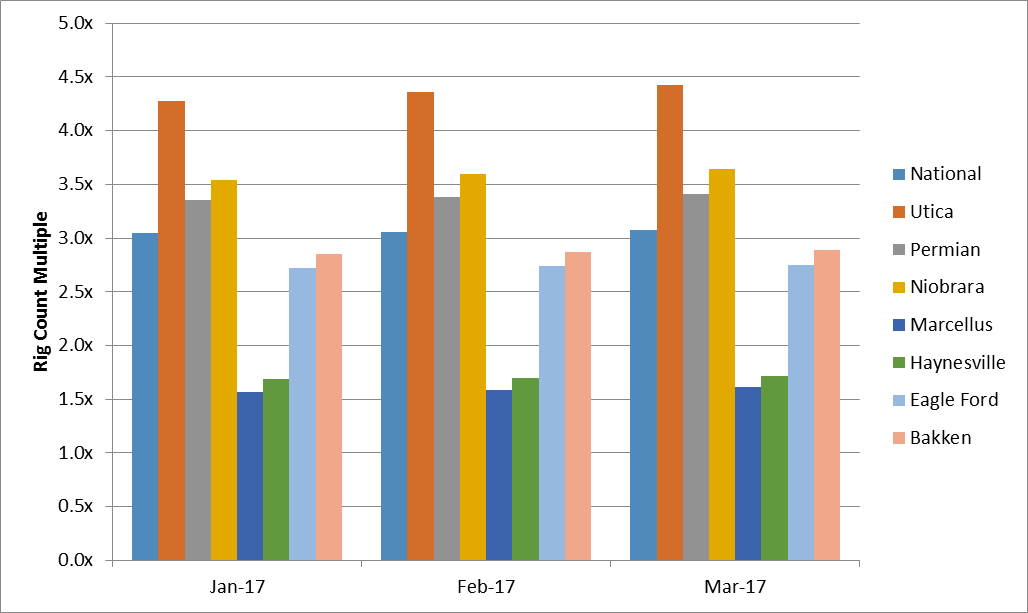

Utica rigs have seen largest productivity increase

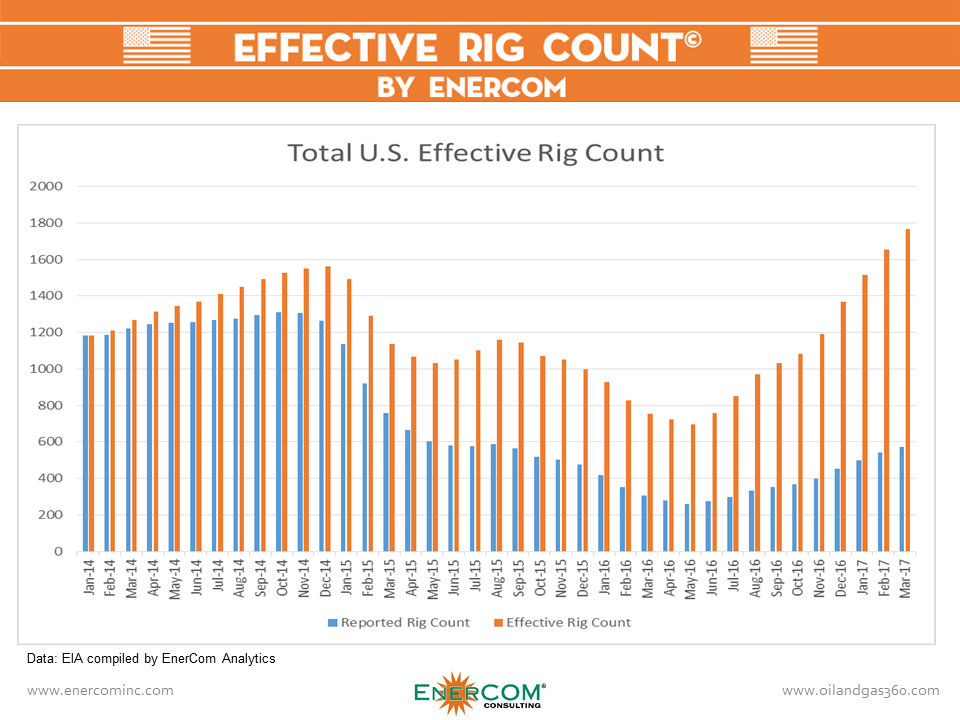

EnerCom released its EnerCom Effective Rig Count today. Launched in January, the Effective Rig Count seeks to account for improved productivity from recent development. New technologies and techniques have allowed wells to be drilled faster and produce more hydrocarbons. Each rig yields greater production now than it did before the downturn.

Based on the Effective Rig Count, rigs in the Utica have seen the greatest productivity increase, yielding 4.4x as many barrels of oil equivalent on an individual basis in March 2017 (the last month with available data for both rigs and production) than rigs in the region were producing in January 2014, when oil prices were at their peak in the triple digits.

Significant productivity gains are also seen in the Permian and Niobrara. 347 rigs were active in these two basins in March, but increased productivity means these rigs are creating production equivalent to 1,193 rigs from early 2014.

Nationally, rigs are producing 3.1x more production than they were before the crash. While 541 rigs are currently active in the major basins, increased productivity means that 1,765 January 2014 rigs would be required to yield the same amount of production that 541 rigs generate in 2017.

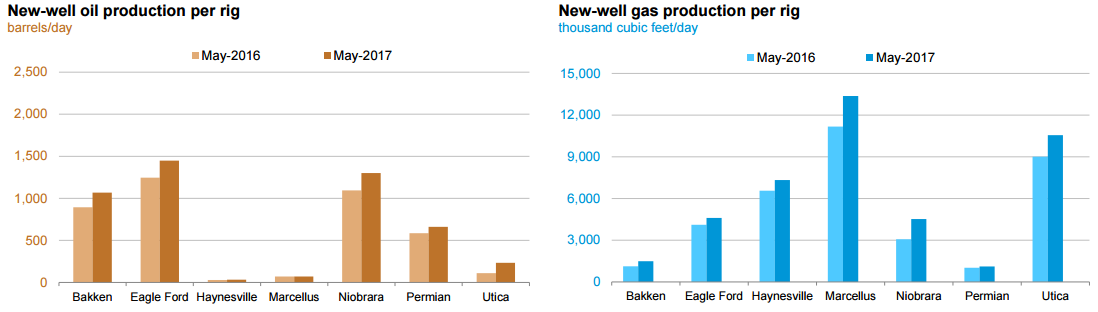

Drilling Productivity Report shows Eagle Ford, Marcellus rigs most productive

The EIA released its monthly Drilling Productivity Report today, outlining recent drilling and production activity. In this report, the EIA gives estimates for new-well production per rig, a value useful for estimating the productivity of activities in the various basins. When considering oil, rigs in the Eagle Ford are the most productive, yielding 1,448 BOPD in May. The most productive gas rigs are found in the Marcellus, where each active rig yields 13,368 Mcfe/d.

Look for production growth from the Permian

Unsurprisingly, oil production is projected to grow most in the Permian, where the EIA expects 76 MBOPD to come online in the next month. Unlike last month, the Permian also is expected to account for the largest growth in gas production, adding 159 MMcf/d. The only decrease in oil or gas production from the seven major basins is found in the Bakken, where the EIA predicts oil production to drop by 1 MBOPD.

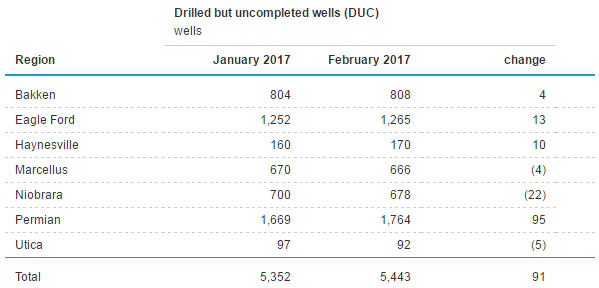

Drilling activity in Texas continues to outpace completion activity. The Drilling Productivity Report estimates the number of drilled uncompleted wells present in each of the major basins.