Raises Production Guidance for 2015

VAALCO Energy (ticker: EGY) reported average production volumes of 4,800 BOEPD in its Q3’15 results on November 9, 2015, marking a sequential increase of 6% from the prior quarter. The volumes surpassed the high end of guidance (4,700 BOEPD) and prompted EGY management to raise estimated 2015 averages to 4,400 to 4,700 BOEPD, up from previous guidance of 4,100 to 4,600 BOEPD. The trend is expected to continue in the upcoming fourth quarter, with volumes projected at 4,600 to 5,000 BOEPD.

The company reported a net loss of $33.7 million in the quarter with an adjusted net loss of $6.5 million, compared to Q2’15 results of a $5.2 million net loss with an adjusted net loss of $0.6 million. Factors contributing to the Q3’15 results included:

- a non-cash impairment charge of $18.0 million, related to lower oil prices;

- a write-off of $9.2 million related to a dry hole exploration well; and

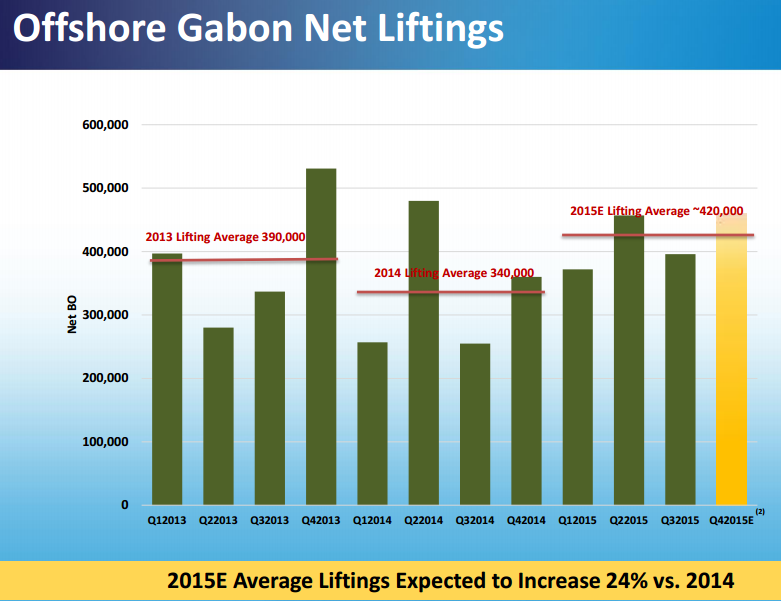

- a quarter-over-quarter decrease of 14% in sales volumes (EGY refers to sales as “lifting”), based on the timing and offloading of its floating production storage and offloading (FPSO) vessel. As indicated below, offloading volumes can fluctuate but EGY’s share is still up approximately 24% year-to-date compared to 2014 volumes.

Production Update

Production Update

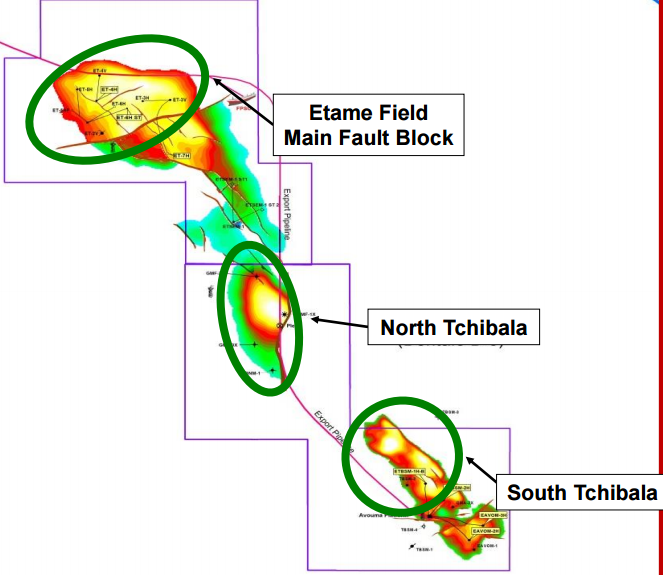

VAALCO’s wells on its Southeast Etame/North Tchibala (SEENT) platform are displaying consistency, with its southeast Etame 2H well continuing to produce in the range of 3,000 BOPD gross (about 800 net to EGY). The well was brought online in July 2015 at an initial gross rate of 3,400 BOPD and continues to be a significant factor in VAALCO’s overall gross output of 20,000 BOPD. “We have not really seen any material decline in the well’s rate or pressure,” said Cary Bounds, Chief Operating Officer of VAALCO Energy, in a conference call following the release. “It’s a very strong well.”

Management added the southeast Etame wells, targeting the Gamba formation, provides returns of 30% to 40% at $55/barrel prices for Brent. Steve Guidry, Chairman and Chief Executive Officer, said, “We think that a 1,500 BOPD gross initial rate is what’s necessary for us to earn an acceptable rate of return on a Gamba well” – which is less than half of the output from the first well.

Its North Tchibala 1H, the first ever offshore well drilled to the Dentale formation, returned an initial gross rate of 3,000 BOPD in September and maintained the volumes for six weeks with “minimal pressure depletion.” The North Tchibala 2H well is currently being drilled to 16,000 feet and is expected online in November. Upon its completion, VAALCO will move the rig to the Avouma platform to perform workovers on three existing wells, two of which are currently offline. The impact from the wells will be most realized in early 2016, and will generate returns greater than 100% at Brent strip pricing of $55/barrel.

The Q4’15 guidance range midpoint of 4,800 BOPD does not include the full impact of the incoming wells, management said. “The production impact from the workovers will be minimal for fourth quarter 2015 volumes, but we do expect to see a robust production boost by early 2016,” explained Bounds.

The Q4’15 guidance range midpoint of 4,800 BOPD does not include the full impact of the incoming wells, management said. “The production impact from the workovers will be minimal for fourth quarter 2015 volumes, but we do expect to see a robust production boost by early 2016,” explained Bounds.

Operations in Angola, meanwhile, are gaining interest for exploratory drilling prior to early 2017. VAALCO has opened a data room in London to farm out a portion of its working interest, and management said 12 companies have indicated interest, including “large and major” E&Ps.

On the Tail-End of Expenditures

VAALCO’s ambitious 2015 program, considering the current market environment, is coming to an end and the company is shifting operations to a “well-by-well” basis for 2016. The company expended $72.2 million in the first nine months of 2015 and plans on spending roughly $11 to $14 million in Q4’15 for its North Tchibala 2H completion and the aforementioned workovers. At the time of its Q3’15 release, VAALCO reported $107.6 million of total liquidity with $57.7 million of cash on hand. The remaining $50 million exists on its $65 million credit facility, of which $15 million is drawn.

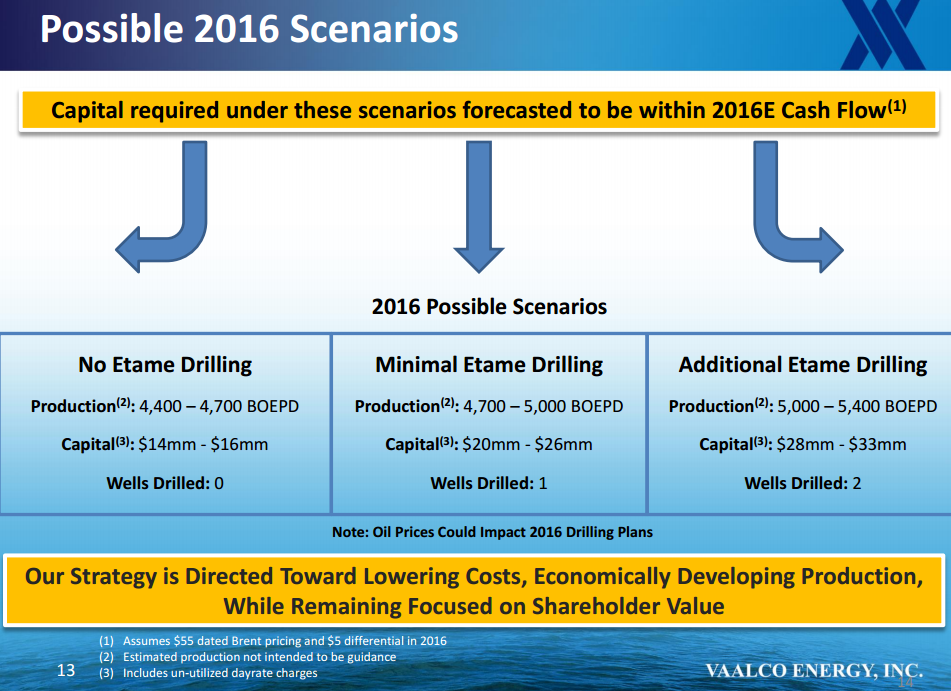

VAALCO management said the cash balance, combined with cash flow from operations, is “more than sufficient” to fund its 2015 budget. In 2016, EGY will adjust accordingly in the evolving commodity environment and outlined three different options, which are listed below.

In the most ambitious preliminary scenario, EGY does not anticipate spending more than $33 million and all scenarios are forecasted to be within its cash flow. Lower production expenses are adding to the margins; per barrel costs of $19.36 in Q3’15 are roughly 29% below Q4’14 costs of $27.43/BOE, and the costs are expected to fall to a midpoint of $17.50/BOE in Q4’15.

EGY management reminded analysts and investors that its plans can change in line with oil prices, and the company is not limited by cash constraints to execute in the case of an oil price recovery. “In the current price environment, we want to protect our liquidity while remaining opportunistic in our investment decisions,” Guidry said.