The EIA released its newest energy consumption and production projections today in its newest release of Annual Energy Outlook 2017.

Across most cases, natural gas production increases despite relatively low and stable natural gas prices, supporting higher levels of domestic consumption and natural gas exports. Projections are sensitive to resource and technology assumptions, the EIA said.

U.S. natural gas consumption increases across most cases through most of the projection period— and in combination with growing net exports, supports production growth, the agency said of its projections.

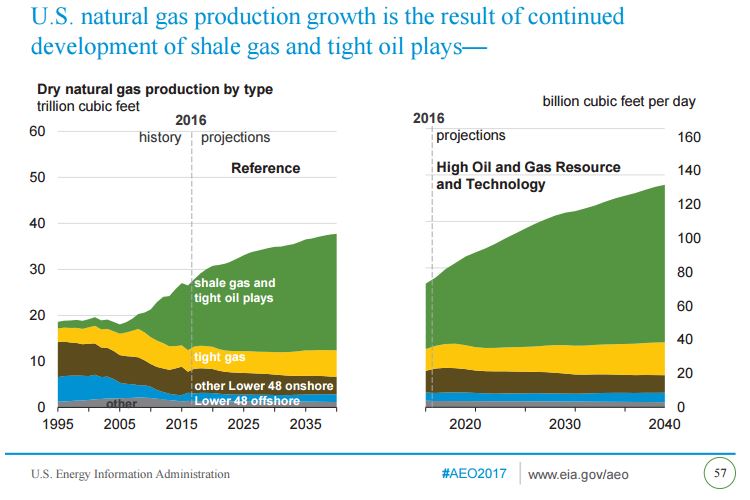

In the Reference case, natural gas production over the 2016–20 period is projected to grow at about the same rapid rate (nearly 4% annual average) as it has since 2005. Since 2005, technologies to more efficiently produce natural gas from shale and tight formations have driven prices down, spurring growth in consumption and net exports.

Beyond 2020, natural gas production in the Reference case is projected to grow at a lower rate (1.0% annual average) as net export growth moderates, domestic natural gas use becomes more efficient, and prices slowly rise. Rising prices are moderated by assumed advances in oil and natural gas extraction technologies.

Near-term production growth is supported by large, capital-intensive projects, such as new liquefaction export terminals and petrochemical plants, built in response to low natural gas prices.

Despite decreasing in the near term, in all cases, other than the Low Oil and Gas Resource and Technology case, U.S. natural gas consumption is expected to increase during much of the projection period.

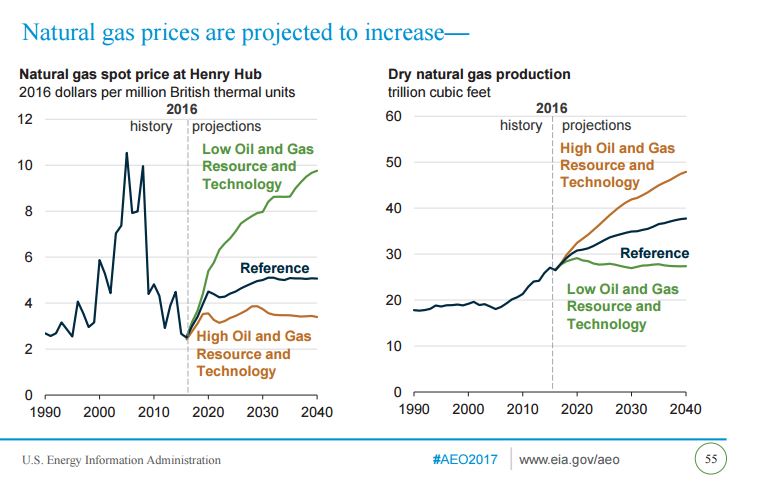

Natural gas prices are projected to increase—and are sensitive to the availability of new technology and resources, the agency said.

The range of projected Henry Hub natural gas prices depends on the assumptions about the availability of oil and natural gas resources and drilling technology.

In the Reference case, the natural gas spot prices at the U.S. benchmark Henry Hub in Louisiana rise because of increased drilling levels, production expansion into less prolific and more expensive-to-produce areas, and demand from both petrochemical and liquefied natural gas export facilities.

Reference case prices rise modestly from 2020 through 2030 as electric power consumption increases; however, natural gas prices stay relatively flat after 2030 as technology improvements keep pace with rising demand.

In the High Oil and Gas Resource and Technology case, lower costs and higher resource availability allow for increased levels of production at lower prices, increasing domestic consumption and exports.

In the Low Oil and Gas Resource and Technology case, prices near historical highs drive down domestic consumption and exports.

The agency sees production from shale gas and associated gas from tight oil plays as the largest contributor to natural gas production growth, accounting for nearly two-thirds of total U.S. production by 2040 in the Reference case.

Tight gas production is the second-largest source of domestic natural gas supply in the Reference case, but its share falls through the late-2020s as the result of growing development of shale gas and associated gas in tight oil plays.

As new discoveries offset declines in legacy fields, offshore natural gas production in the United States increases over the projection period.

Production of coalbed methane generally continues to decline through 2040 because of unfavorable economic conditions for producing that resource.