SM Energy will present at EnerCom’s The Oil & Gas Conference® 21 on Aug. 16, 2016.

SM Energy (ticker: SM) is an independent E & P company headquartered in Denver, Colorado. Its operations include the Eagle Ford and Haynesville shales as well as the Permian/Delaware, Powder River and Williston basins.

Operations Review

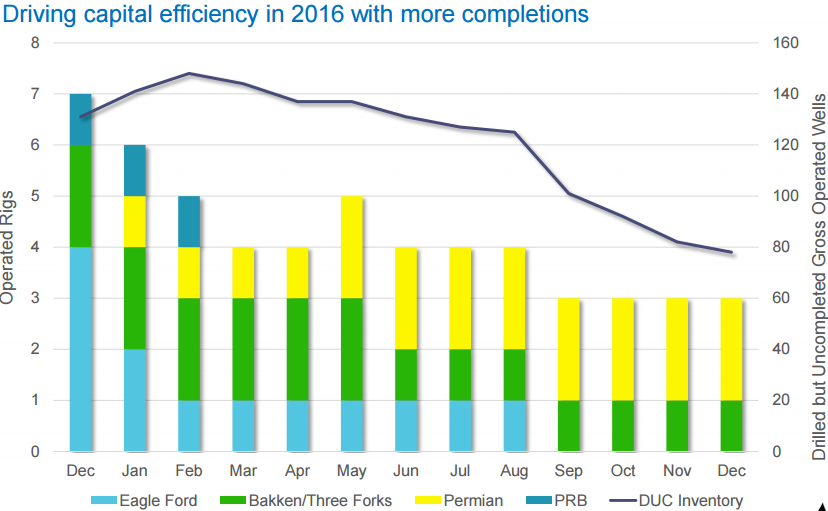

SM Energy has gradually dropped its operating rig count in order to focus more on completing previously drilled but uncompleted (DUC) wells. Below is a graphic showing the plan for rig operation as well as reducing the DUC inventory; this graphic is from the June 2016 presentation.

The change in rig count displays the company’s shift in focus away from the Powder River Basin and towards the Permian Basin. In the 2016 capex plan of $705 million 90% will be split evenly between the Eagle Ford, Permian and Bakken/Three Forks assets. The remaining 10% is allocated for other assets. The plan is for more than 115 net completions and a total budget of $600 million for drilling & completion costs. Overall the stated goal for these expenditures and strategy is to increase the oil portion of the portfolio.

The company is using a slickwater completion with higher sand loading for fracture design in the Permian acreage to increase the near wellbore reservoir fracture contact. This design increased initial year production by 30% over the previous hybrid fluid design to an average of over 230 MBOE. Drilling performance increased for the Permian (Sweetie Peck) acreage as well, bringing the average 7600’ lateral drill time from 11.9 days in 2014 to 6.2 days in 2016. These gains coupled with completion procedural efficiency gains have brought the cost of a well to about $5.3 million. Due to this efficiency, the company has transferred a rig from the Eagle Ford to the Sweetie Peck acreage. The plan is to drill 20 wells and complete 24 wells in this acreage for 2016.

Financial Review

The efficiency gains discussed were able to generate IRR over 20% at $40 WTI and $2.50 HH pricing. This has made the Permian Sweetie Peck the most attractive development opportunity in the company portfolio. Javan D Ottoson, president, chief executive officer and director said “I think right now the incremental dollar goes to the Permian, because the returns are highest.”

During the Q1 earnings call Wade Pursell, chief financial operator and executive vice president, stated “it’s unlikely we would increase activity, i.e. CapEx, until our projected cash flow levels have risen to the projected CapEx level. That translates to commodity prices in the $50s for oil and upper $2s for natural gas.”

The company increased liquidity by buying back $46 million principal amount of bonds at a discount ($0.65 on the dollar) during Q1 2016, this was done at a low point in cost and not due to overall company strategy.

The liquidity position of the company was reported on the Q2 2016 press release to be $925 million. This includes a borrowing base of $1.25 billion of which $325 million is drawn. The adjusted net income for Q2 2016 was a loss of $168.7 million compared to a loss of $57.5 million for the same period in 2015. From the same press release, the adjusted EBITDAX from Q2 2016 was $217 million, with Q2 2015 at $337 million.

Javan D. Ottoson – president, chief executive officer and director – ” Of special note is that we are able to restart our Permian drilling program and achieve very high drilling and completion efficiencies from day one. Our well results were also excellent.”