Enbridge and Spectra will combine to create company with US$127 billion enterprise value

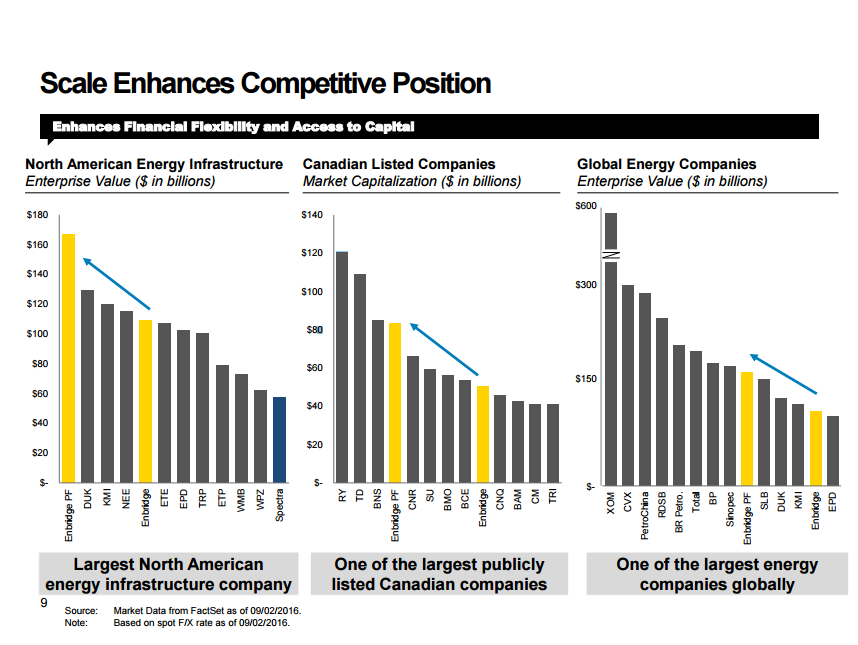

Pipeline companies Enbridge Inc. (ticker: ENB) and Spectra Energy Corp (ticker: SE) announced Tuesday that they have entered into a definitive merger agreement under which the two companies will combine in a stock-for-stock transaction which values Spectra common stock at approximately US$28 billion, based on Enbridge’s common shares on September 2, 2016, the company said in a press release. The combined company, which will keep Enbridge’s name, will have an enterprise value of approximately US$127 billion, making ENB the largest North American energy infrastructure company, and one of the largest energy companies globally.

Under the terms of the agreement, Spectra Energy shareholders will receive 0.984 shares of the combined company for each share of SE common stock they own. The deal values Spectra’s stock at US$40.33 per share, an 11.5% premium to its closing price on September 2, 2016. Upon completion of the deal, Enbridge shareholders are expected to own 57% of the company, with Spectra shareholders owning the remaining 43%.

In a presentation that accompanied an Enbridge conference call Tuesday, Enbridge said it will assume approximately US$16.9 billion of Spectra debt as well. The companies expect to save about US$415 million in costs, most of which will be achieved toward the end of 2018. Enbridge said it would divest US$1.5 billion of noncore assets over the next 12 months to strengthen its balance sheet.

Enbridge diversifies low-risk assets

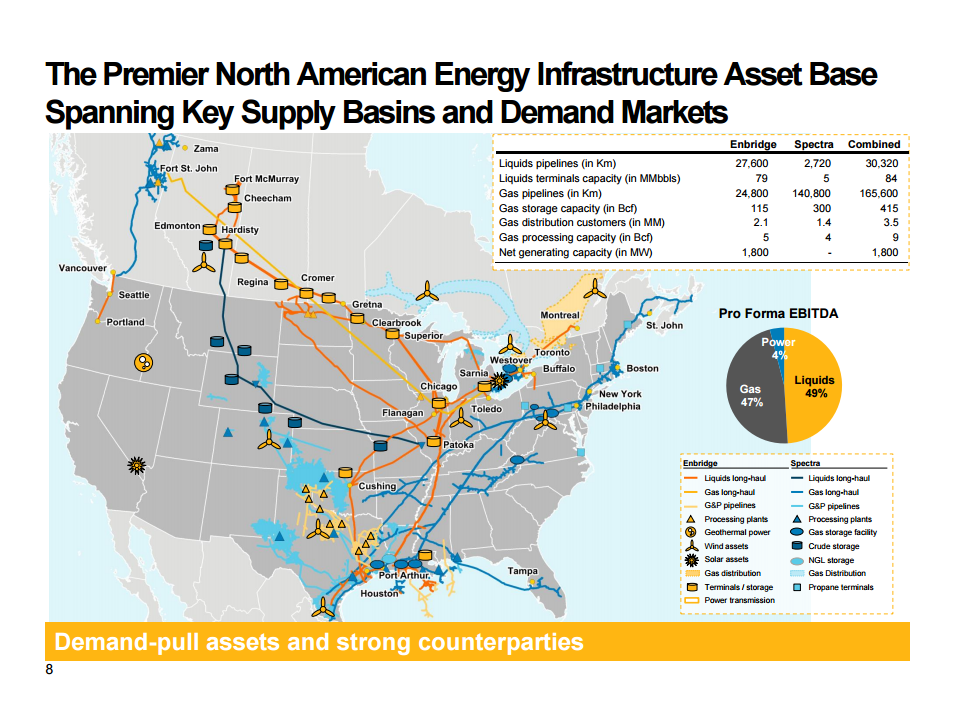

The deal will help to diversify Enbridge’s assets as the company continues to navigate lower oil and gas prices. Once combined with Spectra’s natural gas-focused network, Enbridge’s previously oil-weighted infrastructure will be 49% liquids, 47% gas, and 4% power, according to the company’s presentation.

The companies’ pipeline assets “are irreplaceable; you could not build those assets today,” Spectra Chief Executive Greg Ebel said on an analyst conference call held to discuss the deal.

Enbridge has identified expansions it can do on its old pipelines which will eventually carry another 800 MBOPD of oil across the border. The added capacity would be the equivalent of building Keystone XL, the TransCanada (ticker: TRP) project that was bogged down in legislative limbo for eight years before finally being vetoed by President Obama. The ENB expansions will not require the same type of approval from the U.S. government, however, meaning they are not subject to the same political exposure.

Also helping to build a low-risk profile, 96% of cash flow is underpinned by long-term take-or-pay contracts, Enbridge said in its presentation. Roughly 93% of the combined company’s customers will be investment grade, and less than 5% of combined EBITDA is exposed to commodity prices.

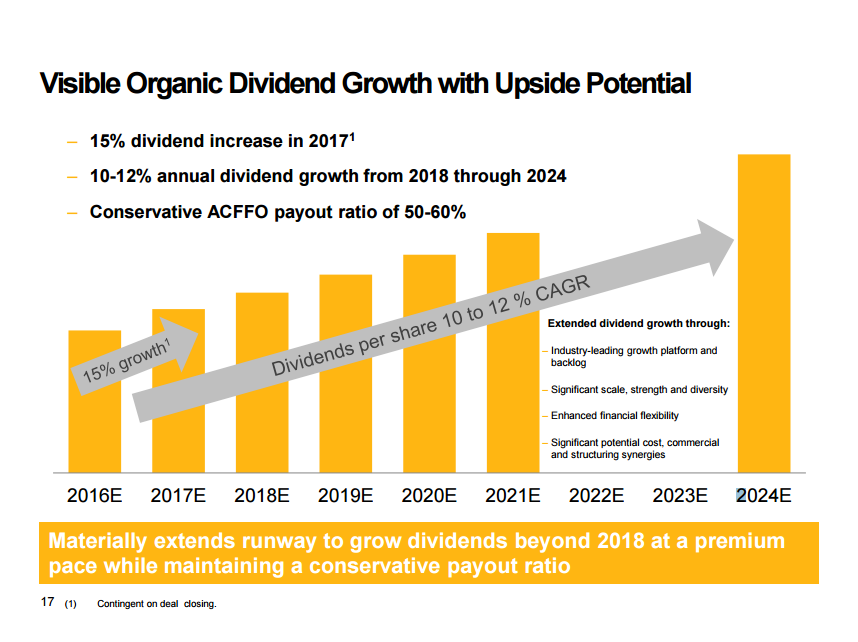

Enbridge expects 10% to 12% annual dividend growth through 2024

As companies remain under pressure to continue growing dividends in today’s unfavorable commodity price environment, Enbridge’s expanded assets will allow the company to continue increasing the amount it pays out to its investors, despite the price of oil. The combined company will have approximately US$20.0 billion in projects coming online between 2017 and 2019, with another US$37.0 billion in risked development projects.

These projects, along with the low-risk profile of its current assets, will give Enbridge a platform to grow its dividend by 15% in 2017, and 10-12% every year after that through 2024.