The oil and gas industry is a cyclical business, but it also a business of trends.

At last year’s The Oil & Gas Conference®, the term “sand” was mentioned repeatedly in regards to completion techniques and optimizations. The term of choice during the commodity downturn is “efficiency” as operators develop methods to generate the best bang for the buck.

At last year’s The Oil & Gas Conference®, the term “sand” was mentioned repeatedly in regards to completion techniques and optimizations. The term of choice during the commodity downturn is “efficiency” as operators develop methods to generate the best bang for the buck.

A popular topic in the third quarter earnings season, particularly for larger companies, was the amount of drilled but uncompleted wells. The deferred wells, known as DUCs for short, are garnering attention as a potential factor in the market’s consistent state of oversupply. And while North Dakota’s duck season has an optimistic outlook, the DUCs in the oil and gas industry are just another muddy stop on the road to the oil price recovery.

How Many DUCs are There, Exactly?

As mentioned in the Q3’15 conference calls (and some dating back to earlier this year), companies are deferring completion on wells and creating an inventory backlog for their respective 2016 operation programs. The aim is to generate a greater cash return, which is essentially hedging a bet for prices to recover in the meantime.

OAG360 spent much effort to discover the number of DUCs across the United States. Finding and translating data associated with DUC wells on the sites of various state industrial commissions was partly fruitful. We found that North Dakota is the only industrial commission to report its DUC count in black and white, as part of its monthly Director’s Cut report. By the way, the estimated number of wells waiting on completion as of September 2015 was 1,091 – a 79% increase from September 2014’s count of 610, even though the running rig count has dropped by 68% (63 from 198) in the same time frame.

Colorado, Pennsylvania and Texas were unyielding as to DUC data, no matter what perspectives we took and how many intelligence agencies were contacted. So it was somewhat reassuring to see a note from Raymond James Equity Research on November 23, 2015, expressing similar levels of difficulty. The first bolded sentence in the three-page report reads, “Frankly, any definite answer regarding the DUC question is conveying a completely false sense of precision.” The firm used the term “Sisyphean” later in the report.

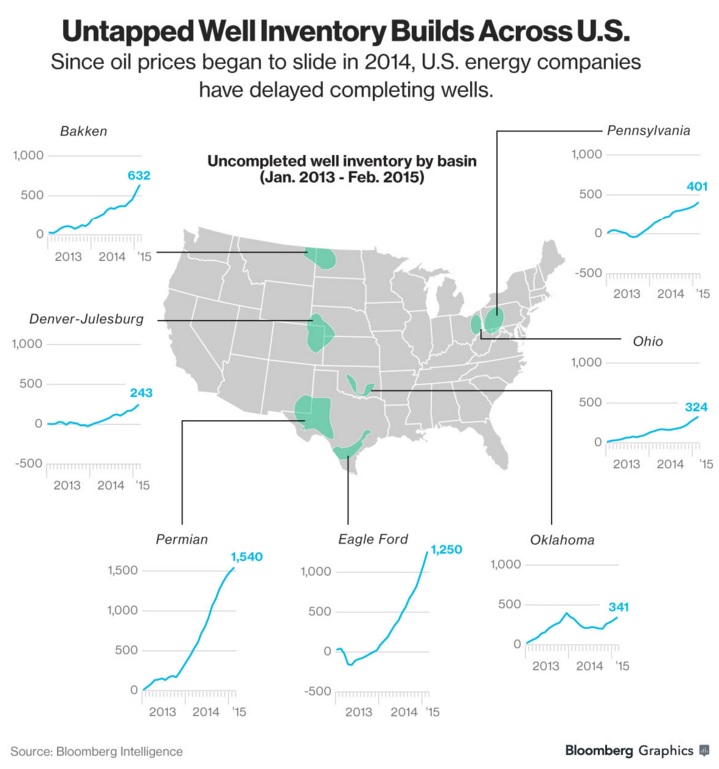

Rewind: DUCs in Q1’15

Bloomberg Intelligence released an estimate for year-end 2014 DUCs in April, revealing a rapid climb of incompletions even before prices began to head south. Estimates showed more than 4,700 DUCs were in inventory in early 2015, with approximately 80% of them being oil wells. The “fracklog” was leaving more than 300 MBOPD off the U.S. production grid. In an email, Bloomberg Intelligence told OAG360 that it plans to update the model again early next year.

IHS Inc., RBC Capital Markets and Wood Mackenzie each estimated roughly 3,000 DUC wells were sitting in the U.S. Halliburton (ticker: HAL) said the number could be around 4,000. In March, Harold Hamm, Chief Executive Officer of Continental Resources, estimated that 85% of U.S. wells weren’t being completed at the time, an increase from roughly 40% in November. Continental was certainly adhering to that strategy, considering the company monetized all of its hedges in December 2014, leaving it completely exposed to the commodity market.

Completing the DUCs will take precedence over drilling entirely new wells, says a report from IHS, citing costs are 35% lower considering the drilling portion will already be out of the way. Bringing these wells online will have a considerable impact on the market – IHS believes bringing 150 Eagle Ford wells online per month would result in a DUC wedge production increase of 269 MBOPD after 12 months.

Fast Forward: DUCs Today

Estimates for a current DUC number can be anybody’s guess, but certain companies did provide their inventory backlog in respective conference calls. EOG Resources (ticker: EOG) holds one of the largest, with about 300 DUCs on the docket. Anadarko Petroleum (ticker: APC) also has a sizable inventory of about 200 DUCs, which management believes provides optionality for its volume output. Continental Resources is also in the 200 DUC camp.

Some gas drillers also have deferred wells, albeit a much lower amount than their oil counterparts. Range Resources (ticker: RRC), Cabot Oil & Gas (ticker: COG) and Antero Resources (ticker: AR), three of the premier producers of the Marcellus/Utica, each have about 50 to 60 regional wells waiting on completion.

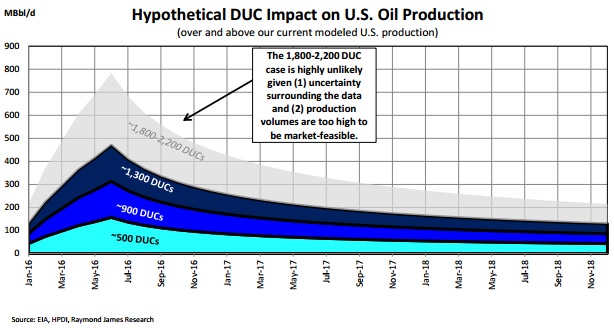

The effects of those DUCs coming online were explored in the Raymond James note, but not without extensive caution and consistent reminders that any estimates were made with “very low confidence levels.” Raymond James estimates said the incoming DUC wells could add anywhere from 100 to 300 MBOPD, which, at the high end, would match up with estimates from previous studies in this article.

What’s the Point of Creating a DUC Backlog?

Jeb Armstrong, Vice President of Energy Research for the Marwood Group, doesn’t expect most producers to have a large inventory of DUCs. Instead, he sees the backlog as a matter of circumstance rather than a way of loading up on potential volumes. “The only reason why I can see a company willingly drilling DUCs is because they have a rig contract that’s too expensive to cancel,” he said in an email to Oil & Gas 360®. “Might as well keep the rig operating and plow the capital into the ground than pay a penalty to the rig owner.”

Raymond James analysts shared a similar viewpoint, noting a certain dynamic on the oilservice industry. “Lower returns and crimped cash flow lead operators to slow activity and conserve cash in any way possible,” the note said. “Since many of the land rigs had longer-term contracts and the frac crews didn’t, the quickest way to conserve cash is to drill but not complete.”

Raymond James analysts shared a similar viewpoint, noting a certain dynamic on the oilservice industry. “Lower returns and crimped cash flow lead operators to slow activity and conserve cash in any way possible,” the note said. “Since many of the land rigs had longer-term contracts and the frac crews didn’t, the quickest way to conserve cash is to drill but not complete.”

Raymond James explains that the “frac crews” are an important factor; most are contracted on a job-by-job basis, while rig contracts can last years and include penalty fees if the operator chooses to break the contract. A further explanation includes: “As operators were faced with cycle-low pricing they were forced to decide between (A laying down rigs and taking the capital hit as a result or (B continuing to drill wells until the contracts rolled off. On the whole, we believe many E&Ps chose the latter option; deciding to drill these wells at near-or-below breakeven pricing and deferring the completion (and thus production) for a later date.”

So What’s Your Best Guess?

That number, in our opinion, is a risky, widely ranging number that outweighs any type of reward. We’re saying that based on the reception we received during our research. Several analytical firms and consulting agencies initially expressed interest in cooperating with our research, followed by an email that the task was being passed on to the technical team, followed by silence. In searching for DUC counts online, there are a handful of estimates in the early stages of 2015 – spanning from about February through April. From that point on, there’s nothing. And now we know why.

Raymond James sums it up the DUC count mystery succinctly: “If anyone tells you they know the number, they haven’t done the work.”