41 Gen 3 wells on line in the Eagle Ford

In its Q2, 2017 earnings call WildHorse Resource Development (ticker: WRD) reported second quarter production of approximately 22,600 BOEPD—which was 28% higher than its average production in Q1, 2017. It achieved a net income of $25.9 million, or $0.28 per share.

Drilling activity

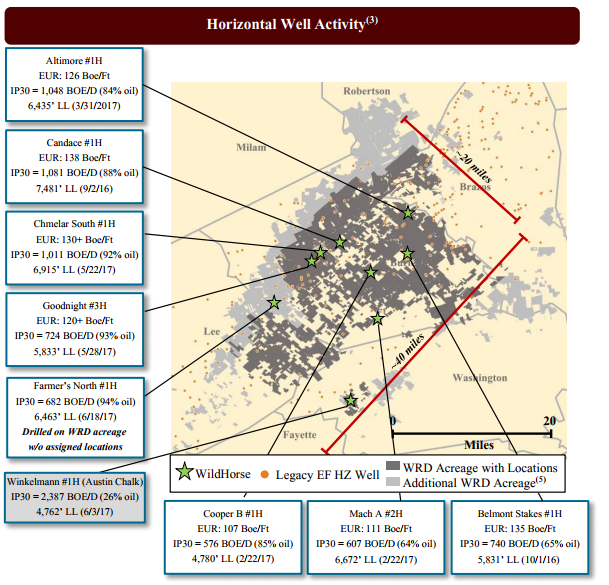

During the course of Q2, the company brought 18 gross (17.4 net) wells online in the Eagle Ford, one gross (1.0 net) well online in the Austin Chalk, and two gross (1.1 net) wells online in north Louisiana. The company’s Eagle Ford rigs averaged 13.2 drilling days in Q2.

The single Austin Chalk well was WildHorse’s first well drilled into the formation, which showed a 30-day initial production of 2,387 BOEPD. Because of the success of this well, WildHorse noted that it would continue delineating its Austin Chalk assets with new wells in the remainder of the year.

WildHorse said that, as of the Q2 update, it now had 41 Generation 3 wells online in the Eagle Ford.

The company expects to bring another 60 wells online in the Eagle Ford during the second half of 2017. WildHorse added a second rig to its Louisiana acreage during Q2. Both rigs are drilling two separate 3-well pads—which will be brought online during Q4, 2017.

Finance

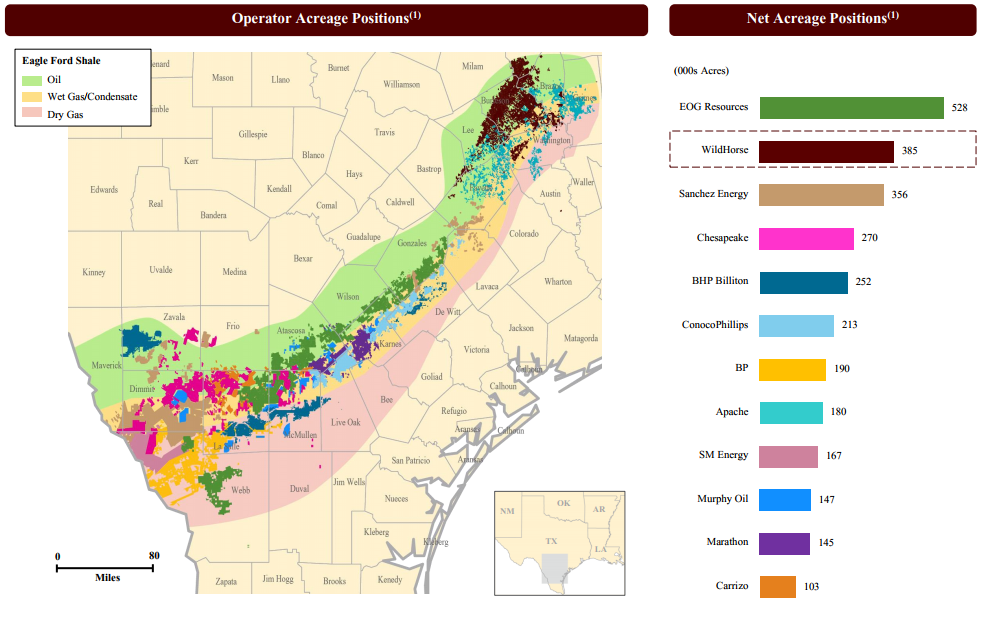

WildHorse also closed a $594 million acquisition of 111,000 net acres in the Eagle Ford during the quarter. As of Q2, 2017—the company was operating the second largest Eagle Ford area. Its borrowing base on its revolving credit facility was raised from $450 million to $650 million.

The company reported an increase in lease operating costs to $3.33 per BOE in Q2, 2017, up from $1.73 per BOE in Q2, 2016. WildHorse attributed the increase to higher lease operating costs out of its Clayton Williams acquisition in December, 2016. Company continues to build efficiency in the area, reflected by a quarter-to-quarter decrease from $4.37 per BOE in Q1 to $3.33 per BOE in Q2.

WildHorse anticipates that its lease operating costs will be impacted by the Anadarko/KKR acquisition, which will come in with higher legacy lease operating costs of between six and seven dollars per BOE. Despite this, the company estimates that its full year LOE will be within its full year guidance of $3.25 and $3.75 per BOE.

WildHorse spent approximately $11.5 million in exploration during Q2, up significantly from its exploration expenses in Q2, 2016—which totaled $0.1 million. The increase in exploration expenses were attributed to undeveloped leasehold impairments, totally $9.9 million, and $1.5 million in seismic acquisitions.

The company’s drilling and completion costs were $182.2 million for the second quarter, which brought the year-to-date total to $267.6 million. Approximately 90% of the drilling and completion capital was allocated to the company’s Eagle Ford acreage, with the remaining 10% allocated to its northern Louisiana acreage.

Looking forward

WildHorse decided to keep its 2017 operational and financial guidance—which was given on May 11, 2017. The company expects its production fall with the range of 27,000 to 31,000 BOEPD. Its capital expenditure guidance was between $550 and $675 million.

Over the course of the year, the company expects to spud a total of between 100 and 120 gross wells, and complete between 85 and 105 gross wells.

WildHorse Resource Development is presenting at EnerCom’s The Oil & Gas Conference® 22

WildHorse will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.

WildHorse Q2, 2017 Earnings Call Q&A

Q: On the Austin Chalk Well, could you talk about the cost perhaps lateral length completion design and how many wells are being planned for back half of the year?

WRD: Several questions there. Cost, we’re not releasing any specifics guidance on ranges. Obviously, there’s going to be a number of variations in the first few wells that we drilled, so I don’t want to lay a number out there and then the next one be materially different. But we’re kind of roughly saying $7 million to $7.5 million for an Austin Chalk Well. As far as completion design is concerned, it’s roughly in line with the way we’re completing the Eagle Ford well, but we all recognize it’s the different reservoir. So, that may merely represent a starting place. And so, we would expect to be continue evolution on how we hone in on the best way to complete those wells.

And at this point, we don’t have a fixed number of additional loss in Chalk well that we planned to drill this year. I think we talked about we have drilled the second Austin Chalk well and it is in early flow back right now and the results look encouraging. It is not in Washington County, it’s in Burleson County, but we’ll continue to work on potential locations. And as we’ve indicated thus far, we’ll continue to delineate the Austin Chalk position.

Q: In the Austin Chalk I know you only have one well, but I was curious how the current iteration of the Chalk play ties to the old fractured carbonate play. In other words, do you want to go toward fractures or stay away from fractures, and does that add a layer of complexity when you think about completing and the predictability of the reservoir?

WRD: I would say the short answer is it may be too early to tell. But if you look at it from a high-level perspective, obviously, the early development of the Chalk back in the 1980s and 1990s, most of the good results and, obviously, most of the activity was focused on where it was naturally fractured because that was what enabled the hydrocarbon to flow to the wellbore.

We may be seeing an opportunity now to generate our own fractures in the reservoir because of the current fracture technology that we employ. And so, that may be much less of a driver going forward as to whether there is a lot of natural fractures in the Chalk at that particular location.