EnerCom built and maintains its own proprietary WTI price model to gain insights into the current market

In the company’s recent monthly report, we reviewed the current drivers of WTI pricing. Because oil is a globally traded commodity with numerous possibilities for arbitrage, worldwide benchmark prices often move in sync with one another and are affected by the same global events, trends, and conditions. Thus, although WTI is a benchmark for U.S. light, sweet crude oil, attempting to understand its dynamics requires a look beyond U.S. borders at the factors affecting world oil markets.

EnerCom’s WTI forecasting model, based on current market data points and activity levels, is currently predicting that oil will range between $48 and $52 over the next 12 months. The chart below outlines our price predictions compared to a number of other key pricing forecasts. EnerCom’s estimate is in line with near term analyst estimates but slightly lower than the median analyst forecast supplied by Bloomberg in the out years. And when we say predictions, it’s more about the direction. As one of the most, if not THE most followed global commodities, countries are highly dependent on the realized price of their production. As proof, just look at the percentage of export earnings derived from petroleum products for the 14-members of OPEC.

|

Country |

Value of Country Exports $MM1 |

Value of Petroleum Exports $MM1 |

% of Petroleum Exports of Country Exports |

| Algeria | $37,787 | $21,751 | 58% |

| Angola | 32,637 | 31,696 | 97% |

| Ecuador | 18,366 | 6,660 | 36% |

| Gabon | Unknown | Unknown | |

| Indonesia | 150,283 | 6,397 | 4% |

| Iran | 77,974 | 27,308 | 35% |

| Iraq | 54,667 | 54,394 | ~100% |

| Kuwait | 54,959 | 48,782 | 89% |

| Libya1 | 10,861 | 4,975 | 46% |

| Nigeria1 | 45,365 | 41,818 | 92% |

| Qatar1 | 77,294 | 28,303 | 37% |

| Saudi Arabia1 | 205,447 | 157,962 | 77% |

| UAE | 333,370 | 52,369 | 16% |

| Venezuela1 | 38,010 | 35,802 | 94% |

1 http://www.opec.org/opec_web/en/about_us/171.htm

Almost more importantly than the numerical output, having a model allows us to do scenario testing to get a better view on the key drivers that are moving oil prices.

We have concluded that in different markets, different variables become more significant, one many reasons why predicting oil prices is difficult. At the moment, heightened uncertainty over future oil prices, a strong U.S. dollar, a persistent global supply glut, and subdued outlooks for economic and oil demand growth are the main factors that will likely keep WTI prices range bound in the $48 to $52 per barrel range for the next twelve months.

The strong, inverse relationship between WTI prices and the U.S. dollar’s value against other currencies that emerged in the early-2000s is complicated and has been examined by many organizations and agencies including the EIA and European Central Bank.

Oil benchmarks are traditionally denominated in dollars, meaning that a strong dollar limits the purchasing power of other currencies, which reduces consumer demand and pushes oil prices down. The chart below plots oil prices and the Trade Weighted Dollar for the period between January 2010 and August 2016. The two have shown a strong inverse relationship since the beginning of 2010, with the relationship strengthening since the beginning of 2014.

With OPEC’s Announcement Will Forward Strip Change Trajectory?

With yesterday’s OPEC announcement, will there be a change in the trajectory of the forward crude oil contract?

OPEC announced it would “decide at the group’s next formal meeting, on Nov. 30 in Vienna, on details of trimming production by up to 700,000 barrels a day, from a current level of just over 33 million barrels a day.” That would be a little more than two years to the day that OPEC decided to keep their output at 2014 levels.

The model suggests that a significant decrease in OPEC supply would weaken the U.S. dollar against other currencies. Oil prices, as historically seen, would increase, giving OPEC nations greater levels of export earnings, thus strengthening each country’s currency against the U.S. dollar. Of course there is a tipping point when crude oil prices are at higher levels, read: greater than US$100/barrel, but we’re not there yet. In terms of WTI price, a 200,000 barrel per day decrease in OPEC supply suggests a WTI price of $47.67. West Texas Intermediate closed at US$47.72 today. A 500,000 barrel per day decrease suggests a price of $50.45. Inventory? Inventory is not significant in the model right now. Historically, a 1 MMB withdrawal from storage equates to about a $0.08 to $0.10 increase in the price per barrel of WTI. Crude oil storage has dropped about 23 MMB since the end of August.

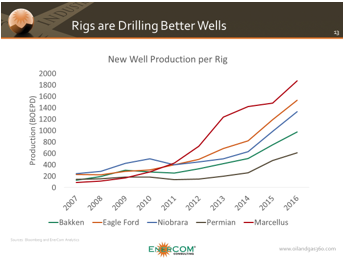

Will companies call up rig companies and scream “drill, baby, drill!”? A few will. The larger names for sure. Operating in one of the Big 5 Basins (Williston, Permian, Marcellus, Eagle Ford and D-J) will be important. Working to justify or raise corporate valuations is a given. The 12-month forward price for crude oil is $50.16. Yesterday it was $49.53. Crude oil traders are not buying the OPEC announcement as the 12-month forward curve only moved 1.3%.

If OPEC is going for market share, U.S. E&P operators addressed well economics to stay in the game and to get to the next up cycle. The 12-month forward curve suggests that each of these basins are economic, but only if your target is a 10% IRR. Managements are not paid to be mediocre. There was hope (which is not a strategy) that crude oil prices would have hit $60 per barrel two months ago. Rig, completion and frac companies were calling back crews and starting the re-training process. We know this because a whole dad-gum group of oil field workers from Grenada, Mississippi were told in March/April to turn in their resignation at Walmart, Dickie’s BBQ and with the county and get on a plane and fly up to the Williston Basin and start getting ready to drill. A few of them are now back home in Mississippi because the work didn’t materialize as hoped for.

An independent oilman in Midland today said the town is doing really well. “Schlumberger and Halliburton are in town, and buying lots of donuts and beverages in the hope that they will be getting business when their customers start firing up their spending. Halliburton has about 25% of the business in the Permian, while SLB has less than 10%. Given the number of bankrupt oilfield service companies, the Midland oilman said it will be very difficult for companies smaller than HAL and SLB to capture meaningful market share in the Permian. A single county in the Permian could hold as much as 90 billion barrels of oil. Using a $10 finding cost, $900 billion of spending capital is there for the big companies to do everything they can to get their share of the opportunity. Start adding in drilling in the Delaware, and Midland, and New Mexico, there will be lots of oil still to come. I’m in the camp that crude oil will sit below $60 for a while.”

An independent oilman in Midland today said the town is doing really well. “Schlumberger and Halliburton are in town, and buying lots of donuts and beverages in the hope that they will be getting business when their customers start firing up their spending. Halliburton has about 25% of the business in the Permian, while SLB has less than 10%. Given the number of bankrupt oilfield service companies, the Midland oilman said it will be very difficult for companies smaller than HAL and SLB to capture meaningful market share in the Permian. A single county in the Permian could hold as much as 90 billion barrels of oil. Using a $10 finding cost, $900 billion of spending capital is there for the big companies to do everything they can to get their share of the opportunity. Start adding in drilling in the Delaware, and Midland, and New Mexico, there will be lots of oil still to come. I’m in the camp that crude oil will sit below $60 for a while.”

He could be right. The new well production per rig is well documented. Why shouldn’t the next drilled well be better than the one before it. After all, we don’t drive Model T’s anymore.

He could be right. The new well production per rig is well documented. Why shouldn’t the next drilled well be better than the one before it. After all, we don’t drive Model T’s anymore.

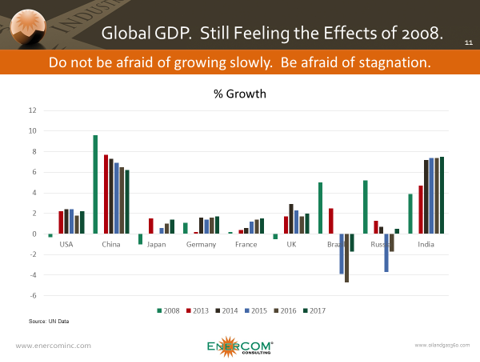

We believe the crude oil bubble goes away when global GDP gets back on a growth trajectory. China and Brazil and down significantly, Japan is flat at best, and Germany and the rest of the EU are dealing more with social spending as a result of the immigrant inflow from war-torn Middle East. There is no peace dividend for the world.