On Wednesday, December 17, Egypt’s Ministry of Petroleum announced that Egypt’s state oil company (EGPC), Houston based Apache Corp. (ticker: APA) and Shell Egypt (ticker: RDSA) have entered into an agreement for the production of unconventional gas using hydraulic fracturing in the Northeast Abuel Garadeek region of Egypt’s Western Desert, about 200km (124.27 miles) west of Cairo.

According to the ministry’s release, the deal is for three horizontal wells using multi-stage fracing. The project investments are expected to be $30-40 million. A source at the petroleum ministry told Reuters that the wells are expected to operate at depths of 14,000 feet.

One part of Egypt’s plan to end an energy crisis

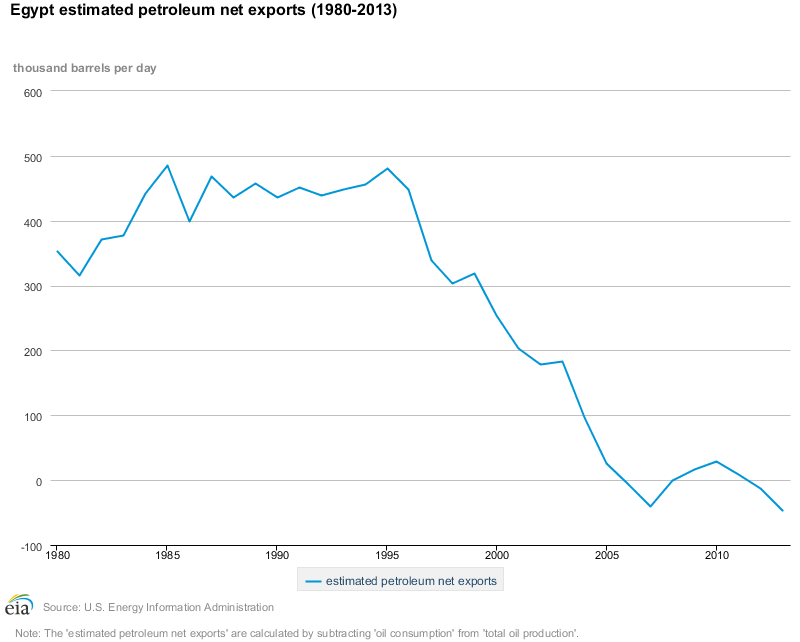

News of fracing in Egypt come as the country tries to find ways to end its worst energy crisis in decades. Egypt has struggled with maintaining high subsidies that it provides on fuel for its population. The subsidies, along with fast growing demand, have turned Egypt from a net energy exporter into a net importer over the course of a few years.

In order to combat the growing energy crisis, Egypt has signed supply contracts for liquefied natural gas (LNG) to help meet its energy needs.

In November, Egypt finalized a deal with Norway’s Hoegh LNG for a floating storage and regasification unit that will allow the country to begin importing LNG, reports Reuters. The unit is expected to launch in March 2015 – in time to receive at least 48 tendered LNG cargoes through the end of 2016.

The contract with Hoegh, which was signed November 3, 2014, is for a period of five years and expected to generate an average annual EBITDA of around $40 million, according to the company.According to the Energy Information Administration, the venture with Hoegh will take some weight off of the country’s rapidly declining gas exports. Total LNG exports in 2013 nearly halved on a year over year basis as the resource has been diverted to supply domestic energy needs.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.