Despite supply disruptions and security threats, Iraq was the second-leading contributor to global oil supply growth in 2014

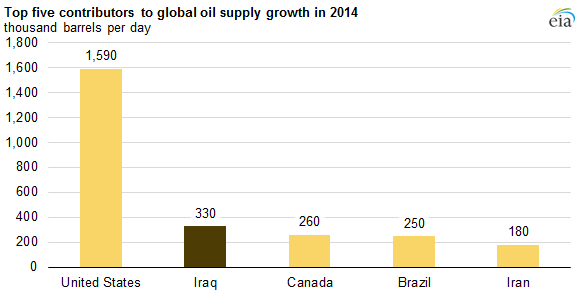

According to information released by the Energy Information Administration (EIA) today, Iraq’s production growth in 2014 was the second largest in the world, trailing only the United States. Iraq accounted for almost 60% of production growth among OPEC members, although its growth was more than offset by production declines in other OPEC countries.

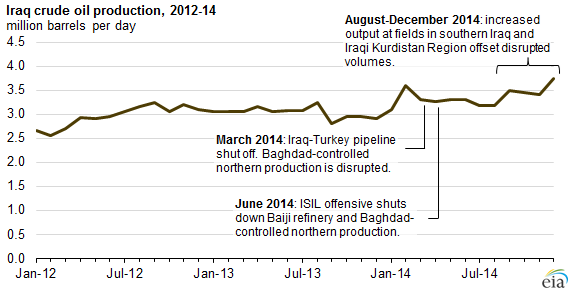

Iraq’s crude oil production, which averaged almost 3,400 MBOPD in 2014, was 330 MBOPD above 2013 levels, despite the heightened security threat from the Islamic State of Iraq and the Levant (ISIL) and disrupted production in northern Iraq, according to the EIA.

ISIL attacks in northern Iraq in early June 2014 reduced regional production and refinery operations, not including the Iraqi Kurdistan Region. These attacks did not affect southern production and exports, which accounted for 95% of Iraq’s total crude oil exports in 2014.

Iraq’s crude oil production fell to its lowest monthly levels for the year during July and August following the start of the ISIL offensive. From August to December, Iraq’s production grew by almost 600 MBOPD. In December, Iraq’s crude oil production reached 3,750 MBOPD, the highest amount on record.

While some companies were forced to abandon exploration projects in northern Iraq due to the ISIL offensive, which could delay future development, more increases in production seem likely, report the agency. In December, Iraq’s central government and the Kurdish Regional Government reached a deal on oil exports and revenues, which could facilitate significant increases in production and exports from fields in the Iraqi Kurdish Region. Barring any major supply disruption, the EIA expects that Iraq will continue to be OPEC’S largest source of production growth over the next two years.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.