Activity growing, but growth slowing: Fed survey

The Federal Reserve Bank of Dallas released its quarterly Energy Survey today, giving the results of the bank’s survey of energy executives.

Overall, these energy executives reported that business activity continues to increase, though at a slower pace than earlier in the year. The Fed’s business activity index, intended to represent changes in overall conditions and activity, was 27.3 in Q3. This number is positive, representing growth in the third quarter, but is not as high as the 37.3 reported in Q2, meaning growth has slowed. This is the sixth quarter in a row that has seen a positive business activity index, indicating the industry has been recovering for six quarters.

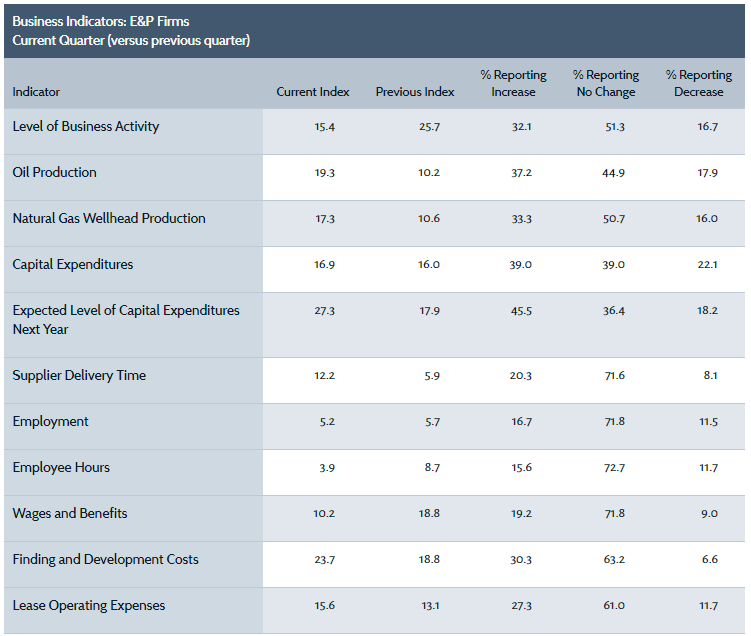

Both E&P firms and service firms reported activity growth in Q3, but service companies showed significantly higher levels of growth. The Fed’s E&P-specific business activity index is 15.4 this quarter, compared to a service-specific index of 41.6. Both sides of the industry reported increases in company outlook, with only 9.6% of companies reporting a worsening outlook.

All of the Fed’s more specific indices were positive also, results that are consistent with increases in activity. Oil and gas production, capital spending, employment and expenses all grew in Q3.

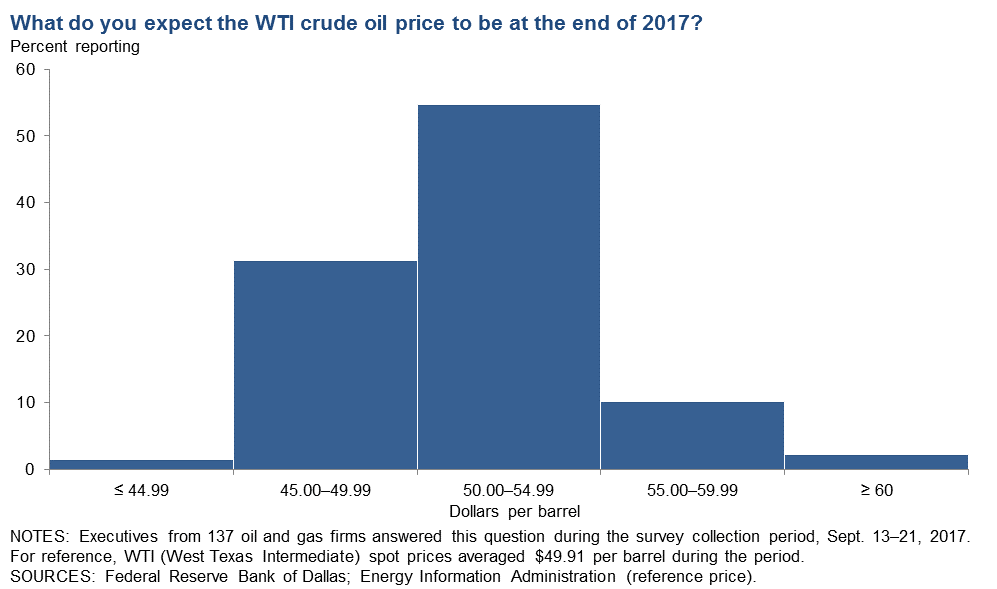

Expected WTI price rises, gas price steady

The Fed also surveyed executives on expected oil and gas prices. The average predicted year-end WTI price is $50.20/bbl, higher than the average of $48.79/bbl last quarter. Unsurprisingly, the range of expected prices narrowed, as there is less time for the current environment to change before year-end. The highest and lowest prices forecast this quarter were $63 and $40, compared to $30 and $65 last quarter.

The expected natural gas price, on the other hand, was virtually unchanged from Q2. The average predicted Henry Hub price at year-end was $3.02/MMBTU, compared with $3.01/MMBTU last quarter. The highest and lowest predicted prices were also unchanged at $4 and $2, respectively.

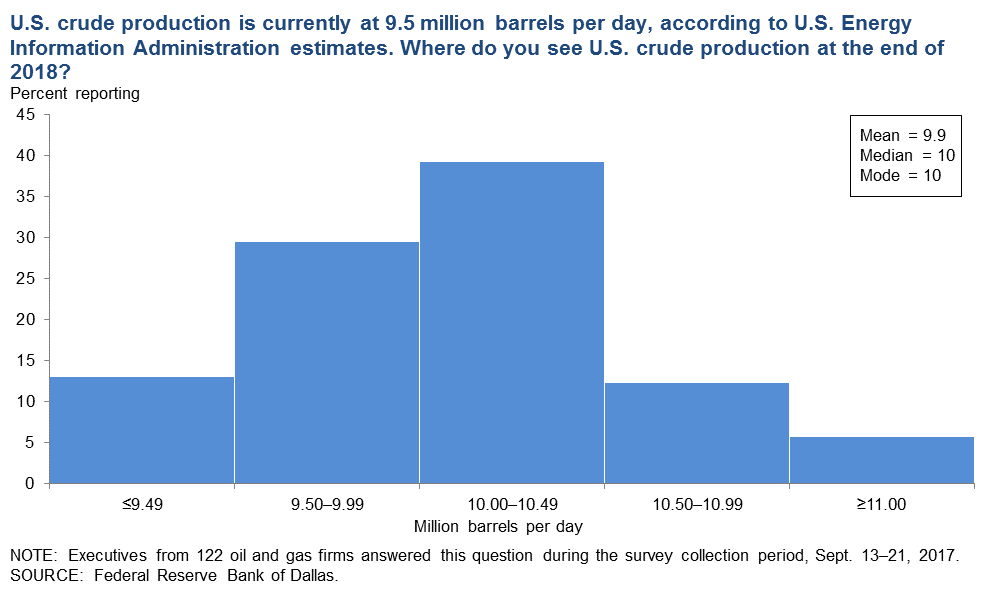

Production expected to grow by ~500 MBOPD

In addition to the standard questions regarding prices and activity levels, the Fed asked several special questions this quarter. The first of these addressed oil outlooks, asking “Where do you see U.S. crude production at the end of 2018?”

Less than 15% of executives predicted a decline from current levels, but most were more pessimistic than the EIA and IEA. The average expected production was 9.9 MMBOPD, and more than one-third of executives predicted exactly 10 MMBOPD. Current production is about 9.5 MMBOPD, so some growth is expected. The EIA’s Short-Term Energy Outlook, by contrast, predicts 10.1 MMBOPD at year-end 2018, and the IEA’s Oil Market Report expects 10.4 MMBOPD.

The Fed also asked several questions regarding the effects of Hurricane Harvey, inquiring on the immediate and six-month impacts. Only 28% of energy executives reported no negative impact from the storm, while 53% reported slight negative impacts. 18% of respondents indicated moderately severe impacts, and only 1% were severely affected.

Most expect these effects will diminish in time, and 62% expect no lingering effects in six months. Most of the remainder predict only slight effects, and only 8% expect moderate or severe affects in six months.

Executives do predict larger overall effects, though. More than half of those surveyed, 55%, expect Hurricane Harvey will still have slight negative effects on the broader energy sector six months from now. Nearly one quarter expect moderate effects, while 18% predict that all effects will have been mitigated in six months.

Comments reflect wide range of views

Executives were also able to make comments on the state of the industry, which showed significant variability in outlook.

- Any production/supply reduction (or status quo, for that matter) that is experienced in the next six months is entirely synthetic. If OPEC/Russia were to take their foot off the brake, supply would increase fairly dramatically, consequently negatively impacting crude prices. Domestic production will continue to increase in the $48–$52-per-barrel environment as access to capital will be sufficient to materially maintain capital expenditure budgets at least into the first half of 2018. As trite and overused as the statement has become … the cure for low oil prices is low oil prices.

- There is an improving mood in the industry.

- We have found several projects that work at the lower crude price and are expecting to increase our production from these areas.

- In the absence of an “event”—material, political, economic or military—crude should trade in a fairly narrow channel in the $50–$60-per-barrel range. If there is an event, particularly a military event, whether in Asia or the Middle East, there is the potential for grossly exaggerated price inflation, particularly if the event is in the Middle East. As somewhat a pessimist, I expect an event.

- The ability to find employees to fill open positions is becoming problematic. Immigration and Customs Enforcement raids of various oilfield servicing and other industries in the South Plains district have reduced the available workforce by 40 to 50 percent, resulting in significant wage pressures due to competition between all industries drawing from the same reduced employee pool.

- I am still optimistic about West Texas activity levels. Pipeline and other infrastructure projects are doing well. It was interesting to see the effects of that much water in and around hurricane-affected areas. East Texas is still lagging behind the rest of the industry, but there are hopeful signs that activity might be picking up.

- We are still trying to find that new “normal.” With gross margins down significantly, we are breaking even most months and occasionally posting a small companywide profit.

- For starters, the Internal Revenue Service has no compassion for the small businesses; no matter rain or shine, they want their money. We have paid penalty fees and interest on borrowing, and we get no credit whatsoever. We had 63 employees, and now we are down to 36 employees in my trucking oilfield business company (vacuum trucks). I put it up for sale and had no luck; I am left with no choice but to close the business by the end of this year. The oilfield industry is not easy; waiting two to three months to get paid and paying the IRS every week is not an easy task. Good luck to the rest of the companies out there working in the oil industry. Be safe!

- The unknowns are still, in no particular order: OPEC, expiration of hedging contracts, and return on investment. With OPEC, the questions are the same as last quarter: Will they continue their cuts, are they enforceable and are they enforced? Hedging contracts should expire at the end of the year for almost all those who hedged their oil; the question is, what will be the effect? Will drilling decrease? Will there be bankruptcies? But the big question is whether “other people’s money” flowing into the oil business will continue to saturate leasing, drilling and completions. For the time being, the oil and gas business is an attractive place for investors who know little or nothing about the realities of the oil and gas industry. Whether they will continue to be happy with the return on their investment, particularly in horizontal wells, remains to be seen.