Denbury Resources Inc’s (ticker: DNR) producing acreage is spread across seven states in both the Rocky Mountain and Gulf Coast regions, with an estimated 254.5 MMBOE of proved reserves, as of December 31st, 2016.

Denbury’s primary operational trait is its utilization of CO2 enhanced oil recovery (EOR) methods to increase recovered oil to approximately 50%.

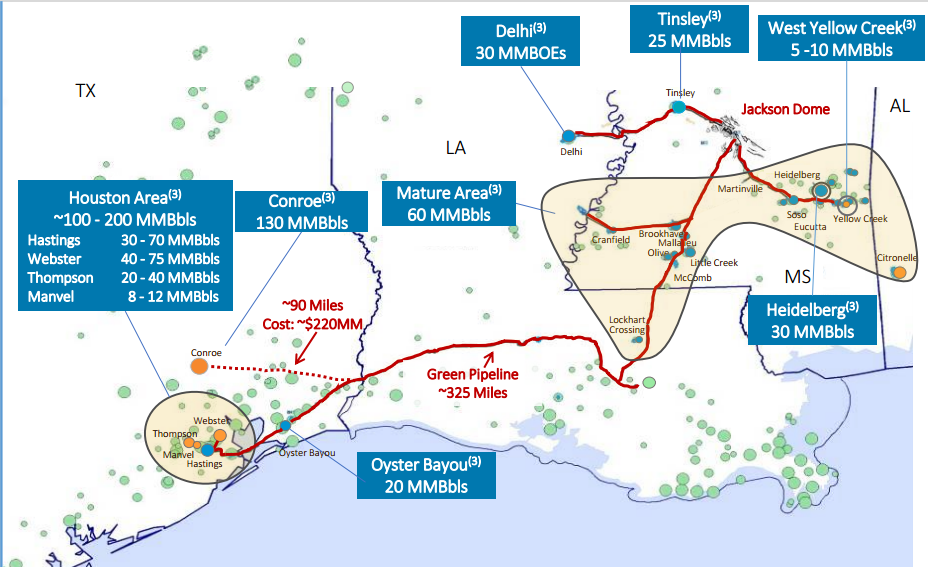

The company sources much of its CO2 from Jackson dome, where it has held reserves since February, 2001, when it acquired the field. Through smaller acquisitions, Denbury has raised its CO2 reserves estimate to 5.3 Tcf, as of December 2016, from approximately 800 Bcf at the time of the Jackson Dome acquisition. The company also sources approximately 60 Mmcf of CO2 per day from industrial sources in Louisiana and Texas.

Denbury, in its first quarter of 2017, produced just under 60,000 BOEPD. Approximately 62% of the production was attributed to CO2 EOR operations, and 97% of the production was oil.

For immediate development, Denbury has allocated approximately $300 million to its 2017 capital budget, with $175 million of that going to tertiary recovery operations—CO2 EOR. Approximately $60 million will be allocated to non-tertiary operations; $55 million to capitalized items like internal acquisition, exploration and development; and the remaining $10 million to developing CO2 sources.

Acquisition in the Rockies

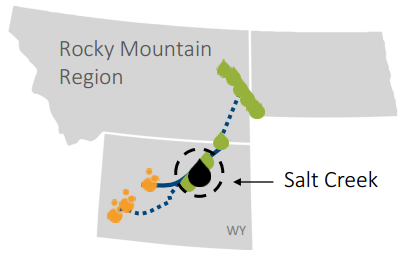

Denbury reached an agreement with subsidiaries of Linn Energy on May 30th, 2017, that it would acquire its 23% non-operated working interest in the Salt Creek Field located in Wyoming. The acquisition of the working interest was priced at $71.5 million.

The Salt Creek Field currently produces approximately 2,100 BOEPD, with a proved, developed, producing reserves value of approximately 9 MMBO.

Acquisition in Mississippi

As of May, 2017, Denbury completed an acquisition of a 48% non-operating interest in the West Yellow Creek Field for $16 million. The operator, which remained unnamed, is set to purchase CO2 from Denbury—indicating that the company can play a strategic role in utilizing its dominant CO2 infrastructure to leverage participation in other EOR floods.

CO2 potential in the future

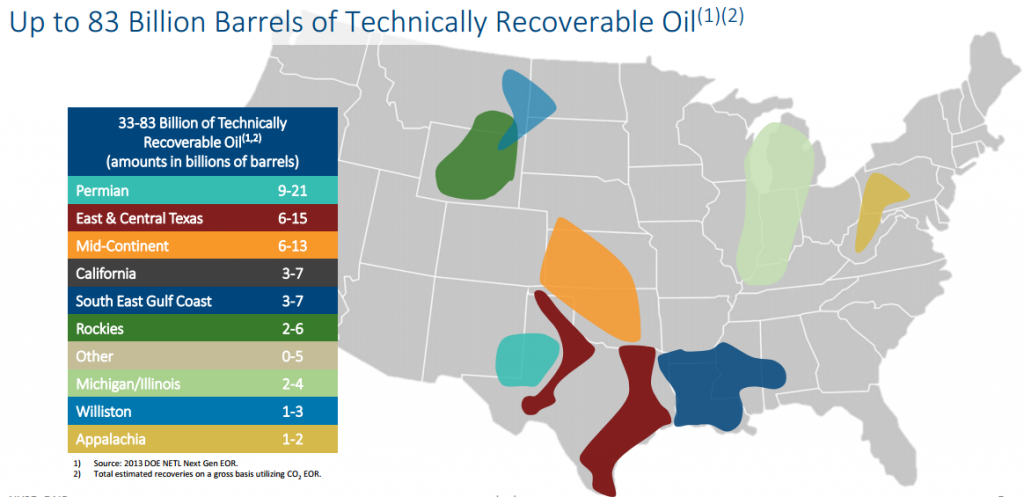

Denbury anticipates that its use of CO2 will be useful for future oil recovery projects as oil-producing fields in the United States begin to mature. According to a 2013 study done by the U.S. Department of Energy and cited by Denbury, up to 83 billion barrels of oil are technically recoverable within the U.S.

Of that potential 83 billion barrels of oil, Denbury’s current operating areas represent approximately 10% of the total recoverable potential in the U.S.

Denbury Resources is presenting at EnerCom’s The Oil & Gas Conference® 22

Denbury will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.