Falling prices at the pump will lead to U.S. households spending less on gas next year than in the last eleven years, according to a forecast from the Energy Information Administration (EIA).

The average U.S. household is expected to spend about $550 less on gasoline in 2015 compared with 2014, as annual motor fuel expenditures are on track to fall to their lowest level in 11 years, according to the EIA.

Household gasoline costs are forecast to average $1,962 next year, assuming that EIA’s price forecast, which is highly uncertain, is realized. Should the forecast be realized, motor fuel expenditures in 2015 would be below $2,000 for the first time since 2009.

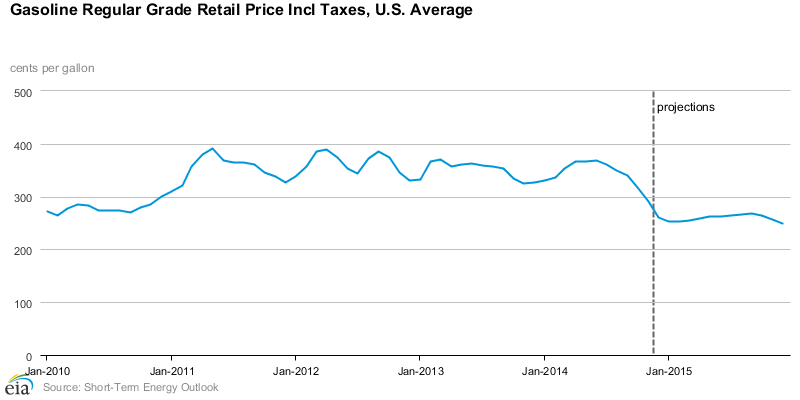

The price for U.S. regular gasoline has fallen 11 weeks in a row to $2.55 per gallon as of December 15, down $1.16 per gallon from its 2014 peak in late April and the lowest price since October 2009. Gas prices are forecast to go even lower in 2015, with the EIA anticipating gas prices at $2.52 a gallon in January.

The EIA’s latest Short-Term Energy Outlook forecasts that Brent crude prices will average $68 per bbl in 2015, with prices up to $5/bbl below that annual average early in the year. The forecast for WTI crude oil spot prices averages $63/bbl in 2015. However, the current values of futures and options contracts show high uncertainty regarding the price outlook. For example, WTI futures contracts for March 2015 delivery traded during the five-day period ending December 4 averaged $67/bbl. Implied volatility averaged 32%, establishing the lower and upper limits of the 95% confidence interval for the market’s expectations of WTI prices at the expiration of the March 2015 contract at $51/bbl and $89/bbl, respectively. By contrast, last year at this time, WTI futures contracts for March 2014 delivery averaged $96/bbl and implied volatility averaged 19%, with only a $30/bbl spread between the corresponding lower and upper limits of the 95% confidence interval.

Increases in fuel economy are also contributing to lower motor fuel expenditures. According to the Environmental Protection Agency, the production-weighted fuel economy of cars has increased from 23.1 miles per gallon (mpg) for model-year (MY) 2005 cars to almost 28 mpg for MY2014, an increase of about 21%. Similarly, the fuel economy for trucks has increased 19%, from 16.9 mpg to 20.1 mpg in the same time frame.

In the Bureau of Labor Statistics’ (BLS) Consumer Price Index, gasoline accounted for 5.1% of consumer spending, as of October 2014. The falling cost of oil and increased fuel efficiency of vehicles has led the EIA to forecast that this number will decline in 2015.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.