QEP Resources will present at EnerCom’s The Oil & Gas Conference® 21 on Aug. 16.

QEP resources, Inc. (ticker: QEP) is an independent crude oil and natural gas exploration and production company headquartered in Denver, Colorado.

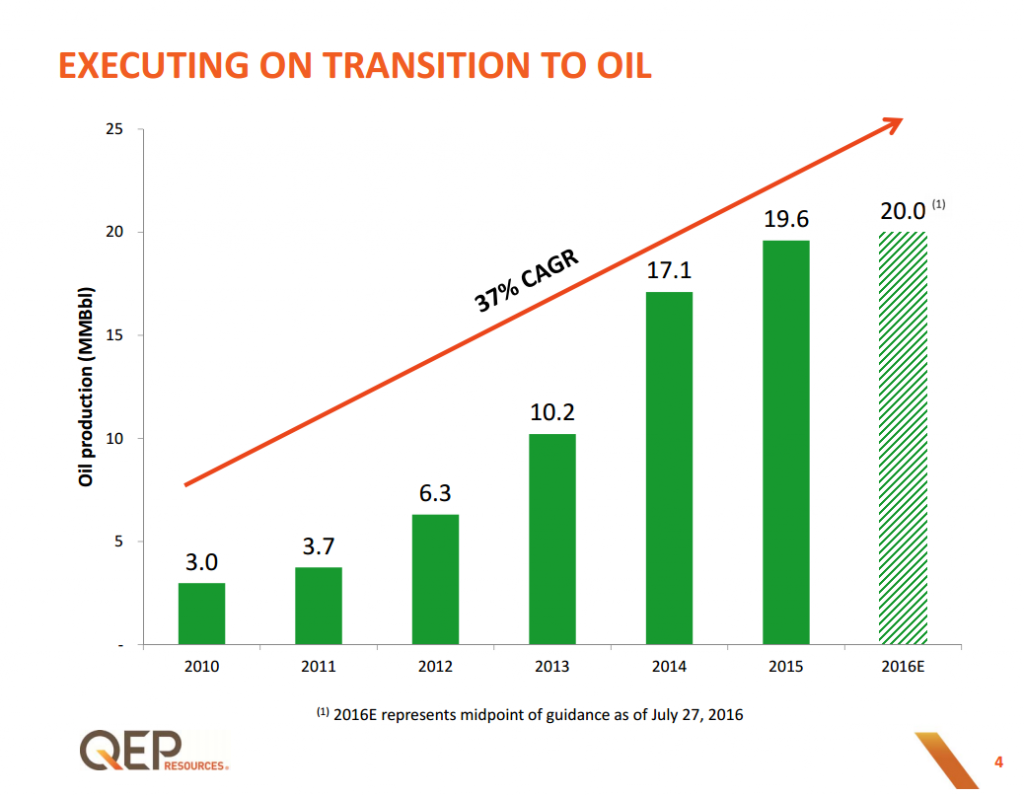

The company’s operations are focused on all three components of hydrocarbon production, oil, natural gas liquids, and dry natural gas. QEP holds acreage in the oil rich Permian Basin and the Williston Basin. The company has acreage positions in the liquids-rich gas plays of the Pinedale Anticline and the Uinta Basin. QEP also has a dry natural gas acreage position in the Haynesville shale.

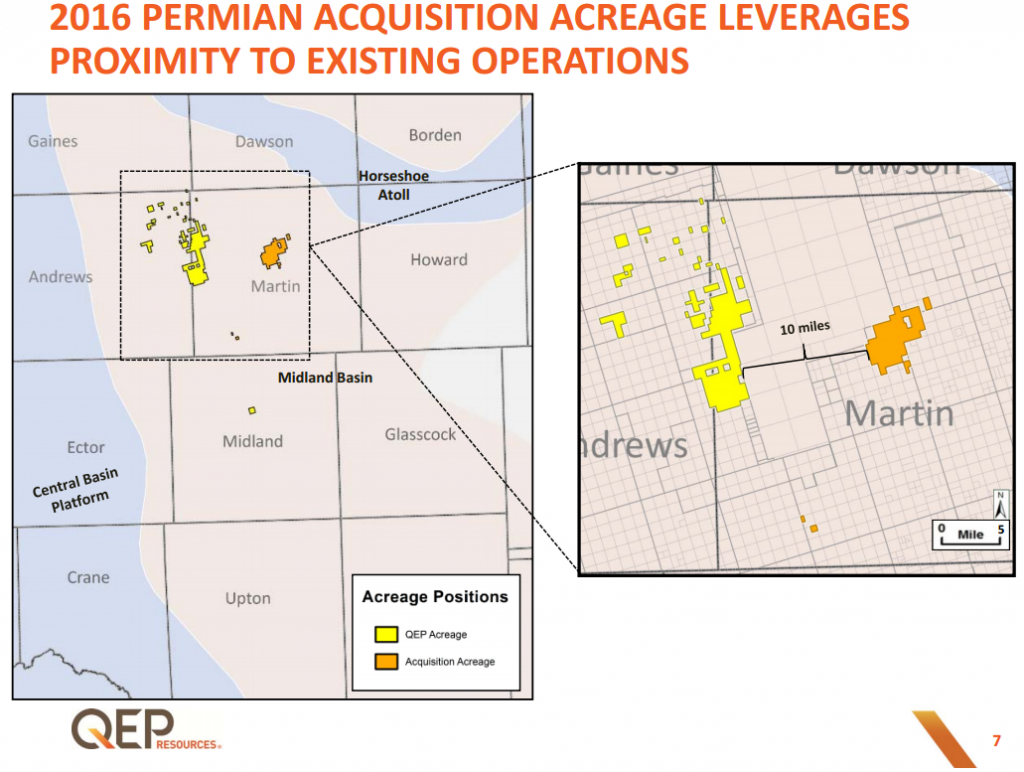

On June 21, 2016, the company announced the acquisition of 9,400 net acres in the Permian Basin. This location is 10 miles from existing QEP properties, and has the potential for over 430 horizontal drilling locations. “The acquisition adds significant drilling inventory in the core of the northern Midland Basin and broadens our footprint in a world-class crude oil basin,” said Chuck Stanley, Chairman, President and CEO of QEP. “We believe this acquisition, combined with our existing crude oil assets, will enhance our crude oil production growth and improve our operating efficiency.”

During the second quarter 2016, QEP’s total production was 83.3 Bcfe, an increase of 2.4% over Q2 2015, despite the decrease in capital spending and commodity prices. The production mix is 51% natural gas, 38% oil, and 11% natural gas liquids.

Drilling continued during the first and second quarter in accordance with the 2016 plan, maintaining 3 to 4 rigs in the Williston, Permian and Pinedale areas. The Q1 drilling cost of $145.5 million was down by $69.6 Million from the previous quarter. The 2016 plan expects the total drilling costs to be reduced by 50% from the 2015 costs. Well cost reductions have been evenly split between better pricing and improved drilling efficiency. A main contributor to cost reductions is the reduction in pipe cost.

QEP has developed an inventory of DUCs (Drilled but Uncompleted wells). The Williston Basin DUC inventory is expected to grow during Q2 of 2016. The completions cost in the Williston have been around $5.3 Million per well. QEP is also participating in 31 DUCs in the Pinedale, with an average working interest of 61%.

The Spraberry shale in the Permian Basin is being tested with a pad drilling geometry called wine rack geometry. New microseismic data collected is pointing towards a possibility that the current development is accessing only 1/3 of the Spraberry potential due to bench isolation within the unit.

QEP posted a net loss of $197.0 million in Q2 2016 with an adjusted EBITDA of $168.3 million. QEP has been working to increase company liquidity, increasing the cash position from $376.1 Million at year end 2015 to $1,038.3 million during the second quarter 2016. QEP has completed two equity offerings in 2016, one in February for gross proceeds of $379 million, and a second offering in June for gross proceeds of $422 million.

EnerCom’s The Oil & Gas Conference® Denver – August 14-18, 2016

QEP Resources (ticker: QEP) will be presenting at EnerCom’s The Oil & Gas Conference® 21 in Denver on Tuesday, August 16, 2016 at 4:45pm EDT. Conference information and registration for this year’s EnerCom conference may be accessed here.