Executives expect $48.80/bbl WTI at yearend, down from Q1 survey expectation of $53.50

“The exploration and production industry needs to get used to the paradigm that oil prices will be set for the next several years by the breakeven prices needed to drill Permian Basin shale wells because there is a lot of tiger in this tank!”

Those comments were from one of the Federal Reserve Bank of Dallas’s oil and gas industry survey respondents in its quarterly Energy Survey results released today. The survey outlines the thoughts of oil and gas industry executives.

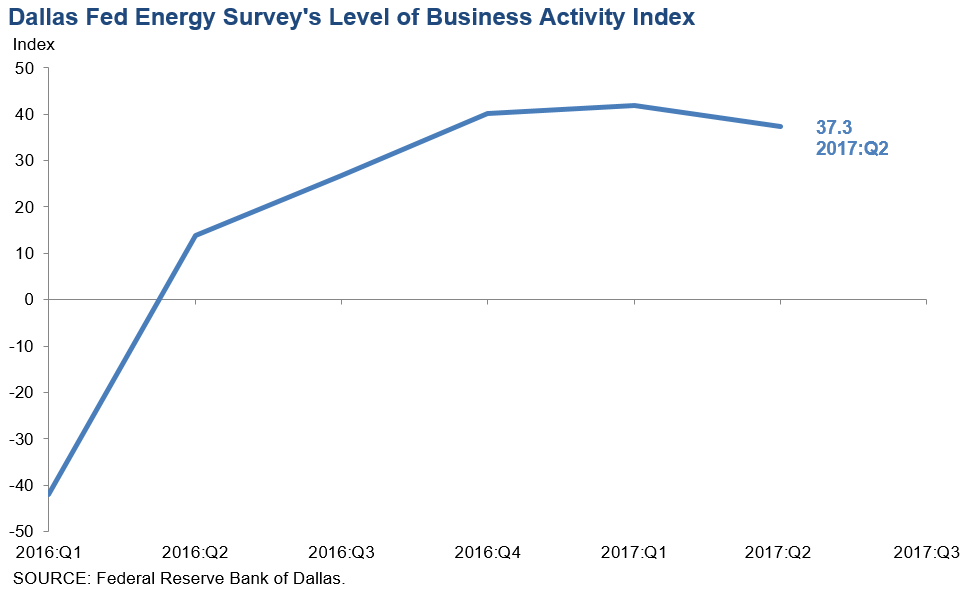

Business activity increased in the second quarter of 2017, though at a slower pace than in Q1. The Dallas Fed’s business activity index, which outlines the overall conditions facing energy firms, was relatively high this quarter, but below Q1 levels.

Business activity for oilfield service firms increased in Q2 to the highest levels since at least 2016, when the Dallas Fed began this survey. The increased activity among service firms has translated to employment data. According to the Fed, employment, employee hours and wages and benefits increased in Q2, driven by service operations.

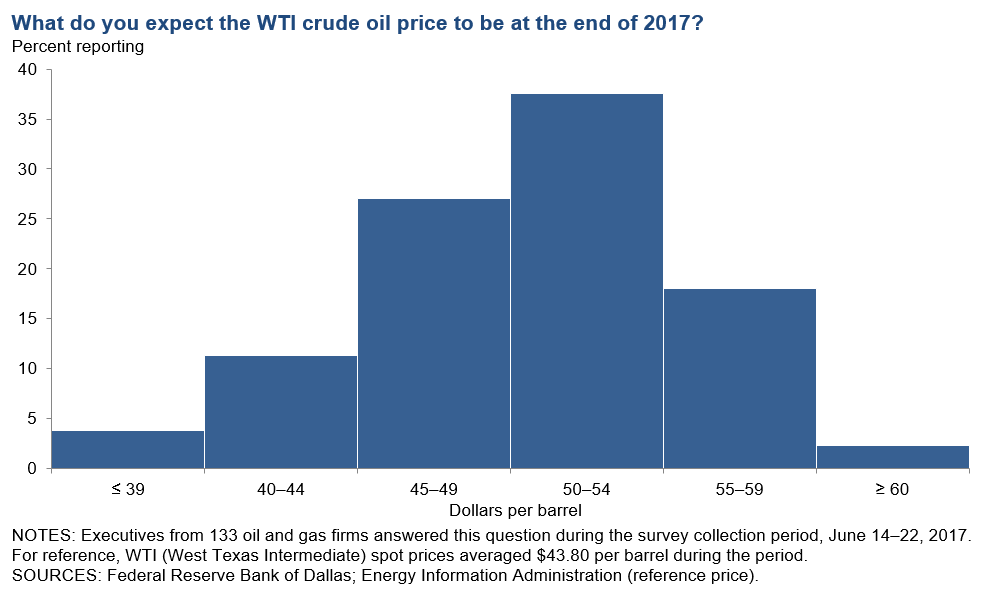

Companies pessimistic about WTI price picture

The respondents to the survey are more pessimistic about the prospects for WTI prices in the rest of this year. In the Q1 2017 survey, oil and gas executives predicted year-end WTI prices would be around $53.50/bbl, while the most recent survey predicts $48.80/bbl.

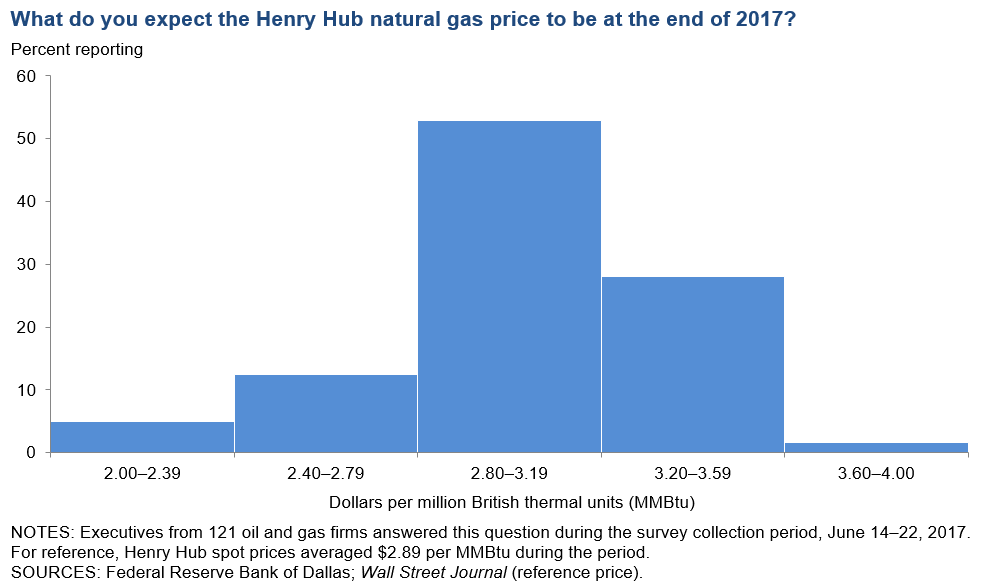

Survey respondents expect year-end Henry Hub natural gas prices to be an average of $3.01/MMBTU, up from the $2.95 predicted in the previous survey.

OPEC cuts are a big question

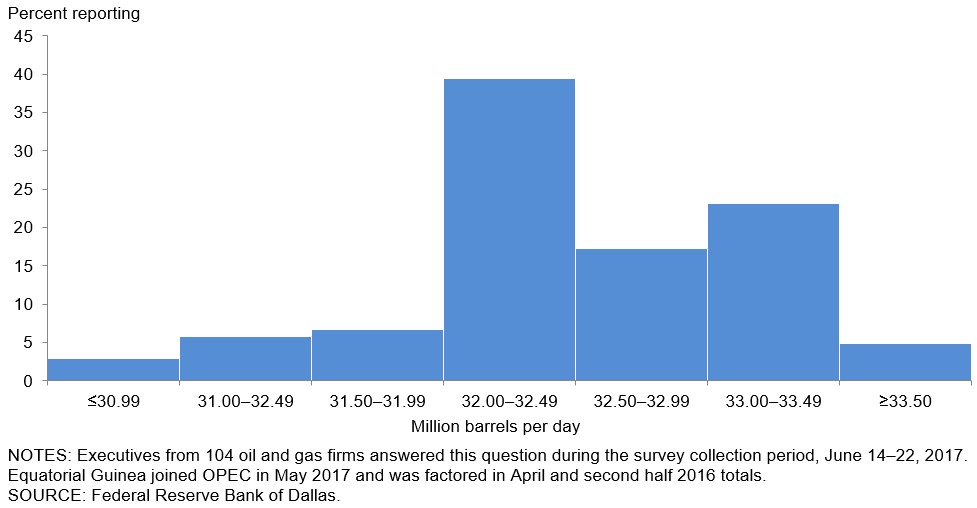

Along with the standard questions of activity level and price expectations, the Fed survey asked several questions on the recent OPEC cut extension.

Most executives do not expect the market rebalance to occur soon, and only 19% believe that the market is already balanced or will balance in 2017. Nearly half of respondents expect the market to balance in 2018, with Q2 2018 the most popular response. However, one third of all surveyed predicted that the market will not rebalance until 2019, or even later than that.

Like the rest of the global oil market, survey respondents are uncertain if OPEC will extend cuts beyond the current expiration date of March 2018. 55% of those surveyed predicted further production limits, while 45% did not.

OPEC production was around 32.0 MMBOPD in April, down from 33.3 MMBOPD in late 2016. Theoretically, the extended production cuts should keep production at this level through the second half of 2017. However, executives do not all expect cuts to remain as successful the rest of the year as they currently are. While about 40% of survey respondents expect cut compliance to be at or near 100%, about 45% expect production to increase. A small portion expects production in the second half of 2017 to exceed that of 2016.

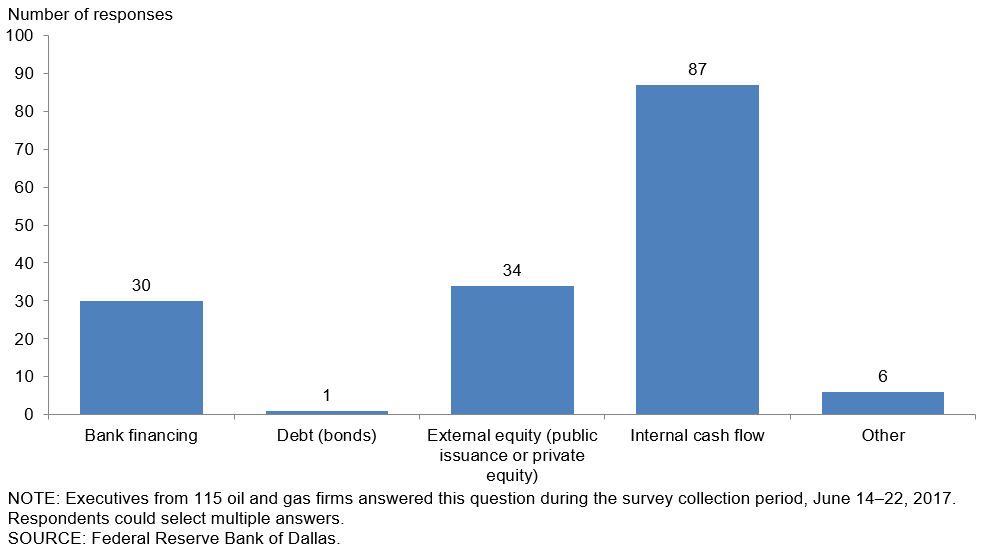

75% expect to finance activity from cash flow

The final question in the Fed’s survey considers how firms will finance increased activity. The vast majority of the respondents to this question, 87 out of 115, expect internal cash flow will support increased activity. External equity and bank financing are also commonly expected sources of financing. Only one executive expects to use debt in the form of bonds to support increased activity.

Comments show mixed sentiments

The Fed survey also allowed respondents to leave comments, which often give insight into the respondents’ companies’ outlook. Some of the comments were:

“There is not enough time in the day to cover all the due-diligence jobs due to the acquisitions and divestitures between companies. I’ve had to put on extra crews to handle different areas and to handle all the requests, and there is still plenty to go around. Nice problem to have!”

“Currently, we are still responding to the weekly increase in rig activity. Since our business is completions focused, we should have some lead time to react to any decline in activity as a result of weak prices for WTI. Today, we are sold out and trying to add capacity, but that situation could change abruptly.”

“‘Uncertainty’ seems the best description. Rig count and production continue to grow, while commodity prices are as uncertain as ever. Any animal spirits seem to be tamped down as quickly as they emerge.”

“The exploration and production industry needs to get used to the paradigm that oil prices will be set for the next several years by the breakeven prices needed to drill Permian Basin shale wells because there is a lot of tiger in this tank!”