouraged” by the rebalancing act of the marketplace, which is coming into view as production growth is declining. However, the company is exhibiting caution as the industry continues through the transition, and believes oil prices may experience strain for the remainder of 2015. PAA notes that the crude export ban only makes these matters more difficult.

PAA’s enviable balance sheet and $4.4 billion in liquidity makes the company a popular pick for acquisitions, but management said the current asking prices are too high – especially since PAA is taking a guarded approach to becoming too invested in the volatile market. Several companies have successfully extended their lifelines by means of private equity investments, ultimately making the M&A market less of a feeding frenzy than initially expected.

North America Still has LOTS of Running Room

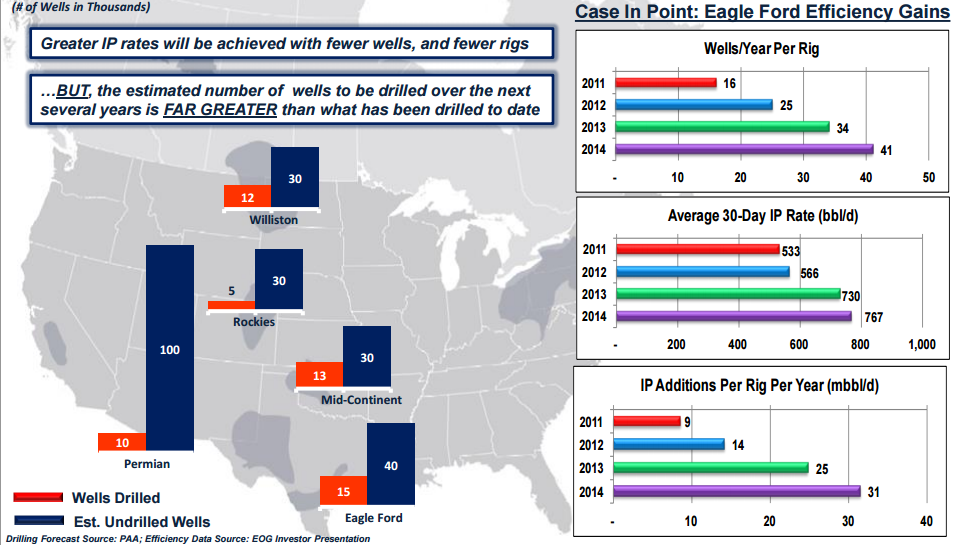

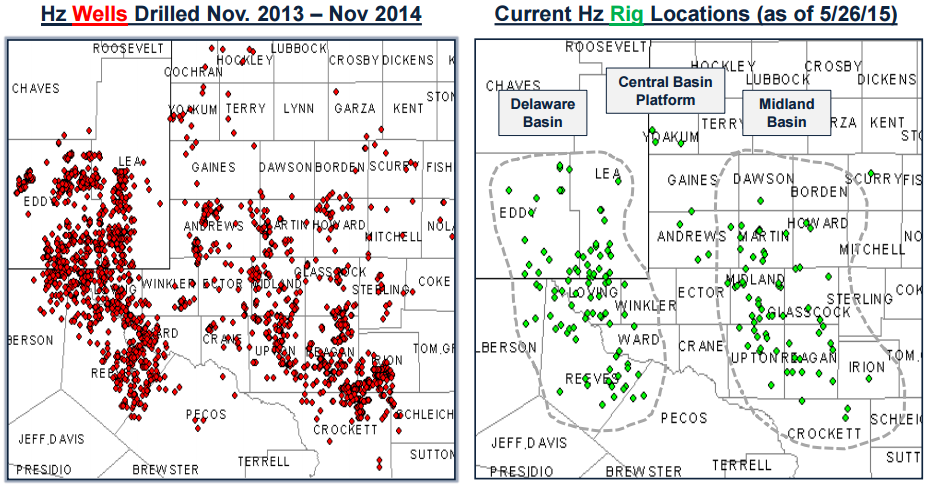

Acreage in the major basins and shales have largely been snapped up by E&Ps, but that doesn’t mean industry activity will be capped. PAA believes there are more than 190,000 additional horizontal well locations in the Denver-Julesburg, Eagle Ford, Permian and Williston plays. An estimated 38,500 of those horizontals have been drilled since 2009, and companies are improving drilling techniques on what seems like a daily basis. PAA estimates that 65% of current production is sourced exclusively from wells drilled in that time frame.

North America, at least Canada and the US, is part of the long-term solution. PAA says the two nations accounted for 100% of crude supply growth since 2011, while the rest of the world (excluding OPEC) actually declined in volumes by 0.6 MMBOPD in the same time frame. While activity and volumes from the United States has skyrocketed in recent years, the rather rapid decline curves require producers to maintain its feverish drilling pace to sustain production. Not maintaining the pace will result in a reduction of 2.2 MMBOPD in just 12 months, and overall production would be cut in half as early as 2018. That projection, however, is at $50 oil prices – an amount PAA does not believe is sustainable.

$50 Oil is NOT Here to Stay

Only the core areas of the best basins are economic at $50/barrel and $3/MMbtu prices, says PAA. The Eagle Ford and Permian, along with only the very best areas of the Williston, offers return at such prices. The drastic shift completely changes the game involving investment decisions, as indicated by a PAA case study below.

The sharp drop in operating rig counts has surprised the markets, including PAA. The company estimates the rig count as of May 18, 2015 is more than 60% below levels seen in October 2014 and is currently about 8% below the “rig trough.” PAA believes oil will settle in the $60 to $70 range as early as 2016 once the markets correct themselves.

Hang in There!

Near-term prospects for the industry will likely be challenging, warns PAA. The record-high inventory levels and possibility of additional incoming international production (from Iran and Libya, for example) will likely place downward pressure on oil prices, but the commodity swoon allows for North American operators to pause and reassess their respective positions. Efficiency gains and cost reductions will lower breakeven prices and the industry’s long-term outlook appears to be “fundamentally sound.”

PAA, meanwhile, is positioning itself for long-term projects that may span as much as 70 years. The oil price curveball has created unprecedented uncertainty, adding to PAA’s cautious approach to future growth projects. The company anticipates a slow but steady pace of “constructive consolidations for the next 12 to 24 months… or longer.”

Where Does PAA Fit into the Recovery Cycle?

Plains All American holds very key positions in the focal points of North American midstream. Approximately 23% of storage in Cushing belongs to PAA, along with a significant portion of the St. James terminal in Louisiana. Its Cactus Pipeline was one of the first to connect the Permian to the Eagle Ford, creating a strategic advantage to more outlets in the Gulf Coast. Its buildout in Canada touches 32% of all produced conventional crude, and the company plans on more than doubling its heavy grade oil storage to accommodate future development.

The midstream provider also utilizes a fee-based system to set the tables for organic growth. Approximately 98% of all invested capital is aimed at fee-based projects and, according to its Analyst Day presentation, generates unlevered returns in the teens. The company is assumedly seeing attractive opportunities, considering its portfolio of organic growth projects increased by $2 billion year-over-year to $9.5 billion overall. The more guaranteed rates of return will provide further boost to its distribution program, which has increased in 42 of the last 44 quarters.