Is Saudi’s Market Share War Over, Is It On-Hold, or Is It Still Coming?

OPEC surprised the markets yesterday when word came out that for the first time in eight years the cartel planned to put oil production limits in place at its upcoming November meeting. Rumors have been zinging around media for a little while, but yesterday’s announcement from OPEC sent oil markets upward to the tune of almost $3 per barrel. The rally continued on

Thursday with WTI November contracts piercing $48 per barrel for a while in morning trading.

E&Ps were buoyed by the news, but a hundred oil and gas bankruptcies (and counting) serve as an ugly backdrop for recent predictions of continued record inventory levels and no market balance for another year—or two.

But that gloomy future gave way yesterday to a day of sunshine for the North American E&Ps, a generally optimistic group that has been too busy retooling their companies to smile much since OPEC last startled the global oil and gas sector by announcing its new strategy to chase market share rather than maintain price stability. That was on Thanksgiving Day of 2014. That took oil out of triple digits all the way down to the $20s–briefly. Oil producers have endured almost two years of being smacked around by post-crash market pricing.

But the projected changes that would be caused by such a move—representing an unprecedented agreement by arch-rivals Saudi Arabia and Iran—has analysts scratching their heads, sharpening their pencils, rebooting their commodities price models and spitting out research notes in a flurry of activity after delivery of yesterday’s OPEC news.

We noted the drop in U.S. oil inventories in recent weeks: OPEC

In its announcement, OPEC said the following:

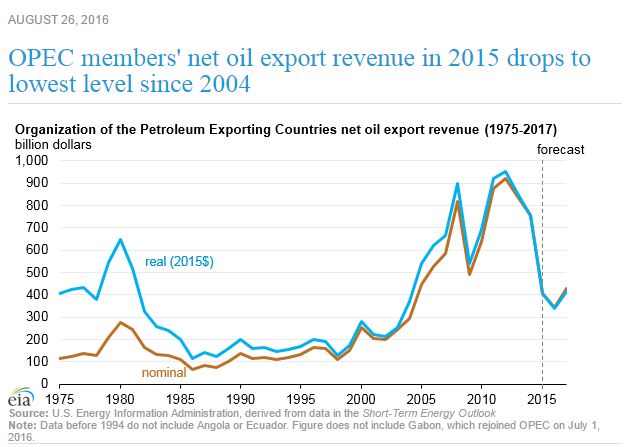

“In the last two years, the global oil market has witnessed many challenges, originating mainly from the supply side. As a result, prices have more than halved, while volatility has increased. Oil-exporting countries’ and oil companies’ revenues have dramatically declined, putting strains on their fiscal position and hindering their economic growth. The oil industry faced deep cuts in investment and massive layoffs, leading to a potential risk that oil supply may not meet demand in the future, with a detrimental effect on security of supply.

“The Conference took into account current market conditions and immediate prospects and concluded that it is not advisable to ignore the potential risk that the present stock overhang may continue to weigh negatively well into the future, with a worsening impact on producers, consumers and the industry.

“Based on the above observations and analysis, OPEC Member Countries have decided to conduct a serious and constructive dialogue with non-member producing countries, with the objective to stabilize the oil market and avoid the adverse impacts in the short- and medium-term.

“Based on the above observations and analysis, OPEC Member Countries have decided to conduct a serious and constructive dialogue with non-member producing countries, with the objective to stabilize the oil market and avoid the adverse impacts in the short- and medium-term.

“The Conference, following the overall assessment of the global oil demand and supply balance presented by the OPEC Secretariat, noted that world oil demand remains robust, while the prospects of future supplies are being negatively impacted by deep cuts in investments and massive layoffs. The Conference, in particular, addressed the challenge of drawing down the excess stock levels in the coming quarters, and noted the drop in United States oil inventories seen in recent weeks.

“The Conference opted for an OPEC-14 production target ranging between 32.5 and 33.0 mb/d, in order to accelerate the ongoing drawdown of the stock overhang and bring the rebalancing forward.”

In a conference call today hosted by Paul Sankey and David Clark of Wolfe Research, the analysts examined what the surprise change in direction will mean to global oil prices and U.S. unconventional producers in particular, if OPEC follows through.

“What we are looking at here at the very least is a freeze,” Sankey said. “We were looking for more OPEC production growth but now we no longer think so.”

The analysts issued a research note yesterday that summed up the news like this:

“… little did we realise that not only would Saudi not cut to defend a weakening market but they would increase by 1Mbd by summer 2015. Why? To fight Iran for market share. Two years later, we again head towards a landmark Thanksgiving, this time with OPEC reverting to managing the market. Why? We believe the organization may be concerned about potential excessive under-supply by 2020. Maybe the Saudi IPO played a part. And simply, cartel economics, as we have repeatedly pointed out, have become compelling: 10% cut in volumes for 30% rise in price.”

During today’s call, Sankey and Clark said that a Saudi-Iran agreement “changes entirely what OPEC is doing.”

Sankey said he believes that the market is already in balance, based on EIA data, OECD data and other analysis. “Let’s call it a balanced market we’re in now. So every barrel they cut gets toward an undersupplied market. 32.5 -33 MMBOPD is the suggested range OPEC will move to. The cut would be 700,000 BOPD. Remember that is every day,” Sankey said. “If you go from a balanced market to a 700,000 barrel undersupplied market, that is a big deal.”

“The key question is ‘will Iran respect the deal?’. In general Saudi has done what they said, followed by UAE, Kuwait and others. … [But,] if these guys don’t trust each other then it’s a different story if there is a race to more production.”

Why did OPEC do it?

“With weaker demand predicted through 2017 they could see a rough market coming,” the analyst theorized. “Being a cartel the economics were overpowering: a 10% cut could give as much as a 30% rise in oil prices.

“The thesis is that marginal supply growth comes in the future from U.S. unconventional [production]. “This is extremely bullish for all the U.S. E&Ps on the unconventional side,” Sankey said.

“U.S. production growth hit 1.3 MMBOPD in Dec. 2014. Today the capacity limits are geology, infrastructure, and water handling. Let’s say they can get back to 1.3, 1.4 MMBOPD by 2020, we could hit that place in the market a year earlier or more. In the scenario with OPEC capped at 33 MMBOPD, that wipes out the overhang by 2017.”

A call participant asked the question, “Do you think there is an implicit price they’re trying to target? What price do you think the Saudis want?”

The Wolfe analysts said, “I think they want demand growth and not too much supply growth. Saudi believed that the marginal breakeven price in the U.S. is $80 per barrel. But [ExxonMobil CEO Rex] Tillerson talked about how good the U.S. E&P guys are, especially when their backs are against the wall.”

“It goes to $51 per barrel at the margin. We think there will be acceleration [of activity] above $50. I would say if we were in a $60 + environment that would be a good price – without destroying demand. I don’t think we could sustain prices as high as they were in the past, but $60-$80 I would think [OPEC] would be very happy with.”

Q: What outcome do you expect from the November OPEC meeting? Are we going to get specific quotas?”

“A camel is a horse designed by a committee,” Sankey said, referring to the punchline from an old joke. “OPEC has appointed a committee to work this out. Seems they’ll exclude Libya and Nigeria. Iran will stick at 3.7 [MMBOPD] because they are just back in the markets post sanctions… . The details are extremely unclear and some of this was from the original Algerian proposal. The fact that Saudi and Iran are remotely agreeing is the headline.”

In an interview on Bloomberg Television today, IHS Markit Co-Chairman Daniel Yergin quipped that the past decade’s commentary that OPEC is dead turned out to be premature.

Full Text of OPEC Announcement after Extraordinary Meeting in Algiers

170th (Extraordinary) Meeting of the OPEC Conference No 11/2016

Algiers, Algeria

28 Sep 2016

The Conference of the Organization of the Petroleum Exporting Countries (OPEC), following a Consultative Meeting in Algiers, Algeria, resolved to convene an Extraordinary Meeting of the Conference on Wednesday, 28th September 2016 under the Chairmanship of its President, HE Dr. Mohammed Bin Saleh Al-Sada, Qatar’s Minister of Energy and Industry and Head of its Delegation.

The Conference expressed its respect and deep appreciation to the President of Algeria, HE Abdelaziz Bouteflika, and to the Prime Minister, HE Abdelmalek Sellal, for hosting the 170th (Extraordinary) Meeting of the OPEC Conference. The Conference, furthermore, acknowledged and thanked HE Noureddine Boutarfa, Algeria’s Minister of Energy, for his untiring efforts and support for the ongoing consultations between all parties involved in the preparations for these meetings. At the same time, the Conference also congratulated HE Noureddine Boutarfa, who was attending a Meeting of OPEC Ministers for the first time since his appointment as Algeria’s Head of Delegation, and thanked his predecessor in office HE Dr. Salah Khebri, for his contribution to the work of the Organization.

The Conference warmly welcomed Gabon that was attending a Meeting of OPEC Ministers for the first time since officially rejoining the Organization in July, and HE Jabbar Ali Hussein Al-Luiebi, who was also attending a Meeting of the Conference for the first time since his appointment as Iraq’s Minister of Oil and Head of its Delegation.

In the last two years, the global oil market has witnessed many challenges, originating mainly from the supply side. As a result, prices have more than halved, while volatility has increased. Oil-exporting countries’ and oil companies’ revenues have dramatically declined, putting strains on their fiscal position and hindering their economic growth. The oil industry faced deep cuts in investment and massive layoffs, leading to a potential risk that oil supply may not meet demand in the future, with a detrimental effect on security of supply.

The Conference took into account current market conditions and immediate prospects and concluded that it is not advisable to ignore the potential risk that the present stock overhang may continue to weigh negatively well into the future, with a worsening impact on producers, consumers and the industry.

Based on the above observations and analysis, OPEC Member Countries have decided to conduct a serious and constructive dialogue with non-member producing countries, with the objective to stabilize the oil market and avoid the adverse impacts in the short- and medium-term.

The Conference concurs that there is firm and common ground that continuous collaborative efforts among producers, both within and outside OPEC, would help restore the balance and sustainability in the market.

At this juncture, it is foremost to reaffirm OPEC’s continued commitment to stable markets, for the mutual interests of producing nations, efficient and secure supplies to the consumers, with a fair return on invested capital for all producers.

The Conference, following the overall assessment of the global oil demand and supply balance presented by the OPEC Secretariat, noted that world oil demand remains robust, while the prospects of future supplies are being negatively impacted by deep cuts in investments and massive layoffs. The Conference, in particular, addressed the challenge of drawing down the excess stock levels in the coming quarters, and noted the drop in United States oil inventories seen in recent weeks.

The Conference opted for an OPEC-14 production target ranging between 32.5 and 33.0 mb/d, in order to accelerate the ongoing drawdown of the stock overhang and bring the rebalancing forward.

The Conference decided to establish a High Level Committee comprising representatives of Member Countries, supported by the OPEC Secretariat, to study and recommend the implementation of the production level of the Member Countries. Furthermore, the Committee shall develop a framework of high-level consultations between OPEC and non-OPEC oil-producing countries, including identifying risks and taking pro-active measures that would ensure a balanced oil market on a sustainable basis, to be considered at the November OPEC Conference.

Finally, the Conference again expressed its deepest appreciation to the Government and to the people of Algeria, and to the authorities of the City of Algiers for their warm hospitality and the excellent arrangements made for the Meeting.