The Energy Information Administration does not expect production to fall alongside rig counts

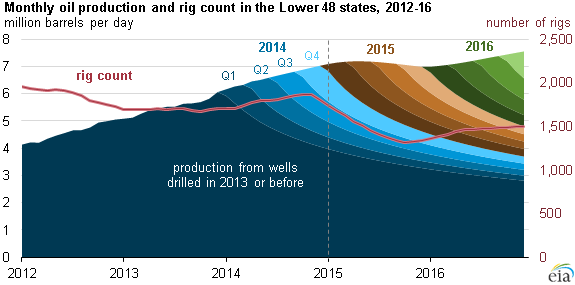

The Energy Information Administration (EIA) released a note today saying production is expected to remain relatively stable, despite lower rig counts. According to the EIA, a backlog in well completion will act as cushion for production rates, offsetting the more immediate decrease in drilling and permitting activity.

The latest information on rig counts from Baker Hughes (ticker: BHI) shows 1,633 wells in the United States. That’s 43 fewer total rigs compared to last week, and 144 less than this time last year. The EIA notes that active onshore drilling rigs in the Lower 48 have decreased 16% between the weeks ending on October 31, 2014 and January 23, 2015. The EIA said that despite this decline in the number of rigs drilling in the Lower 48, that production will continue to increase slowly.

The government arm projects the number of operating rigs will decrease by 24% by October 2015 before finally rebounding, assuming Brent prices of $58/barrel and $75/barrel in 2015 and 2016, respectively. The price of West Texas Intermediate is slated at $55/barrel and $71/barrel for the same time frame.

Despite projections that active rig counts could fall by nearly a quarter from their current level, the EIA does not expect the same kind of decrease in production. Pointing back to the 2008-2009 financial crises, the EIA noted that while rig counts fell drastically, production saw only moderate decreases before increasing past its former highs.

During the July 2008 peak prices, drilling activity in the Bakken-Three Forks formation outpaced well completion activity as increasing numbers of wells were drilled. “Averaging about 70 days before the oil price peak, spud-to-completion times almost doubled within two months, reaching more than 130 days. This increase created a backlog of wells that had been drilled but not yet completed,” says the EIA. The administration went on to note that increased drilling activity in the Bakken since 2011 has again increased spud-to-completion times, which have stabilized at more than 120 days per well.

The EIA says this backlog of wells will again act as a cushion for production rates, and “At most major plays in the United States, the backlog currently ranges from three to seven months.” The note goes on to say, “[The] EIA’s forecast of rising crude oil prices in the second half of 2015, if realized, is expected to be accompanied by a stabilization of drilling activity that would be sufficient to prevent a substantial production decline in the Lower 48.”

The administration warns that the actual outcome will vary widely based on the actual future price of oil, and that “the 95% confidence interval for market expectations for prices in December 2015 was extremely wide.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.