Proceeds will go to share buybacks

Devon Energy (ticker: DVN) continued its divestiture program today with the largest deal so far, valued at $3.125 billion.

Devon will sell its interest in EnLink Midstream (ticker: ENLC) to privately held Global Infrastructure Partners (GIP). The sale significantly simplifies Devon’s holdings.

EnLink is a major midstream company which handles much of Devon’s production. It was originally formed through a merger of Devon’s midstream assets and Crosstex Energy.

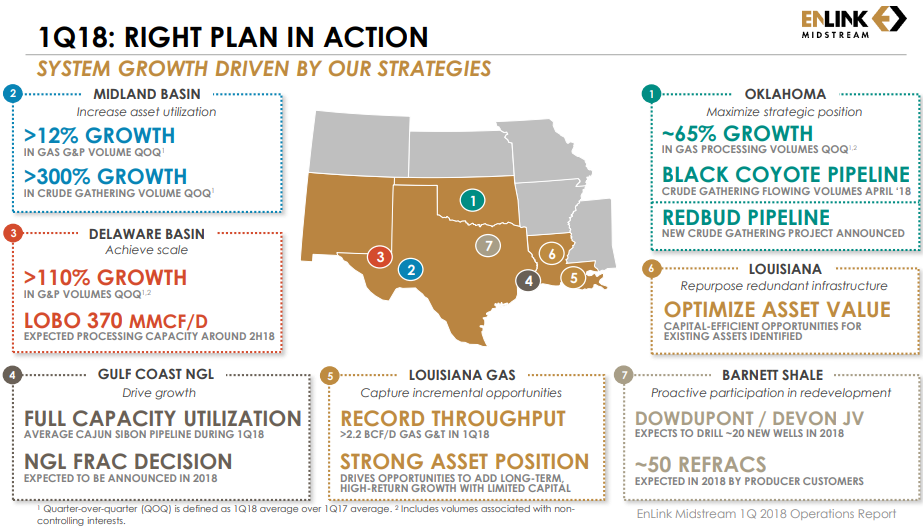

EnLink has extensive assets in the SCOOP/STACK and Permian, and plans significant growth in both capacity and volumes transported. The company also holds several systems in Louisiana and a gas gathering system in the Barnett. The sale does not end Devon’s relationship with EnLink, as midstream contracts remain in place, some stretching through 2029. The companies are currently considering a crude gathering system in the Delaware, so their partnership may instead deepen.

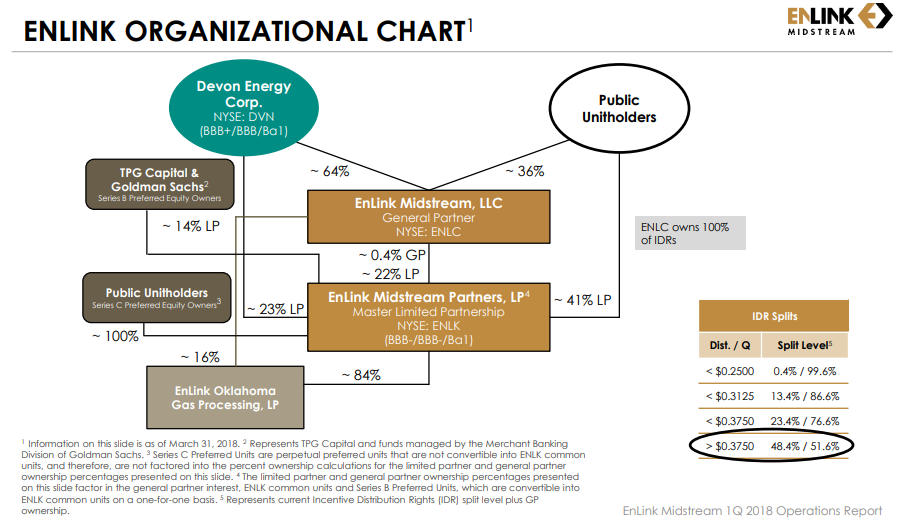

Devon currently holds about 64% of EnLink Midstream and directly holds 23% of EnLink Midstream Partners (ticker: ENLK). Like many other midstream companies, EnLink has a very complicated corporate structure.

Transaction values EnLink at 12 times cash flow

Devon reports it has received $265 million in distributions from EnLink over the past year, so the transaction values EnLink at about 12 times cash flow. The sale is expected to close in July 2018.

Selling EnLink will also significantly reduce Devon’s consolidated debt, as the midstream company accounts for about 40% of Devon’s total debt. Devon’s interest and G&A costs are also expected to fall by about $300 million.

Buyback program raised to $4 billion

Devon has already determined what it will do with the $3.125 billion in proceeds from the sale, putting most of it to a use that will please shareholders. Devon will significantly expand its share repurchase program, increasing the amount spent from $1 billion to $4 billion. This would acquire a significant share of Devon’s outstanding stock, about 20%. The program is currently authorized through the end of 2019, but Devon will likely need to either accelerate or extend the program. Devon acquired $204 million in shares in the first two months of the program. At this pace, the entire $4 billion in shares would take more than three years to acquire.

Devon President and CEO Dave Hager commented “The sale of our EnLink interests represents a significant step forward in achieving our 2020 Vision to further simplify our asset portfolio and return excess cash to shareholders. This highly accretive transaction provides a strategic exit from EnLink at a value of 12 times cash flow, a substantial premium to Devon’s current trading multiple. The EnLink proceeds, combined with proceeds from the non-core E&P assets already sold and those currently being marketed, will exceed our $5 billion divestiture target.”

GIP Chairman and Managing Partner Adebayo Ogunlesi commented, “Our investment in EnLink is a unique opportunity for us to partner with a leading energy infrastructure company with scale and a diverse portfolio of operations in leading North American crude oil and natural gas basins at an exciting time. EnLink provides critical midstream infrastructure services to Devon and a host of customers across all segments of the value chain. We look forward to building on the success that EnLink has achieved and are confident in our ability to further EnLink’s growth trajectory.”

New York-based GIP is an independent infrastructure fund manager that manages over $40 billion for its investors. GIP reports that the companies in its portfolio have combined annual revenues greater than $5 billion and employ approximately 21,000 people. The firm’s energy investments include Freeport LNG, Hess Infrastructure Partners, Gas Natural Fenosa, Medallion Gathering & Processing, several power projects, gas and crude oil pipelines, plus a number of international airports and ports.