Encana reported an increase of 24 MBOEPD from Q2 averages

Calgary-based Encana Corp (ticker: ECA) reported today that production from its four main assets increased to 257,000 barrels of oil equivalent per day (MBOEPD), up 24 MBOEPD from the average production of 223 MBOEPD in the second quarter of 2015.

Operations in the Permian, Eagle Ford, Duvernay and Montney will remain the company’s focus through 2015, receiving approximately 80% of ECA’s capital through the end of the year, according to a company presentation given at EnerCom’s The Oil & Gas Conference® 20 in August.

“Our strategic assets are delivering high-margin production growth and are on track to meet our fourth quarter expectations,” said Doug Suttles, Encana president and CEO in a press release.

According to ECA, the company’s production in the Permian wells was up 26% from the second quarter, with 44 net wells brought online in July and August, bringing August average production to 45 MBOEPD. In the Eagle Ford, August production average 57.1 MBOEPD, up 25% from Q2 averages, while the Montney showed 7% higher production at 145 MBOEPD. The company’s Duvernay assets showed an increase of 62% from the second quarter, producing 9.4 MBOEPD.

Maintaining focus

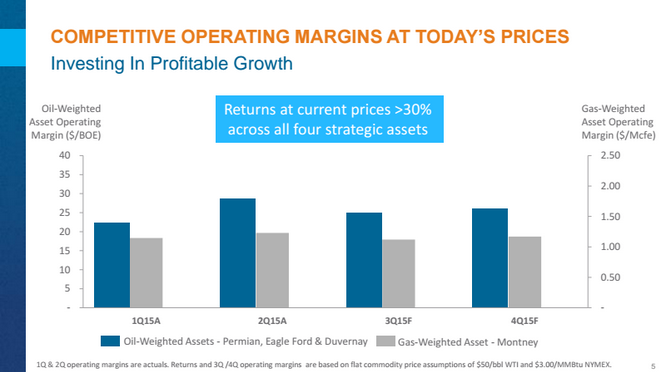

Encana’s focus on these four assets is part of the company’s strategy to remained focus on high-yield assets, while it divests lower-yielding ones in order to strengthen its balance sheet. According to the company’s presentation, the four assets that it covered in its operations update all deliver rates of return over 30%.

ECA hopes to reach 270 MBOEPD of production from its four core assets before the end of 2015, with targeted year-over-year liquids growth of 50%, according to the company’s presentation. The company has traditionally been a gas weighted producer, with 72% of its production coming in the form of natural gas, according to EnerCom’s E&P Weekly Scorecard.

Management acknowledged plans in 2013 to increase its presence with liquids, and made a “transitional” $7.1 billion purchase of Athlon Energy in September 2014. Athlon, a pure play Permian producer, brought 20 MBOEPD of production and 173 MMBOE of reserves to ECA.

On August 25, Encana announced that it had sold the entirety of its assets in the Haynesville for total cash consideration of $850 million to GEP Haynesville. The assets were producing 217 MMcf/d with 720 Bcfe of proved reserves as of year-end 2014. Approximately 300 net wells are currently operating on the 112,000 net acres in northern Louisiana. Overall, the Haynesville contributed 9% of companywide production and less than 2.5% of operating cash flow, excluding hedges, in the first half of 2015.

Encana said the proceeds from the divestitures will total approximately $1.8 billion. The company plans to use the total cash consideration from the sale reduce its debt in 2015 to approximately $2 billion by year end. Global Hunter Securities projects net debt to EBITDA to remain below 3.0x for the remainder of 2015. The company’s capital program and dividends will be fully funded, with approximately $100 million of surplus cash, according to Encana.

ECA’s other non-core assets, like its position in the San Juan and Denver-Julesburg Basins, could also become targets for divestitures as well, said GHS. The two plays combined for 18% and 2% of oil and natural gas production, respectively, according to Encana’s 2014 annual report.

Canada’s liquids-rich gas

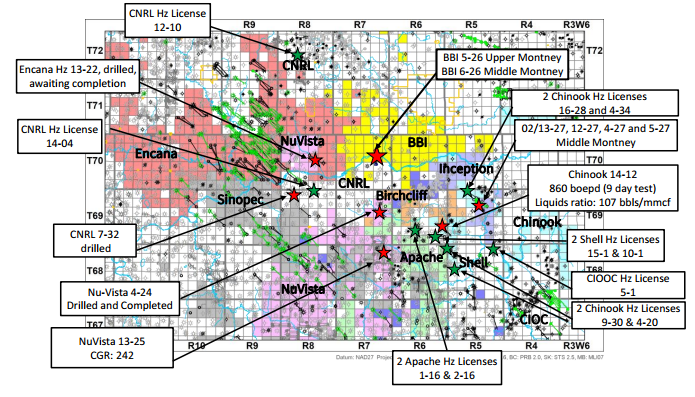

The only gas-weighted play among Encana’s four core plays, the Canadian Montney, is becoming an increasingly attractive area for oil and gas companies, with other majors like Shell (ticker: RDSA), Apache (ticker: APA) and CNRL (ticker: CNQ) also picking up acreage in the area. Recently, Nuvista Energy (ticker: NVA) purchased 12.5 sections in the Montney for $35.5 million (about $2.9 million per section).

Oil & Gas 360® spoke with Garth Braun, CEO of Blackbird Energy (ticker: BBI), whose position is just east of Encana’s in the Montney, about the economics of the play. “The Montney, like the Eagle Ford, has very specific sweet spots where the resource transitions from a dry gas play to a highly liquids-rich/free condensate play,” said Braun. As the oil market remains oversupplied companies are focusing on the highly-economic liquids-rich areas of the Montney to drive shareholder value, he explains.