12-well Showboat project 40 days ahead of schedule

Devon Energy’s massive Delaware Basin wells have generated headlines, but the company has achieved much more than two titanic wells in the past quarter.

The company reported a net loss of 197 million this quarter, or ($0.38) per share. After adjusting for early retirement of debt and other special charges, Devon earned $108 million, or $0.20 per share.

The company produced an average of 544 MBOEPD in Q1, down slightly from the 548 MBOEPD it produced in Q4. However, Devon anticipates significant growth in its Permian and STACK properties, so it is raising 2018 guidance for U.S. oil production, suggesting growth of 16% in the year.

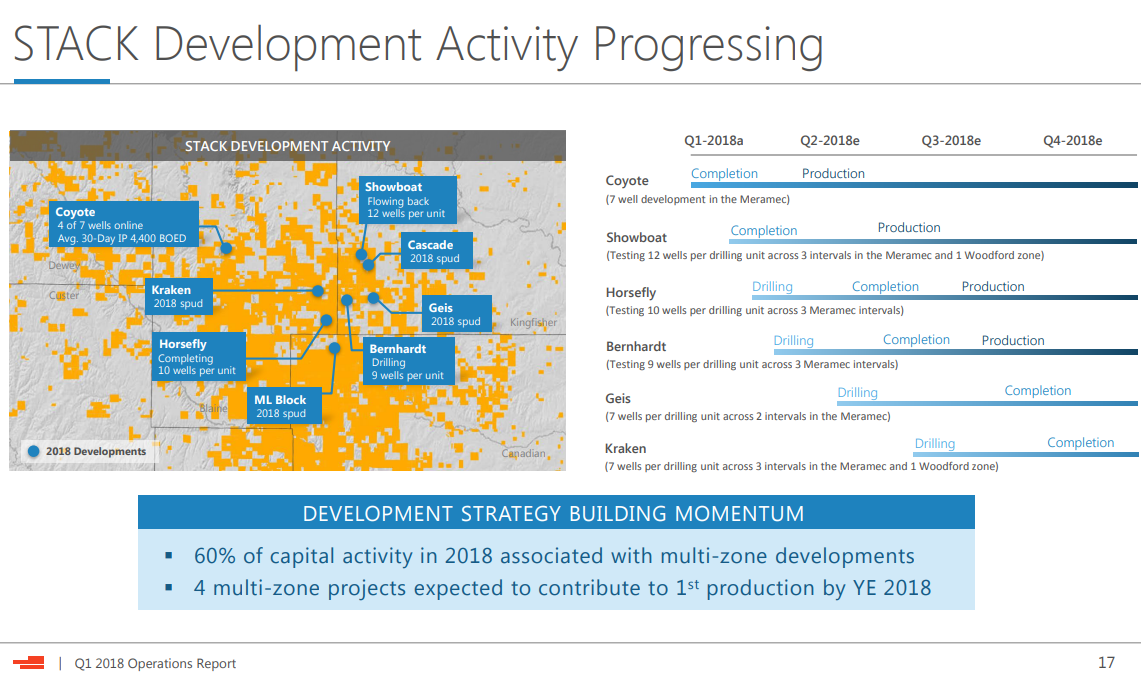

Reducing cycle times with multi-zone development projects

The improving productivity from both plays partially drove this increase, but Devon is also reducing cycle times through development projects. The company reports its Showboat project in the STACK, which involved 12 wells across three intervals in the Meramec and one Woodford zone, is ahead of schedule. The project has begun flowback about 40 days ahead of schedule, and reported numerous improvements in efficiencies. The company was able to complete an average of eight frac stages per day at Showboat, double the average in 2017. In all, Devon estimates the project saved $1.5 million per well.

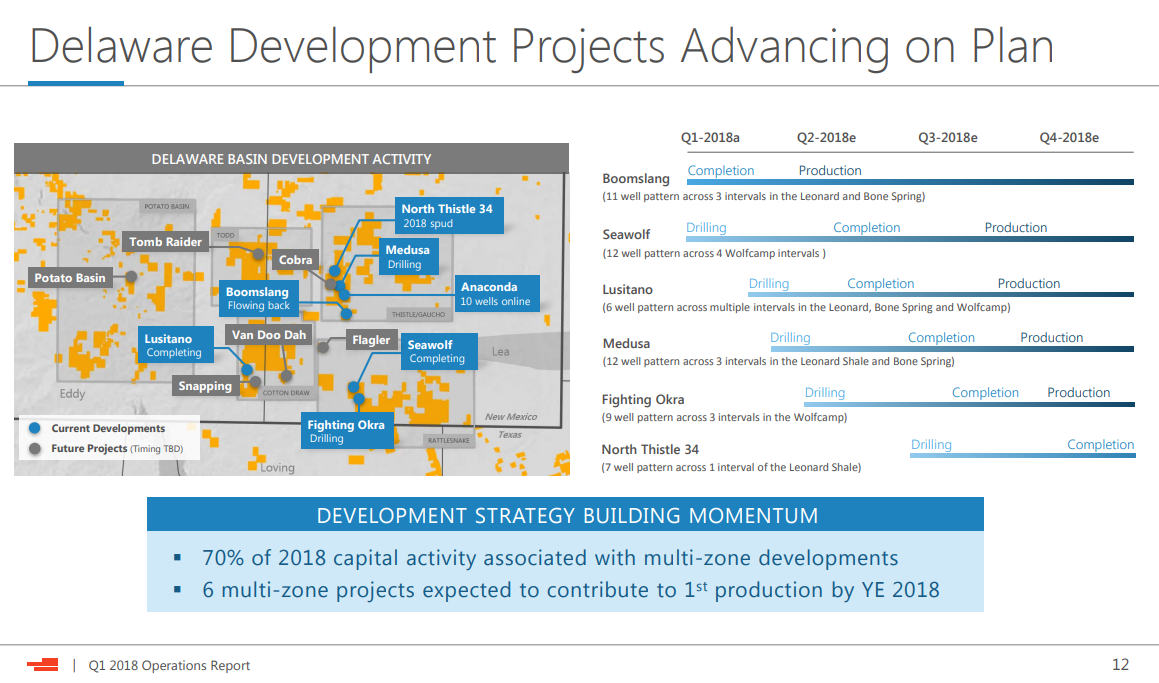

Anaconda produces $1 million in savings per well, Boomslang produces even more

The company has similar projects in the Delaware, where the Anaconda, the first such multi-zone project, is now online. Anaconda achieved an average IP 30 of 1,600 BOEPD and savings of $1 million per well. This was just the start of multi-zone development, though, as Devon reports the next project, Boomslang, is beginning flowback. Boomslang achieved drilling improvements of 15% compared to Anaconda, and the company should have early production data by the time it reports Q2 results.

Barnett JV announced

Devon has announced further activity in the Barnett, after selling its southern Barnett properties for $553 million in March.

In April the company formed a JV with DowDupont, encompassing much of Devon’s central Barnett assets. Devon will sell a 50% working interest across 116 gross undrilled locations for about$75 million. The agreement requires Devon to drill and operate up to 24 wells per year, with volumes dedicated to the EnLink gathering infrastructure.

Devon continues to reduce its leverage, and repurchased $807 million in debt in March. The company has consolidated debt of $10 billion, but much of that is due to Devon’s involvement in EnLink. On a stand-alone basis, Devon has $4.7 billion in net debt.

Q&A from DVN conference call: elaborating on Boundary Raider wells

Q: I would like to ask, I know you guys touched on the Boundary Raider wells, those really remarkable wells in the Delaware Basin. But can you talk a little bit about what led you to target this area? And perhaps elaborate a bit on how those results came in versus your pre-drill? And what if anything has changed on your view in that zone or that area or in any respect?

DVN: I’m going to ask Rick Gideon, who is our Senior Vice President in-charge of the Delaware Basin Rockies to comment further. But I just want to make one thing really clear before he goes into his comment, you didn’t ask this, but I’m going to make it really clear.

This is not due to us opening the chokes up really wide to get a huge 24-hour IP. This is truly an exceptional area where we’re seeing not only great wells with strong pressures but also you’re going to anticipate the EURs on these wells in this area to be two to three times what our normal type curve type is out there. So this is truly an outstanding area that we have discovered.

DVN: I was hoping somebody would ask about these wells. How did we find them? Well, I’ll tell you. I think we have the best technical teams in the industry working these basins. And these teams are focused on identifying the best parts of these basins or the sweet spots.

So when we went into this, this was an identified sweet spot. We were aware these wells would be much better than typical wells. I think they surprised us a bit that they were even better than what we thought.

As Dave indicated from a choke management, we did nothing different than we typically do on any of our wells from a choke management standpoint. None of these wells were opened to full open chokes. They were managed in order to maintain the value of the reservoir.

And as we’ve identified this, as we said in the operations report, we have additional wells we’ll be drilling in this area over the next 1.5 years.

Q: Has it changed your view on other sweet spots you’ve identified in the Second Bone Springs, are there things you’re going to be doing differently going forward, having seen what these wells actually delivered?

DVN: I think it’s confirmed our view. I don’t know that this changed our view. We knew what we were looking for. The teams did a great job again in identifying the different metrics to make these better wells. On top of that it was the outstanding execution of these wells and the ability to flow these back into a large battery and test them.

So I don’t know that it changed it, but it did affirm our views. And I think we’ll continue to identify these throughout all of our basins.

DVN: And maybe to help out, give a little context of I think where you may be going with this too. First, there is obviously a great area. We are going to have to build out the infrastructure more in the area. And we’re going to be building that out commensurate with drilling the wells.

We think we have about 25 wells in this area. We can’t say they’re all going to be this good, but we think they’re all going to be well above our type curve. And we feel really good that we’ve identified a sweet spot here.

The production impact of this is going to be more a – and the biggest part is going to be more of a late 2018 on into 2019 and beyond type impact, just given the timing of the drilling of these wells and actually bringing them online.

So it obviously has impacted a little bit here our results already by that and other wells allowing us to raise our production guidance. And frankly, we see some upside to our production guide, U.S. oil production guidance as we continue to execute throughout the year.

But the bulk of the benefit will be late 2018, 2019, and beyond as we bring these wells on. So, Tony, you had one more comment on that?

DVN: Yeah, Charles, it’s hard for me to keep quiet on this. We’ve talked to you quite a bit over the last couple years. But really made this data driven approach, a big shift in our mentality about three – probably three, four years ago. It’s really coming to fruition right now.

And so as Rick mentioned, these weren’t random events. These were well planned. And we’re seeing this across all the areas that we work, not just in the Boundary Raider localized area, not just in the Coyote area. But you’re starting to see what we’ve always claimed and since late 2015 and beyond. We’ve always been number one in IP90s, which we feel like is the best time to approach and estimate the ultimate recovery and value of a well.

So we’re starting to see an expansion of our results going forward. And so we couldn’t be prouder from a leadership perspective of the technical work that our teams are really doing. We think this is really culminating some good across the board type work.

Q: You had a small, but very interesting joint venture you announced in the Barnett Shale. And is that something you’ll continue to look to do more of, given what the environment is for natural gas asset packages out there in the market? Or how do you think about that, versus stability to continue to monetize the Barnett and doing more of these such deals? Does that necessarily preclude you from continuing to look to monetize the Barnett, even parts that might be subject to some of these sort of deals?

DVN: I want to be clear. This does not change anything with regards to the potential long term strategy of what we do with the Barnett.

This is just we think a very creative business opportunity to take an asset that has identified development opportunities and to form relationship with a great company, such as DowDuPont, where we essentially are now bringing them in on a promoted basis to drill some wells that otherwise we would not execute. So it’d just be an asset that we’re not maximizing the value of with these pud opportunities just sitting there. So we are bringing them in with the promote. It makes the returns to Devon competitive with the rest of our portfolio.

So it’s we think a great way to bring value forward in the short term. But in no way does this change our optionality or decision process in regards to what we’ll do with the Barnett in the long term. We’re still working through that.

Obviously it’s more challenged at these lower natural gas prices. Also provides benefit to EnLink, which accrues back to us as well obviously by additional provided incremental EBITDA, of which we are the majority benefit.

So we think it’s a real great shorter term solution and decision that brings value. We like DowDuPont. And there may be possibilities that we can expand this relationship in the future for similar type situations.

Q: I was wondering if you could talk a little bit about the three spacing pilots. And you mentioned that you kind of conservatively risked the production from these pilots. And I was just wondering if you could maybe comment a little bit around your risking for the projects.

DVN: We’ve got quite an extensive library of information and participated in about a dozen different pilots in the play. These are three more projects that we have that are going to fill in some key data points with us. I have to tell you – and I’m going to turn the call over to Wade Hutchings in just a minute, who is managing that asset base for us. But, Arun, there’s more to it. It’s a more complicated question when we manage these unconventional reservoirs than just simple spacing. And Wade will be able to dial into that a bit.

But we fully utilize this database that we have. We built the 3D earth models. We put a lot of time and attention into the technical competency that we put into it, at least to the optimum design and also leads to the granular attention to execution that we have in our technical groups.

You’re seeing some prolific well results in both the Coyote areas and across STACK, and the same thing in the Delaware Basin. None of that’s really by accident. It’s all by just competency and technical fact-based work that the guys are doing.

So, Wade, why don’t you describe a little bit more what you’re trying to get out of the pilots? Maybe even explain a little bit of how we work in the greenfield and the brownfield type areas.

DVN: When we look at these three projects that we’ve highlighted here, we certainly have a range of spacing that we’re testing, all the way from 12 wells per section in Showboat to 10 wells per section at Horsefly, and then 9 at Bernhardt.

All three of those projects are in the core of the Meramec play. All three of them are landing in the best reservoir, which is essentially what we call the Meramec 200. And then they all are staggering wells in between a couple zones just lower than that core reservoir.

So they’re all testing roughly the same reservoirs but at slightly different staggering and well spacing. And we anticipate learning a lot from these, in addition to the other industry and non-operated investments we’ve made.

Ultimately, we’re testing a lot more than spacing though, because we recognize that the stimulation approach in an infill mode needs to be different than it was in the parent HBP mode. And so we’re testing multiple things in each one of these projects. We’ll certainly give you a lot more detail on that as those projects come online.

But we’re really looking at how do we optimize the stimulation spend to get the most value out of each of these projects. The Showboat particularly is one where we’ve invested a lot of science dollars around monitoring the pressure between wells and between layers and trying to determine if the tweaks we’re making to our stimulation design are being effective or not.