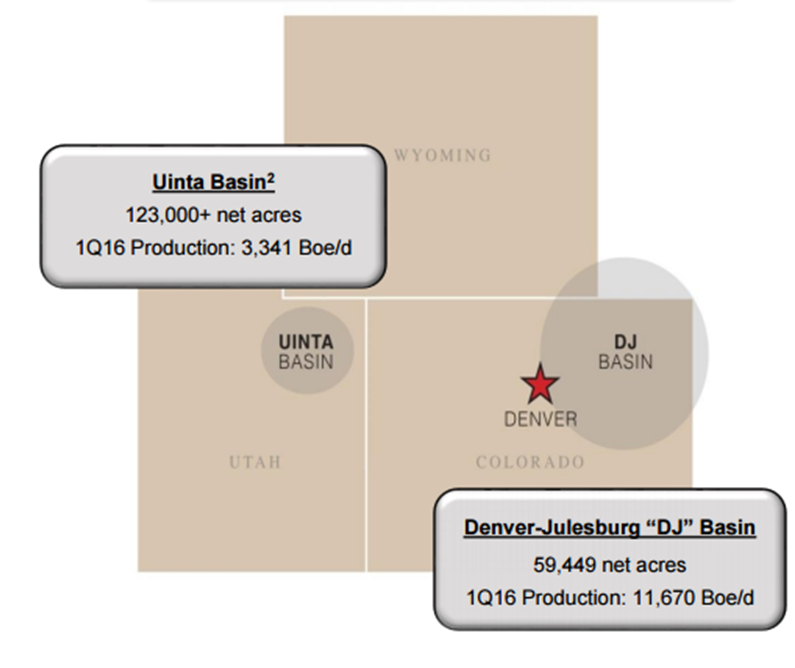

Bill Barrett Corporation (ticker: BBG) is a Denver based exploration and production company that operates primarily in the Uinta Basin in Utah and the Denver-Julesburg basin in Colorado.

Bill Barrett currently operates 182,500 acres in the two basins after streamlining their acreage over the past year. In 2014, the company executed an acreage exchange and sale that added 7,856 net acres to the company’s position in the Northeast Wattenberg and $757 million ($568 million cash), selling the company’s non-core Piceance Basin assets and most of its Powder River Basin position. In December 2015, the company completed a $56 million transaction that included non-core properties in the Uinta and DJ basins. On May 2, 2016, as a continuation of the company’s strategy to focus on crude oil in the DJ basin, BBG announced a $30 million divestiture of its non-core Uinta assets. The company plans to use funds from the divestitures to increase liquidity, and for general corporate purposes.

Operations Review

BBG initially provided guidance for the company’s 2016 capital budget of $100 to $150 million in late 2015. On May 5, 2016, the capex guidance was reduced 10% to $90-$135 million, a reduction that mirrored industry trends. Approximately $46 million of the yearlong guidance was spent in the first quarter. The company will monitor industry conditions “to determine the appropriate time to resume drilling”.

In Q1 2016, the company was able to spud four DJ Basin wells, after which the company released the sole rig it was operating. These wells are expected to be completed along with four other similar wells to begin flowback in Q2 of 2016.

Bill Barrett has focused on increasing the efficiency of their wells, this means lower costs, longer laterals, and shorter drilling times. Drilling operations in the DJ Basin have a drilling and completion cost of $4.75 million per well (down from $8.25 million in 2014), taking approximately 8 days of rig time from spud to release. The most recent well program is composed of extended reach lateral (XRL) wells. The typical Bill Barrett XRL completion utilizes plug & perf technology, with 1,000 pounds of sand per foot for about 55 stages per well.

The lateral target has been the Niobrara formation, which is further separated into an A, B and C target bench, as well as the Codell formations. Overall the NE Wattenberg acreage may support up to 1,100 XRL locations. In the BBG Q1 earnings call the company’s Niobrara acreage was discussed and although the B & C benches have been the main target to date, recent testing in the A bench has projected that acreage could support around 150 future well locations with an A bench target. There is no expiring acreage or outstanding commitment to further drilling in 2016.

Financial Review

In Q1 2016, the company reported an adjusted net loss of $13.7 million (Discretionary Cash Flow Reconciliation), compared to a 2015 Q1 loss of $5.9 million. EBITDAX was also lower, dropping from $63.2 million in Q1 2015 to $39.4 million in Q1 2016. The drop is attributable to lower commodity prices and decline in production due to the previously discussed asset sales. The cash position of the company at the end of Q1 2016 was $106 million. In its Q1 earnings call, management said projected cash flow is expected to be positive for the rest of the year.

During Q2 2016, Bill Barrett Corp. hedged 7,300 Boepd worth of production at $81.65, the same as it was for Q1. The realized per barrel price in Q1 was $63.69 (The hedged production accounted for 75% of total oil production). On the gas side, approximately one quarter of production in Q1 was hedged at $4.10, giving a realized price of $2.26 per Mcf. The gas production hedge is similarly positioned for the remainder of 2016. Q1 2016 had daily production of 15 MBoe/d, which separates into 886 MBbl oil and 1,626 MMcf with NGL volume of 210 MBbl. In the first quarter, 65% of production was from oil.