Devon’s early ’18 production from Delaware, STACK up 20% over 2017 average

Devon Energy Corp. (ticker: DVN) accelerated production growth in early 2018. The company’s Delaware Basin and STACK assets are producing approximately 195,000 BOEPD. The combined daily production rates from these two assets represent a 10% increase over the fourth quarter of 2017, and a ~20% increase compared to the full-year 2017 average.

The substantial increase in daily production is driven by higher operated completion activity in the Delaware Basin and tie-in of more than 50 non-operated wells in the STACK around year-end, Devon said, and these two assets remain on track to increase oil production by greater than 35% in 2018, compared to 2017.

Q4 2017 production

Devon’s net production averaged 548,000 BOEPD in the fourth quarter of 2017. Of this total, oil production in the quarter totaled 246,000 BOPD, which was 14,000 BOPD below the company’s midpoint guidance.

In the fourth quarter, net production in the U.S. was limited by approximately 9,000 BOPD, primarily due to the timing of well tie-ins associated with non-operated activity in the STACK, Devon said. However, this timing issue has been resolved with the tie-in of more than 50 non-operated wells around year-end in the STACK.

In Canada, net production averaged 134,000 BOEPD in the fourth quarter, an 8% increase from the prior quarter. Facility modifications and temporary steam constraints at the company’s Jackfish complex curtailed production by approximately 5,000 BOPD in the fourth quarter, Devon said.

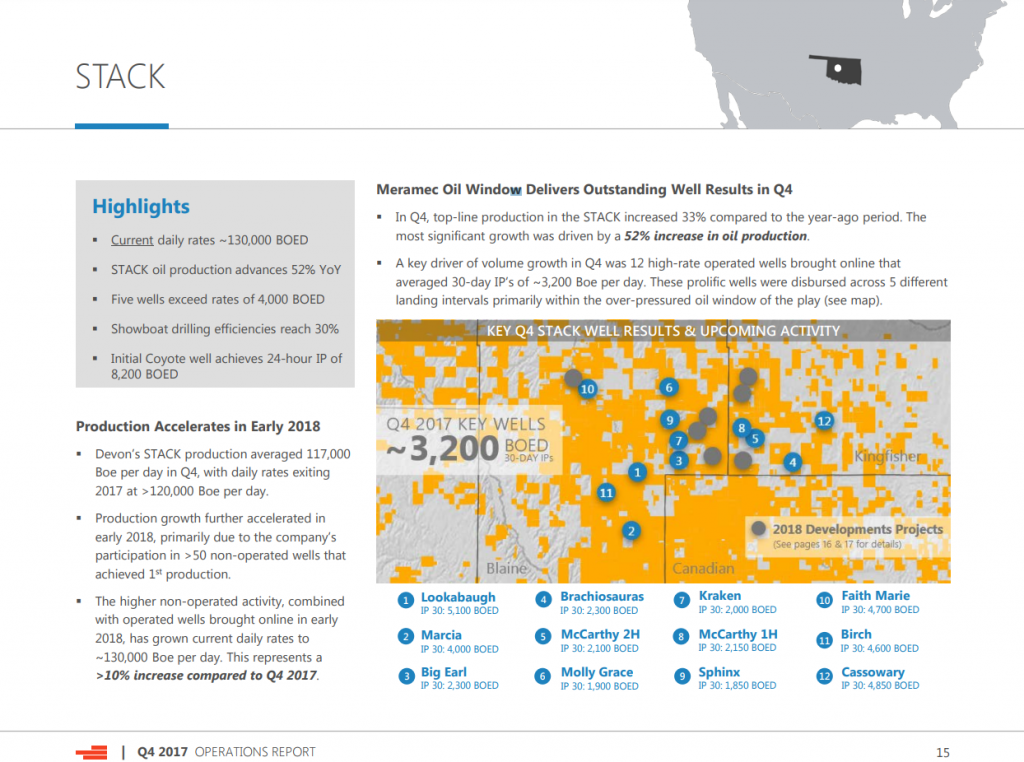

Devon’s operated well activity in the fourth quarter across its U.S. resource plays went as planned. Led by the Delaware Basin and STACK, the company’s top 30 operated wells during the fourth quarter averaged initial 30-day production rates of greater than 2,500 BOEPD (60% oil).

Reserves

Devon’s estimated proved reserves were 2.2 billion BOE on Dec. 31, 2017, a 5% increase compared to 2016. Proved developed reserves accounted for 81% of the total. At year-end, liquids reserves advanced to 1.2 billion BOE, driven by a 32% increase in U.S. oil reserves during 2017.

The company’s reserve growth in 2017 came entirely from its U.S. resource plays, Devon said, where proved reserves increased 11% to 1.7 billion BOE. Led by Devon’s capital programs in the Delaware Basin and STACK, the company’s U.S. resource plays exhibited growth by adding 327 million BOE of reserves in 2017. This result represents a replacement rate of approximately 215%. The capital costs incurred to contribute to these reserve additions were $1.7 billion, equating to a finding and development cost in the U.S. of $5 per BOE.

2018 CapEx and guidance

Devon’s upstream capital budget is projected to be $2.2 billion-$2.4 billion. This capital program is expected to be self-funded at a $50 WTI price deck, Devon said. On a retained asset basis, Devon’s upstream capital plans are expected to drive U.S. oil production growth of approximately 14% compared to 2017. The trajectory of Devon’s U.S. oil production profile is expected to steadily advance throughout the year and exit 2018 at rates more than 25% higher than the 2017 average.

Revenues

In the fourth quarter of 2017, Devon’s operating cash flow totaled $725 million. The company exited the fourth quarter with $2.7 billion of cash on hand. In Q4 2017, Devon’s reported net earnings totaled $183 million, or $0.35 per diluted share.

The company’s upstream revenue totaled $1.3 billion in the fourth quarter of 2017, a 35% improvement compared to the fourth quarter of 2016. Devon’s midstream business generated operating profits of $272 million in the fourth quarter of 2017, increasing 35% year over year. Devon said that this growth was driven entirely by the company’s strategic investment in EnLink Midstream. Overall, for 2017, Devon’s midstream profits reached $912 million, the highest in the company’s history.

For the full-year 2017, operating cash flow reached $2.9 billion, a 94% increase compared to 2016.

Expenses

- Devon’s production expense, which represents field-level operating costs, totaled $463 million in the fourth quarter

- General and administrative expenses (G&A) totaled $222 million in the fourth quarter

- Depreciation, depletion and amortization expense (DD&A) amounted to $528 million or $10.47 per BOE in the fourth quarter of 2017

Conference call Q&A excerpts

Q: I understand you don’t want to be specific on potential asset sales, but I wonder if I could just ask you to opine a little bit on two things, where the Powder River fits in your development outlook. Because either it looks to us like we see we’re going to get a core asset or it’s been primed for sale, and I’m leaning towards the former.

And my second issue I guess, related to the same thing is, what’s in the development outlook that you have, particularly in the Delaware, what is the strategic role that EnLink plays going forward? And I’m just curious whether EnLink is part of the $5 billion target potential asset sales over the next several years.

President and CEO Dave Hager: Well first off, it’s very clear that the two key core assets for Devon going forward are the Delaware and the STACK play. We have positions there that are as good as anybody’s, and we are having outstanding results and they are going to drive the growth in the company for the next few years. And they’re going to take the bulk of the capital for the next few years.

Outside of that, we do still have some great assets in other areas, including the Powder that you mentioned, Barnett, Eagle Ford in heavy oil as well as the EnLink. Specifically in regard to the Powder, we like the opportunities we’re drilling there in the Turner. We see some potential there in the Niobrara as well, and we’re going to be drilling some wells there. We think there’s a good growth opportunity.

But again, it’s not going to reach the scale of the STACK and the Delaware. So I’m not going to get more specific than just to describe that obviously, the two most important are the STACK and the Delaware. And we understand the pluses and minuses and the optionality we have around all of the other assets in our base, whether it be E&P or a midstream asset. But obviously we have a lot optionality.

And the reason – I’m not trying to be coy on this at all – but we’re trying to maximize the value that we can get. And market conditions change through time too. And so to announce a strategic decision one way or the other when we have a lot of optionality and market conditions change is really not in the best interest of the shareholders, we don’t think. So we have that optionality there. There is a lot of ways we can accomplish this. And reiterate once again that when we do this, you can look for us to be authorizing a way to return value to the shareholders.

Q: In regards to your 2018 guidance, could you guys go through some of the thoughts as you laid out 2018 guidance on either the risking of the non-op guidance moving forward, as well as risking on the timing of some of your large pads. You mentioned that they may be actually coming forward, but curious how those were risked within the 2018 guidance as well as the non-op productivity.

Hager: Yeah, I might kick this off and then turn it over to Tony for a little bit more details. But obviously we were disappointed with our miss on Q4 production guidance. And we took the guidance that was provided by the operators on those approximate 50 wells and that’s what we plugged into our guidance. If you look at the STACK overall, it’s a little bit more significant proportion of the STACK production. In other places I think around 23% or so our production is outside operated.

I can tell you that we have taken a much more conservative approach to forecasting non-operated volumes in 2018 versus 2017. I guess you can say we learned our lesson there. We thought we were being appropriate, but in hindsight, some things happened that we didn’t know was going to happen with those non-operated wells. Again, the key is though that all of our operated activity is just doing outstanding, but we have taken a more conservative look to the outside-operated wells. And certainly, we’ve taken a measured approach to our expectations of when our operated large pads are going to come on as well, to make sure that we have confidence in the guidance. So Tony, you want to take it, more detail on that?

COO Tony Vaughn: Yeah, you bet, Dave. Just to add a little bit to what you said, I think if you look at our work on these multi-zone projects, we probably have roughly about 25 to 30 projects in some level of maturity between STACK and Delaware. We’re working those plans. We have a very disciplined stage gate process that we have a lot of transparency into what we’re doing. You can see in our operating report, we have about 10 or 11 of these projects that are going to be really impacting 2018 highlighted here.

And the way we kind of think about this is we’re trying to keep the projects of the right size and scale to reap out the benefits of the efficiencies of doing these batch operations and… utilizing centralized production facilities on a greater number of wells and pads. But we don’t want them so large that we just get extremely lumpy, like we might have seen when we were in the offshore business.

So we’ve done a pretty good job of scaling these appropriately. The one large one that you see in 2018 is the project that we’re on right now, which is the Showboat project. And in there, we have gotten through the drilling portion of this project and saw some great cost savings there on the drilling side. It’s hard for us to explain and convey the synergies and the efficiencies we have when we get when we can park rigs, three or four rigs on a location and just execute, execute and execute. And we’re seeing it in spades here on the drilling side of the business.

I mentioned in my prepared remarks, we’re also starting to see this on the completion side of the business, where we’re zipper fracking not just two wells, but three wells together. And our efficiencies on that side of the business are peaking and really, the cost per well on the facility side is going to be competitive and even improving over time as we continue to utilize all these facilities.

So we think this is the answer to go. I think we’ve commented in the past that we think the present value uplift here is 40%. We still believe that. And I think we’re very pleased with the early work we’ve done on these that we’ve commented on where we are in the maturity of our ability to execute on these. So we’re excited about this part of our business.

Hager: I might just add, too, that when we first rolled up our 2018 oil guidance as a company, our total number was really very, very close to the Street average that we had. What happened really more recently that caused it go a little bit below the Street average is in Canada, where we’re going to be experiencing higher royalties because of higher WTI prices.

And so we’re going to be going from a, as you probably understand, the royalties out there are not based on WCS prices. They’re based on WTI prices. And so based on that, we have taken a more conservative assumption on what we think royalties are going to average throughout the year and increase those from I think around 5% to 7% or so. And that’s really caused our overall oil production guidance to fall a little bit I think below where the Street expectation was.