Bullish or bearish?

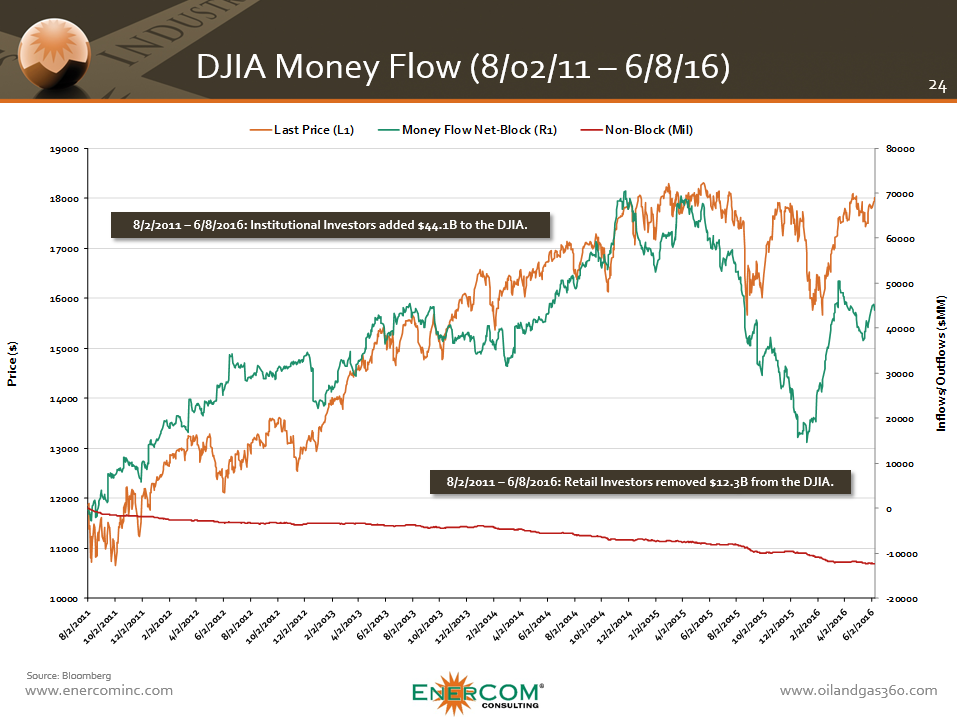

The chart above shows the total amount of money since August 2, 2011 that has been invested in the Dow Jones Industrial Average (DJIA) – the index – by institutional investors and retail investors via various forms of investment vehicles. In total more than $56 billion has been invested in the DJIA since Aug. 2011.

This could be taken as a sign of confidence from institutional investors in one of the most prolific indices in the U.S. market.

Digging a little deeper, there are two major points to extract from this data. First is the actions of retail investors. In the last (almost) 5 years, retail investors have removed a total of $12.3 billion from the DJIA. Since the beginning of 2016 that number has grown from $10.1 billion, meaning that retail investors have removed $2.2 billion in assets from the index. The implication would be that retail investors feel that the index is not the best place for their money.

On the other side of the coin, institutional investors have been pouring money into the DJIA since the beginning of 2016. To start the year, institutional investors had moved $18.6 billion into the index, a number that now stands at $44.1 billion. Institutional investors have added $25.5 billion to the Dow Jones year to date. This would imply a certain bullish perspective from institutional investors.

The actions of institutional investors is exactly opposite of their own actions in 2015. In 2015, institutional investors removed a total of $39.4 billion in assets from the DJIA, implying a bearish perspective on the market.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.