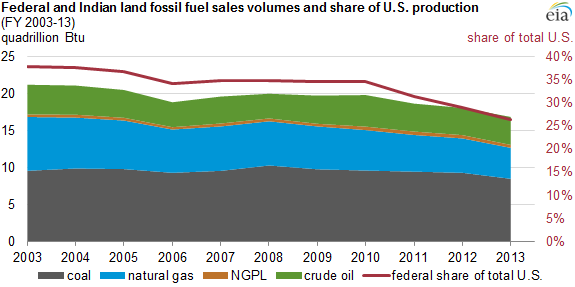

The United States Energy Information Administration reported today that production of fossil fuels from federal and Indian lands fell 7% in FY2013, compared to production in FY2012.

“Since FY 2003, sales of fossil fuels produced on federal and Indian lands have fallen 21%, driven by declines in natural gas production and coal production. From FY 2003 to FY 2013, total U.S. fossil fuel production increased by 14%, with a 34% increase in production from nonfederal, non-Indian lands offsetting the decline from federal and Indian lands,” the EIA report said.

Source: U.S. Energy Information Administration, U.S. Department of the Interior

Note: The federal fiscal year runs October 1-September 30. NGPL denotes natural gas plant liquids.

The declining sales were attributed in large part to the drop in offshore natural gas production, “even as total U.S. natural gas production has grown rapidly due to rising production from onshore shale resources on private lands,” the report said.

Drilling Permits on Federal Lands Take Almost Three Times Longer than on Private, State Lands

The U.S. Chamber of Commerce pointed out on its energy blog that oil and gas production on private lands has been increasing since 2009, and at the same time production on taxpayer-owned federal lands has been decreasing.

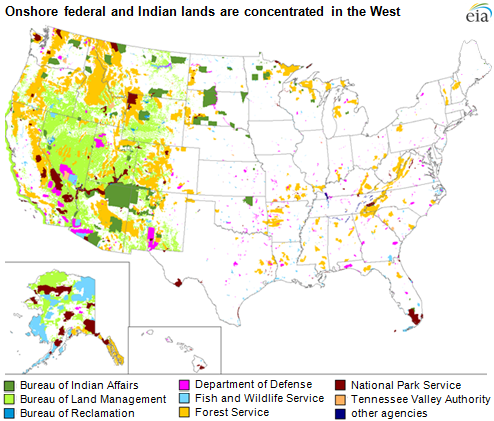

The Chamber points to a Department of Interior Inspector General report that revealed the fact that obtaining drilling permits on federal lands is a long process, fraught with uncertainty. Most state regulators take about 80 days to approve oil and gas drilling permits, while the U.S. government’s Bureau of Land Management (BLM), takes about 225 days to approve a permit, the report said.

A Congressional Research Service report that looked into the finding said,“We found that neither BLM nor the operator can predict when the permit will be approved. Target dates for completion of individual [applications for permits to drill] are rarely set and enforced, and consequently, the review may continue indefinitely.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.