Denbury Resources Inc. (ticker: DNR) released its preliminary year-end 2017 proved reserves, production and capital expenditures, along with its 2018 capital budget and estimated annual production.

Preliminary Q4 2017/annual production

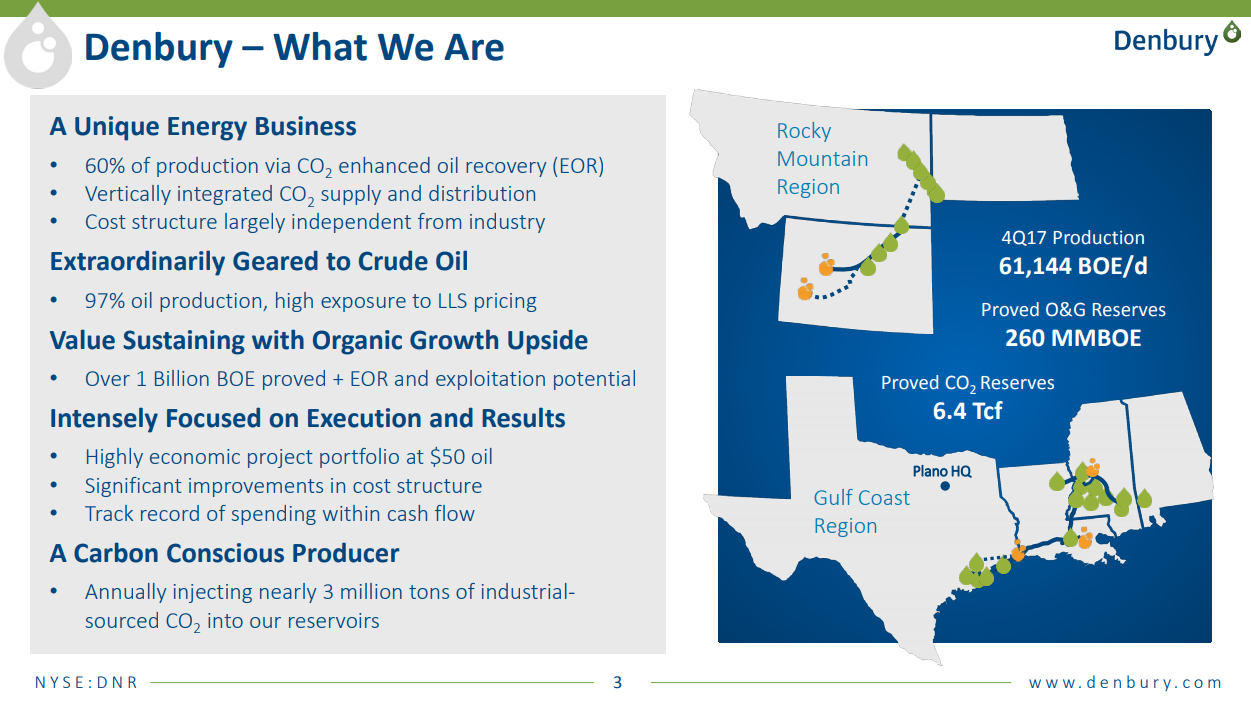

Denbury’s production averaged 61,144 BOEPD (97% oil) during the fourth quarter of 2017, with CO2 tertiary properties accounting for 65% of overall production.

Denbury’s continuing production for full-year 2017 averaged 60,298 BOEPD, down 4% from the prior-year’s level (when excluding properties sold in 2016).

Denbury Company Profile, Feb. 2018

Preliminary 2017 CapEx

Denbury’s 2017 development capital expenditures totaled $241 million, nearly 4% below the $250 million budget amount.

Total capital expenditures for 2017 also included property acquisition costs of $89 million and capitalized interest of $31 million.

2017 proved reserves

The company’s total estimated proved oil and natural gas reserves at December 31, 2017 were 260 MMBOE. Reserves were 97% liquids and 88% proved developed, with 59% of total proved reserves attributable to Denbury’s CO2 tertiary operations.

Total proved reserves increased by 28 MMBOE on a gross basis, a net 6 MMBOE increase after 2017 production, representing a 127% replacement of 2017 production.

The increase was primarily due to 15 MMBOE of positive revisions of previous estimates associated with changes in commodity prices, operating costs and performance, and 11 MMBOE due to properties acquired during the year.

2018 CapEx and production estimates

Denbury 2018 CapEx, Feb. 2018

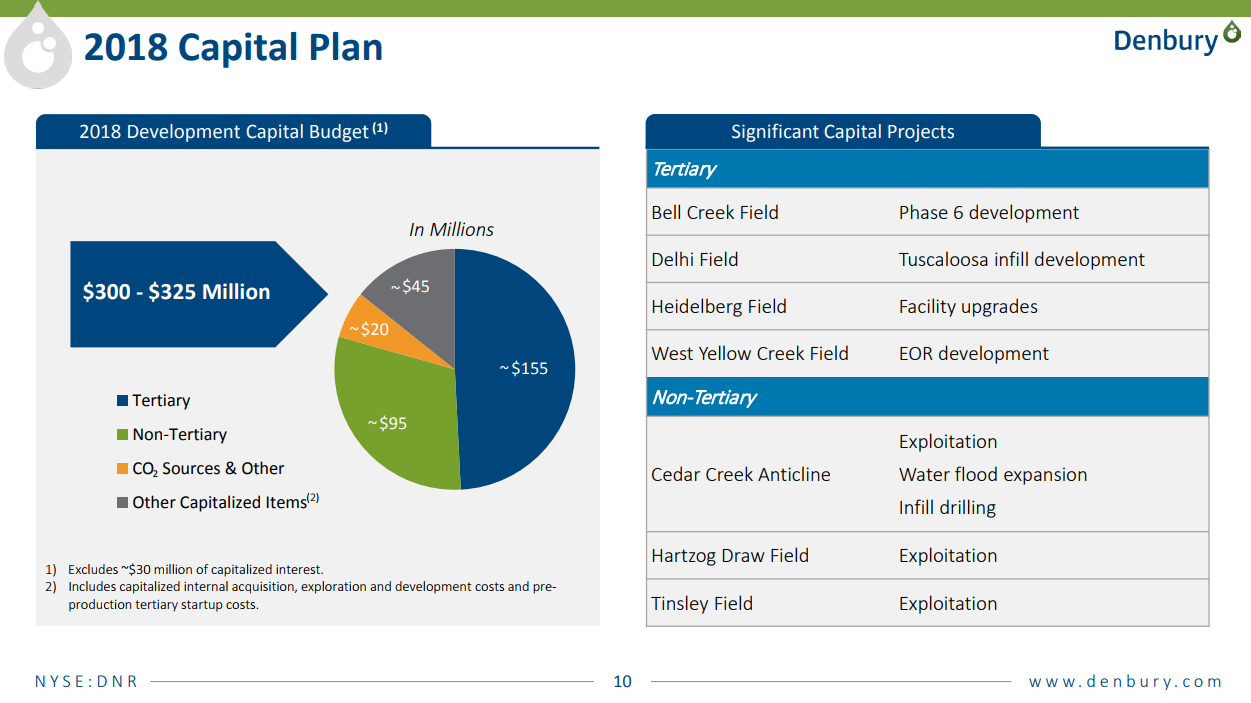

Denbury’s 2018 capital budget, excluding acquisitions and capitalized interest, is between $300 million and $325 million, roughly 30% above the company’s 2017 capital spending levels. The budget provides for approximate spending as follows:

- $155 million for tertiary oil field expenditures

- $95 million for other areas, primarily non-tertiary oil field expenditures including exploitation projects

- $20 million for CO2 sources and pipelines

- $45 million for other capital items such as capitalized internal acquisition, exploration and development costs and pre-production tertiary startup costs

In addition, capitalized interest for 2018 is estimated at approximately $30 million. At this spending level, the company anticipates 2018 production of between 60,000 and 64,000 BOEPD.

Mission Canyon finds a thousand barrels of oil a day

Denbury’s first Mission Canyon exploitation well was drilled during the fourth quarter in the Pennel Field in the Cedar Creek Anticline. The well was drilled to a vertical depth of 7,200-feet, with a 4,800-foot lateral section geosteered in a 4-foot target at the top of the Mission Canyon carbonate formation.

Reservoir quality and rock mechanics permitted an open-hole, non-stimulated completion, the company said. The well began production through an electric submersible pump on December 30, 2017. Average production over the initial 30-day production period was 1,050 Bbls/d of oil. The total cost to drill and complete the well was $3.6 million.

Denbury mobilized a rig in early February to begin drilling on a two-well pad, with first production from this pad expected in the second quarter. A total of six additional Mission Canyon wells are planned for 2018, including four development wells and two wells designed to test other Mission Canyon opportunities.

The program is expected to continue beyond 2018 as the company fully develops the play.

I believe 2018 will be a transformative year for Denbury – CEO Kendall

Denbury President and CEO Chris Kendall commented, “We returned to production growth in the 3rd quarter and are set to continue that growth in 2018. We strengthened our core, replacing 127% of our 2017 production. We significantly lowered our cost structure and streamlined our organization, providing greater upside to an improving oil market. Operational execution was strong, delivering high-return projects on time and on budget, increasing field reliability and optimizing costs.

“Capital allocation was highly disciplined, with our final spend nearly 4% below guidance. Capping off the year, Mission Canyon, a significant new exploitation test, was a resounding success, with a 100% oil, 1,050 barrels of oil per day initial 30-day average rate on a $3.6 million investment. This result… opens the door for multiple follow-on wells across the area.

“As we look to 2018, we will… maintain capital discipline, spending within cash flow while targeting production growth in the range of 3% from 2017 levels. We plan to accelerate investment in our growing exploitation portfolio, including multiple additional wells at Mission Canyon and promising new tests in both operating regions.

“We are excited to have our two newest CO2 floods starting up at West Yellow Creek and Grieve, and are highly focused on bringing initial EOR development at Cedar Creek Anticline to an investment decision in the first half of the year,” Kendall said.