Earthstone Energy (ticker: ESTE) has entered into an agreement with Sabalo Holdings, LLC in which Earthstone will acquire all of Sabalo Holdings’ interests in Sabalo Energy, LLC and Sabalo Energy, Inc., whose assets include both producing and non-producing oil and gas assets in the northern Midland Basin. Sabalo is a privately-held oil and gas company based in Corpus Christi, Texas and is a portfolio company of EnCap Investments L.P.

In addition, on October 17, 2018, Sabalo entered into an agreement to acquire certain well-bore interests held by Shad Permian, LLC which were part of a drilling joint venture between Sabalo and Shad.

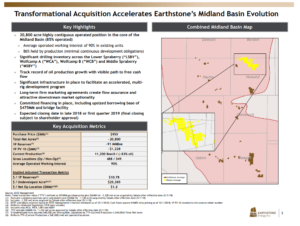

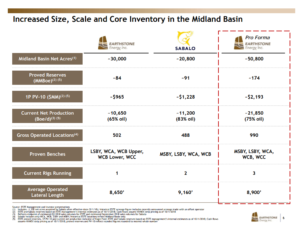

As a result of these agreements, Earthstone expects to acquire 20,800 net acres located in the Midland Basin and an estimated 488 gross operated horizontal drilling locations and 349 gross non-operated horizontal drilling locations for an aggregate purchase price of approximately $950 million (the “Sabalo Acquisition”) which consists of $650 million in cash and $300 million in stock at approximately $9.28 per share comprised of 32,315,695 shares of Earthstone Class B common stock and corresponding membership interests of Earthstone Energy Holdings, LLC.

The purchase price is subject to certain adjustments, including an increase in the purchase price of approximately $26 million to account for approximately 1,330 acres acquired after the effective date of the Sabalo Acquisition (and included in the net acres mentioned herein). All purchase price adjustments will be paid in cash. Sabalo’s and Shad’s combined average estimated production for the month of September 2018 was approximately 11,200 BOEPD with approximately 83% being oil.

The Sabalo Acquisition represents a large, contiguous acreage position with a deep inventory of favorable economic drilling locations and significantly expands Earthstone’s footprint in the Midland Basin. The Sabalo Acquisition is expected to close in late 2018 or in the first quarter of 2019.

Highlights of Sabalo’s asset base and operations include:

- Highly contiguous acreage position comprised of 20,800 net acres (~85% operated) in the core of the northern Midland Basin, largely in Howard County, Texas

- 86% of acreage position is held-by-production (“HBP”)

- Average of 90% working interest in operated units

- Operating a two-rig drilling program, with its position significantly de-risked based on significant horizontal well control in the Lower Spraberry and Wolfcamp A formations

- Middle Spraberry and Wolfcamp B have fewer horizontal well results but numerous vertical wells de-risk the formations as well

- Estimated 488 gross operated and 349 gross non-operated high quality, largely de-risked horizontal drilling locations across four primary benches

- Potential for additional upside from down-spacing and additional benches

- Average operated lateral lengths of approximately 9,160 feet

- EURs in Lower Spraberry and Wolfcamp A, normalized to 10,000 foot laterals, ranging from 850 MBoe to 1,080 MBoe (68% to 73% oil), with further upside potential from ongoing improvements in landing zones and completion designs

- Extensive midstream transportation, water sourcing and salt water disposal assets in-place to facilitate accelerated development

- Net production of ~11,200 Boe/d (83% oil) for the month of September 2018 predominantly from 29 gross operated (27 net) and 57 gross non-operated (6.2 net) horizontal Lower Spraberry and Wolfcamp A wells

- Net operated oil production growth of over 300% over trailing twelve months on the acreage

- Strip price PV-10 of proved reserves of ~$1,228 million (1)

- Strip price proved reserves of ~91 million Boe (1)

Highlights of the combined Earthstone and Sabalo asset base and operations include:

- Approximately 50,800 net Midland Basin acres (~81% operated), predominately located in Howard, Reagan, Upton and Midland Counties in Texas (increasing Earthstone’s position by 69%)

- Three rigs operating in the Midland Basin with adequate infrastructure to enable additional rigs

- Production is ~21,850 Boe/d (75% oil and 89% liquids)(2)

- Proved reserve volumes of ~174 million Boe and PV-10 of $2,193 million (1)

- Estimated 990 gross operated Midland Basin drilling locations (increasing Earthstone’s locations by 97%)

- Average of 81% working interest in Midland Basin operated units

- 79% of Midland Basin operated acreage is HBP and highly de-risked for Wolfcamp and Spraberry formations

- Borrowing Base of no less than $475 million, increased from $225 million

Earthstone President Robert J. Anderson said in a press release, “The Sabalo Acquisition is an important milestone in our ongoing transformation into a premier Midland Basin focused operator. We have delivered on our goal, as stated after our 2017 acquisition of Bold, to significantly increase our operated acreage and inventory of highly economic locations. With the addition of this especially attractive contiguous acreage to our existing Midland Basin assets, we have positioned Earthstone to capitalize on increased scale and strong asset quality in order to generate significant returns. This contiguous acreage block in the heart of the northern Midland Basin with a deep inventory of high-return drilling locations provides an exciting foundation for growth.”

“We have identified a high-quality de-risked inventory of nearly 500 gross operated locations in the Middle and Lower Spraberry and Wolfcamp A and B formations. The Lower Spraberry and Wolfcamp A supported the valuation while recent results in the Middle Spraberry and Wolfcamp B create the potential for additional upside and inventory expansion. The Sabalo Acquisition adds strong cash flow generation and increases our footprint in the Midland Basin by 69% and includes substantial operated acreage with high working interests. This larger scale of operations combined with being a much bigger company should drive a number of additional benefits as we now have the ability to secure dedicated services and focus on further improving corporate and field-level operating efficiency.”

“Sabalo’s continuing two rig development program has created significant momentum and driven over a 300% increase in its oil production over the last 12 months. We expect production to continue to increase and our plan is to maintain those two rigs and the single rig we have been operating on our southern Midland Basin acreage since May, 2017. We have a clear line of sight toward being cash flow positive in 2020,” said Mr. Anderson.

2019 Capital Program and Operational Guidance

Based on an assumed closing of the Sabalo Acquisition on January 1, 2019, Earthstone expects full year 2019 production to range from 25,000 to 29,000 BOEPD (~70% oil) with capital expenditures of $425 million to $500 million. This is based on a three-rig program for the full year and a similar level of activity in the Eagle Ford as in 2018. Between the current time and closing of the Sabalo Acquisition, Earthstone expects to maintain one rig full time in the Midland Basin.

Financing and Sources of Funds

Earthstone intends to fund the cash portion of the Sabalo Acquisition with the net proceeds from a combination of:

- A fully committed $225 million preferred stock issuance (the “Preferred Stock”)

- An approximately $500 million unsecured senior notes issuance (the “Notes”)

- A committed amended and restated senior secured revolving credit facility with a minimum initial borrowing base of $475 million (the “Credit Facility”)

In connection with the Sabalo Acquisition, Earthstone entered into a commitment letter dated October 17, 2018 with a consortium of banks to provide a $500 million unsecured bridge facility and the credit facility to achieve certainty of financing.

Wells Fargo Securities, LLC and RBC Capital Markets are acting as Joint Lead Arrangers on the credit facility. Wells Fargo Securities, LLC, RBC Capital Markets, SunTrust Robinson Humphrey, Inc. and Jefferies Finance LLC are acting as Joint Lead Arrangers on the unsecured bridge facility and Joint Bookrunners on the contemplated senior notes offering.

Earthstone also entered into a securities purchase agreement dated October 17, 2018 that provides a commitment to fund the Preferred Stock by certain investment funds managed by EIG Global Energy Partners (“EIG”). EIG is also obligated to fund a $30 million private placement of Class A common stock in the event of a public issuance of at least $60 million of Class A common stock, should such offering occur prior to closing. The Credit Facility, Bridge and Preferred Stock are conditioned upon, amongst other things, the closing of the Sabalo Acquisition.

This $950 million deal by Earthstone in the Midland Basin is largest midland acquisition in Q3, compared to the acquisition of Ajax Resources by Diamondback Energy (ticker: FANG) in Q2 for $1.25 billion. The Earthstone acquisition totaled a net acreage of 20,800, compared to the 25,493 net acre acquisition that Diamondback made back in early August, 2018. While the Diamondback acreage acquisition had greater than 12,100 BOEPD of net production (88% oil), the Earthstone acreage acquisition currently produces a net production of 11,200 BOEPD (83%), making the net oil production of Earthstone in the Midland Basin approximately 21,850 BOEPD.