The Federal Reserve Bank of Dallas released its monthly report of energy-related economics, based on the bank’s September data.

Dallas Fed: Backwardation for Brent

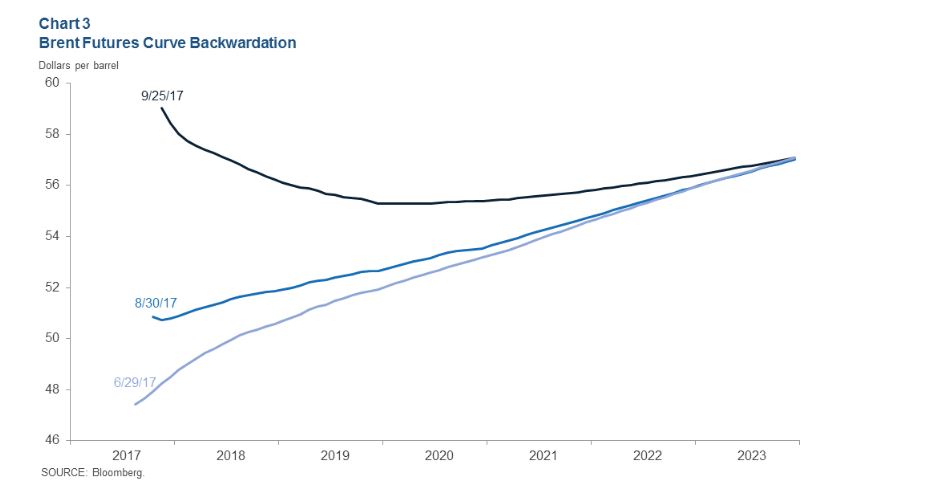

“The Brent futures curve went into backwardation (downward sloping) through year-end 2019 on Sept. 25, 2017, a shift in the shape of the curve compared with the end of June when it was fully in contango (upward sloping) (Chart 3).

“An oil futures curve in backwardation can be seen as a sign of demand in the near-term outpacing supply, with higher near-term prices incentivizing market participants to sell today rather than place crude into storage. Strong OPEC compliance, continuing signs that the global market is rebalancing, and higher-than-expected global demand have helped drive strength to the front part of the curve,” the Texas-based central bank said in its report.

Oil and natural gas prices

“The average WTI spot price increased to $49.82 per barrel in September from $48.04 in August on continuing signs that the global oil market is rebalancing (Chart 1). Strong OPEC compliance, geopolitical issues and strong demand drove the increase in crude oil prices. Henry Hub natural gas prices were $2.96 per million British thermal units (MMBtu) in September, compared with $2.87 in August,” according to the central bank.

Rover starts moving natural gas out of Appalachia

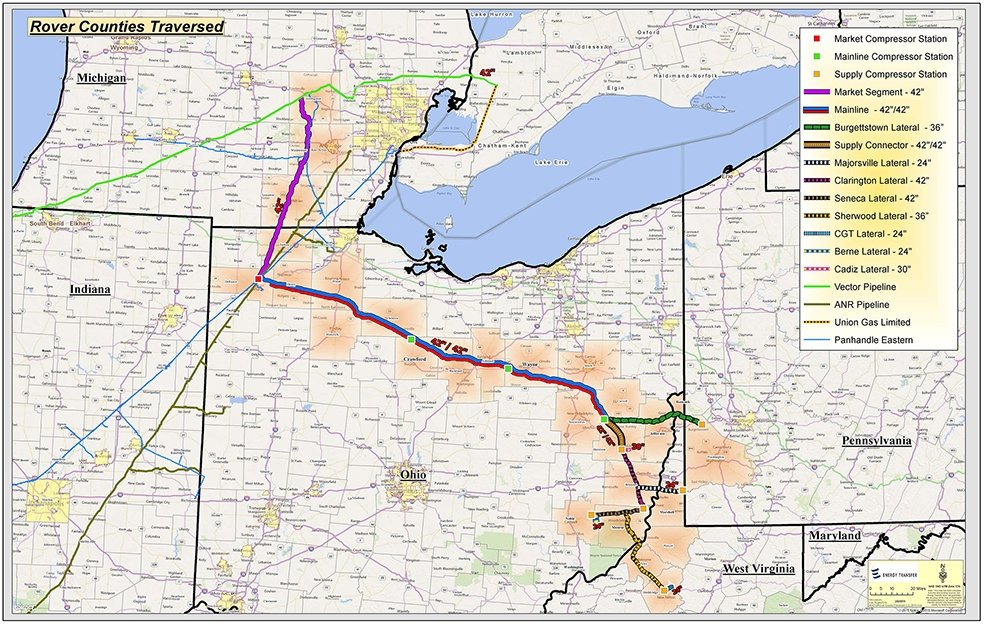

The Dallas Fed noted that Energy Transfer began partial service of the Rover Pipeline at the start of September, “adding to gas flows from the Marcellus basin to markets in the Midwest. Once fully in service, the pipeline will have a design capacity of 3.25 billion cubic feet per day (Bcf/d). The futures curve for Henry Hub continues to remain flat at roughly $3/MMbtu on expectations of ample supply of natural gas to meet demand,” the Dallas Fed reports.

The Rover Pipeline is a 713-mile natural gas pipeline designed to transport 3.25 billion cubic feet per day of domestically produced natural gas from the rapidly expanding Marcellus and Utica Shale production to multiple markets across the U.S. as well as into the Union Gas Dawn Storage Hub in Ontario, Canada, for redistribution back into the U.S. or into the Canadian market, according to Energy Transfer Partners.

Energy Transfer said the pipeline will transport gas from processing plants in West Virginia, Eastern Ohio and Western Pennsylvania for delivery to pipeline interconnects in West Virginia and Eastern Ohio as well as the Midwest Hub near Defiance, Ohio, where more than half of the gas will be delivered for distribution across the U.S.

On Oct. 9, 2017, Energy Transfer announced it had received approval from the Federal Energy Regulatory Commission (FERC) to begin operating three compressor units at its Mainline Compressor Station 1 in Carroll County, Ohio. “Phase 1A of the pipeline can now move more than 1 billion cubic feet per day of natural gas from Cadiz, Ohio, to Defiance, Ohio, which brings the project closer to its design total of 3.25 billion cubic feet per day. Phase 1A began operating on August 31, 2017. Phase 1B of the pipeline from Seneca, Ohio, to Cadiz, Ohio, is anticipated to be complete by the end of the year. The Rover Pipeline Project is expected to be in full service by the end of the first quarter of 2018,” Energy Transfer said in a press release.

Crude inventories

The Fed said crude oil inventories in Cushing, Oklahoma, rose significantly in September by 5.2 million barrels to 62.5 million (9.1 percent increase), while U.S. commercial crude oil inventories excluding Cushing rose by only 2.0 million barrels to 402.5 million (0.5 percent increase) (Chart 2).

“Rising production in the U.S. coupled with temporary refinery outages from Hurricane Harvey have pushed more production into storage in Cushing, deepening the discount between WTI and Brent. The WTI–Brent spread widened to -$6.33 per barrel in September from -$3.66 in August, the largest discount since March 2015. Crude exports for the U.S. reached record levels toward the end of September as marketers took advantage of the differential,” the bank said.