EIA predicts U.S. gas production will grow by nearly 1 Bcf/d in one month

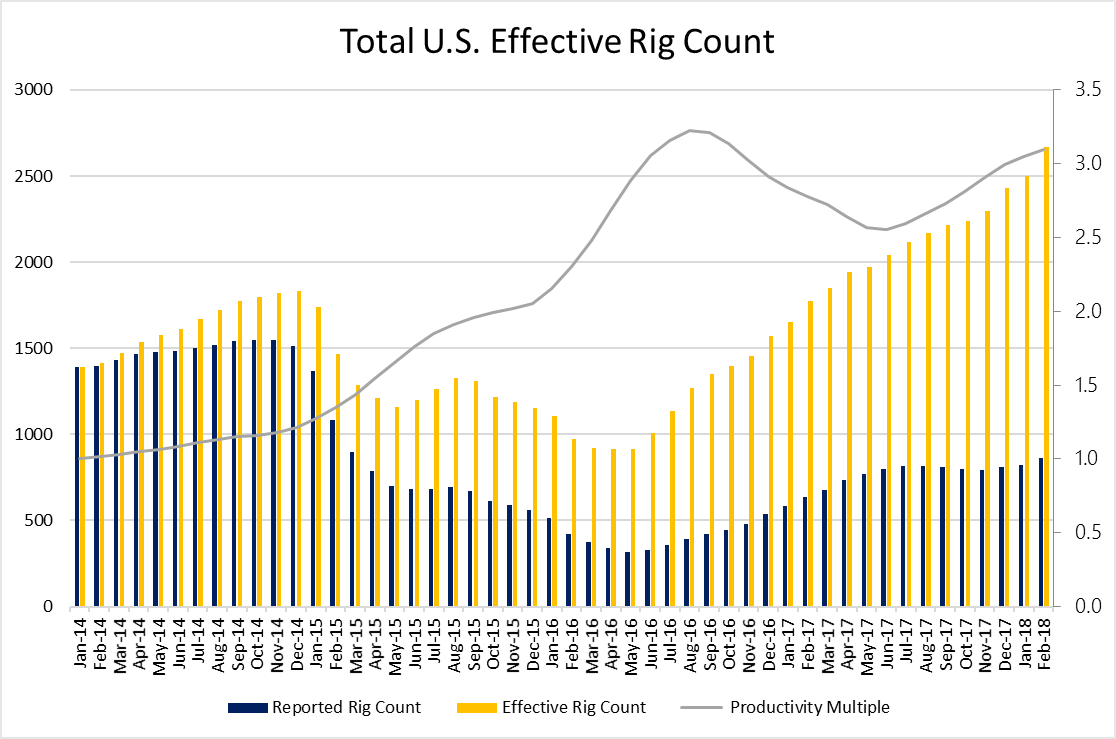

EnerCom’s Effective Rig Count rose sharply last month, as improving efficiencies combined with a jump in active rigs.

The Effective Rig Count now stands at 2,670, meaning it would take 2,670 rigs from January 2014 to yield the same production as current operations are achieving. Current rigs are nearly 3.1 times more productive than January 2014 rigs, the highest overall productivity level since late 2016.

Steadily improving operations and technology means rigs are now as productive as when operators were solely focused on efficiency. Now drilling is outpacing completions, and wells drilled by a given rig do not immediately translate into production. That per-rig productivity is still at near record levels, despite this handicap, is a testament to how much operators have improved processes in just the last two years.

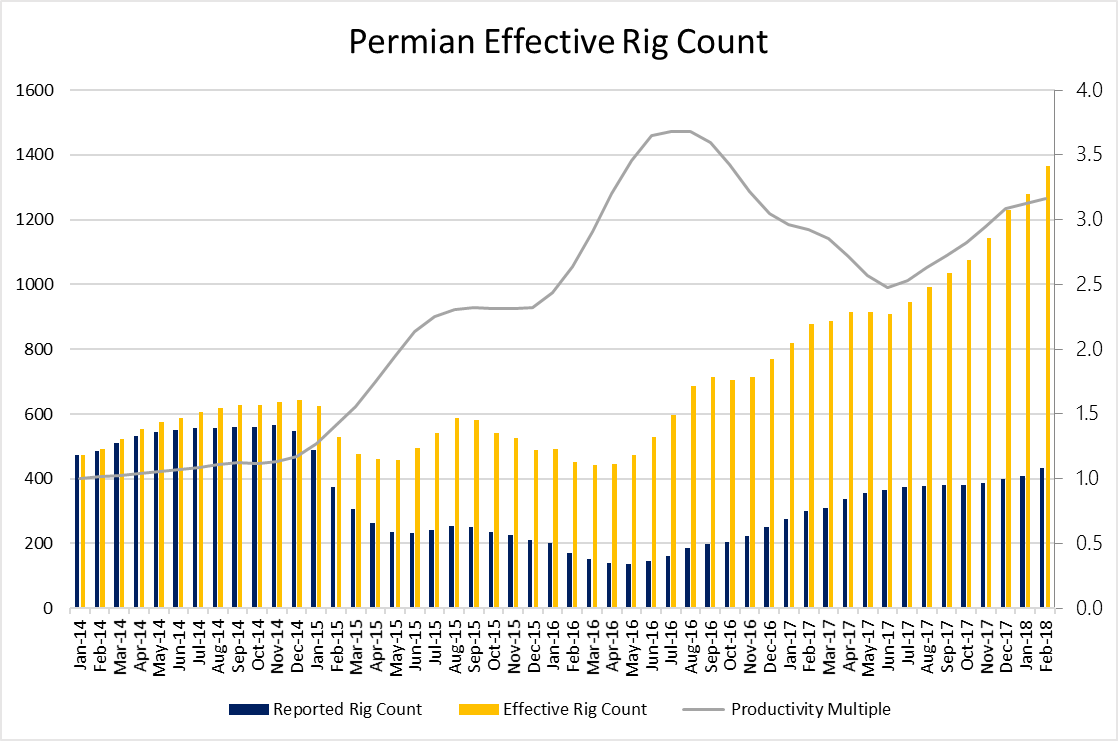

Permian growth dominates

The Permian continues to dominate the ERC, and now accounts for 51% of the national total. Current activity is equivalent to 1,365 Permian rigs from January 2014. Most of the growth in the basin’s Effective Rig Count in 2018 has been due to increases in absolute rigs in the basin, though, instead of improved efficiencies. Rigs in the Permian are just under 3.2 times more productive than January 2014 Permian rigs.

ERC increased in every major basin this month, as productivity and reported rig count increased throughout. The largest rise in ERC came in the Anadarko basin, which added 24 effective rigs, while the Eagle Ford showed the largest increase in efficiencies.

Oil output up 131 MBOPD

The EIA expects this improvement in efficiency will lead to accelerating production growth from March to April. The agency predicts the major shale basins of the U.S. will produce a combined 6.95 MBOPD in April, up 131 MBOPD from March. As usual, the Permian will contribute the majority of oil growth this month, adding 80 MBOPD. More significant acceleration of growth will come in the other basins, though, as the Bakken, Eagle Ford and Niobrara are predicted to grow significantly more in the coming month than in the previous month. These three basins are expected to grow by a combined 47 MBOPD, compared to 31 MBOPD last month.

Similar growth acceleration is expected in gas production, where the EIA expects major basins to add 969 MMcf/d. Unlike in oil activity, gas growth is spread between three major basins, Appalachia, the Permian and the Haynesville. These three basins account for nearly 800 MMcf/d of growth, while the Eagle Ford and Niobrara account for nearly all the rest. This growth seems to be becoming more rapid, as the U.S. added 832 MMcf/d of gas production last month. Each basin saw output of oil and gas increase this month, unlike last month, when gas production in the Anadarko basin fell.

DUC count rising on Permian activity

Completions seem to be catching up to drilling in most basins, as the DUC count is falling in multiple locations. The EIA estimates the number of drilled uncompleted wells fell from January to February in Appalachia, the Niobrara, Haynesville and Bakken. These four basins saw completions outpace drilling by a total of 44. However, companies are still drilling at a significantly higher rate in the Permian and Eagle Ford, so the overall DUC count is rising. The total number of drilled uncompleted wells is estimated at 7,601, up 110 from last month.