The Saudi Aramco IPO, U.S. crude oil exports, U.S. LNG exports

During last week’s EnerCom Dallas oil and gas investment conference, Tom Petrie, chairman and founder of Petrie Partners, gave a luncheon presentation entitled “Scoping 21st Century Energy Geopolitics.”

At its heart, Petrie’s presentation was a look at “today’s realities” especially concerning Saudi Arabia’s oil fortunes, U.S. Middle East policy and American petroleum strategy, the evolving geopolitical power triangles, the Saudi Aramco IPO and the changing dynamic that U.S. LNG exports will drive forward. Petrie is a multi-decade expert in the Saudi Arabian petroleum industry and how geopolitics affect global oil and gas.

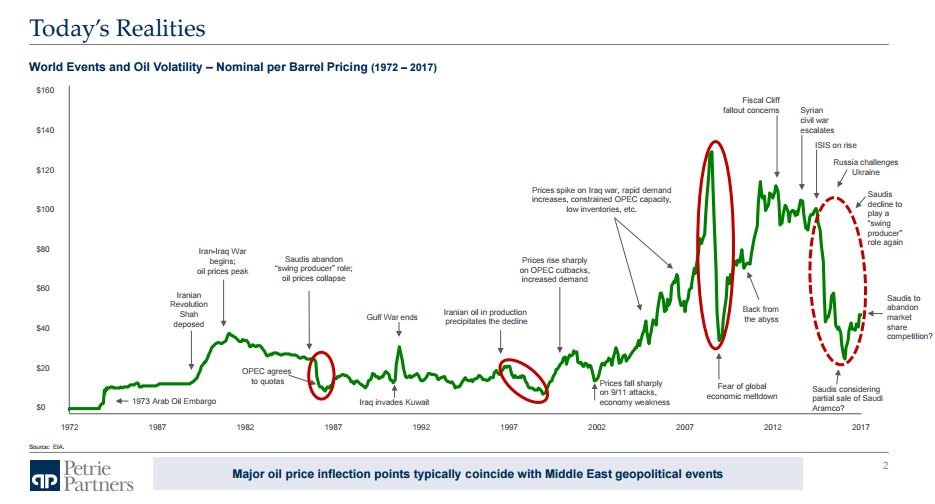

“Something on the order of 80-85% of the time major inflection points coincide with geopolitical events—one way or the other as drivers either to the upside or the downside,” Petrie told the capacity crowd in the main dining room at the Tower Club, which is at the top of the Thanksgiving Tower in Downtown Dallas.

“One of the other realities we have is the legacy of the so-called ‘Arab Spring’. That Arab Spring left North Africa and the Middle East transformed—but not nearly in the way that the press talked about it. It was not the democratization of that part of the world, even though it had all the outward appearances of that with the riots in Tahrir Square and elsewhere. What we really had, instead of the Arab Spring that was going to democratize the Middle East [was something that] skipped the summer and the fall and morphed into winter pretty quickly.

“One of the other realities we have is the legacy of the so-called ‘Arab Spring’. That Arab Spring left North Africa and the Middle East transformed—but not nearly in the way that the press talked about it. It was not the democratization of that part of the world, even though it had all the outward appearances of that with the riots in Tahrir Square and elsewhere. What we really had, instead of the Arab Spring that was going to democratize the Middle East [was something that] skipped the summer and the fall and morphed into winter pretty quickly.

“Today we have three failed states—Syria, Yemen and Libya. We have a virtual cold war state between Saudi Arabia and Iran. And we have the prospect of a virtual merger between Iran and Iraq—something that the Saudis feared back in the second Gulf War.

“And the thing to watch is what happens when Ayatollah Sistani, not just the religious leader of the Iraqi Shiite nation, but also the leader of Shiites beyond Iraq. When he passes it’s not at all clear that there is anyone in Iraq who can take his place as an ayatollah and sustainably exert the kind of influence that he exerts. He’s really looked to be someone who recognizes that difference between Arab and Persian, as well as the difference between Shiite and Sunni. I think that we’ll likely see Iran look to have an ayatollah from Iran step up to take that position of leadership.”

So what is coming for global oil?

“We’re going to have a lot of chaos. This is not an easily resolved set of problems. I think President Trump’s nominations for Secretary of State and Secretary of Defense are strong knowledgeable people, and I suspect dealing with it will be more effective perhaps than we would have expected six months ago, but it’s going to be a challenging period and have lots of consequences. The misread by the press of what was going on is one of those colossal ones that should make us all humble as we think about how one deals with that situation.”

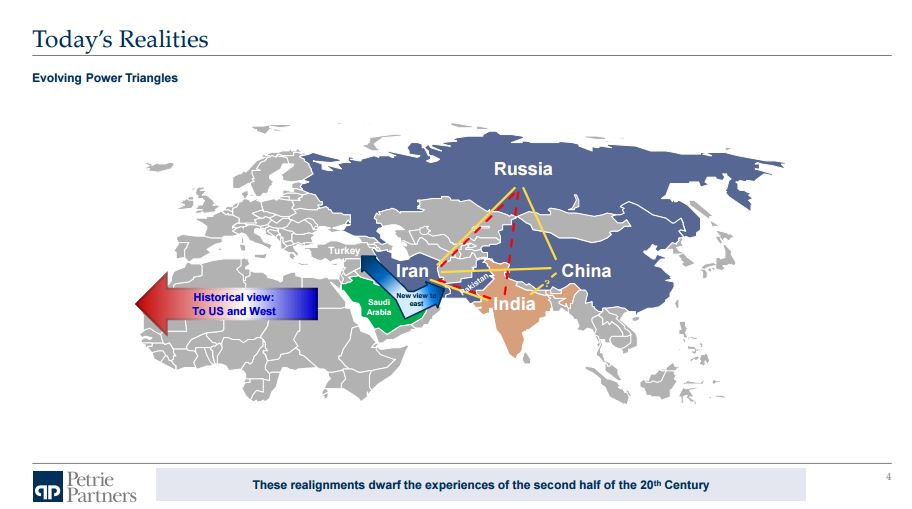

Petrie referenced his belief about the emergence of power triangles following 9/11 between Russia, China and Iran, and a prospective triangle between Iran, India and China—power triangles that have come out of the economic alignment of interests on energy in those countries that have transformed how the Western hemisphere deals with the Eastern hemisphere for the next 30 to 50 years. “This is a transformation from what we had from the end of World War II until 9/11 when there was a powerful two-way trade that I talk about in the book [EDITOR’S NOTE: Petrie’s book is entitled Following Oil: Four Decades of Cycle-Testing Experiences and what They Foretell about U.S. Energy Independence], where exports of manufactured goods from Europe and the U.S. to the Middle East balanced off the oil purchases and there was a security agreement if you will that kept a workable degree of security in that part of the world—most of the disruptions were tactical in nature, not strategic.”

“This is going to be transforming for leaders in this country. That’s why I think the two cabinet members I just identified have their work cut out for them, but they are as well qualified as anybody I can think of to give President Trump advice on this issue.”

Major new oil production sources to meet world demand

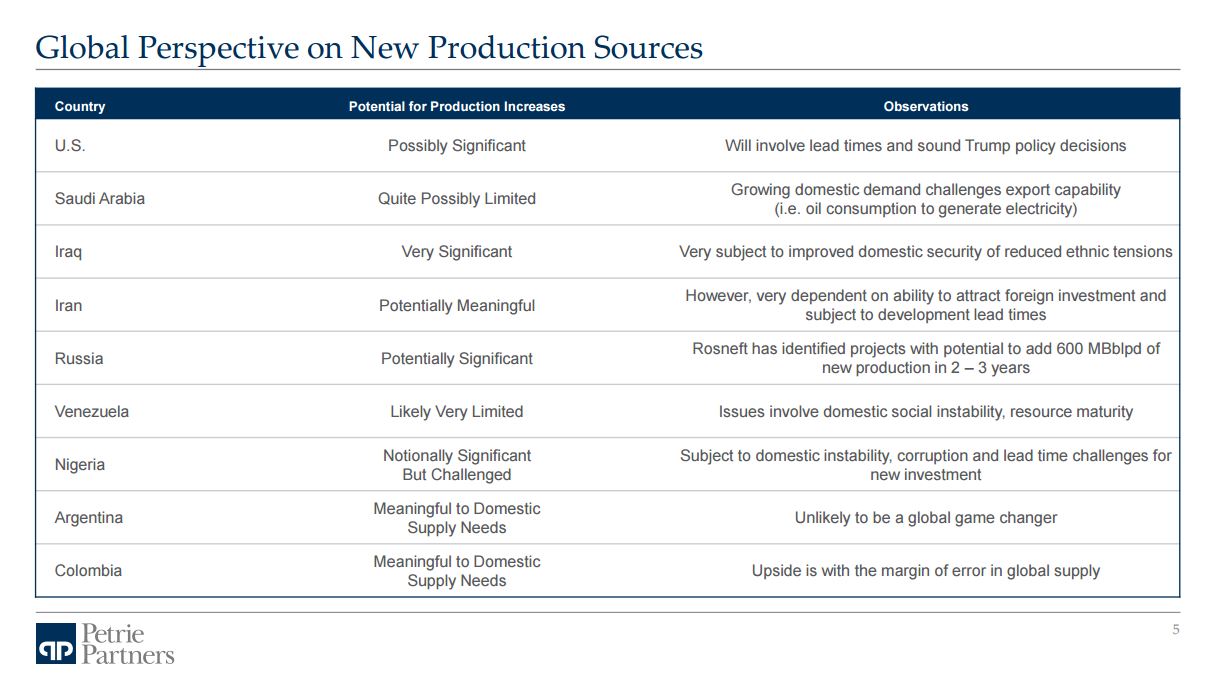

“The U.S. is I would say is ‘probably’ significant. Saudi Arabia is in my mind quite limited. I say that because I actually believe some of the initiatives that Saudi Arabia took starting in the fall of last year, saying ‘we are ready now to support a rebalancing agreement out of OPEC—and oh, by the way, if we need to go down more than proportionally we’ll do it’. That was so uncharacteristic of the prior three decades of Saudi policy and strategy….The maturing of the Saudi productive base when you’re three and almost four decades into waterflooding the giant Ghawar field is changing.

“What we may have here may well be the situation where the Saudis have in fact elected to take a negative and construe it as a positive. By that I mean the willingness to go down in production, which they now have done, and show willingness to do more, may well be acknowledgement that you don’t have compelling alternatives to develop more production and stay in the driver’s seat. So rather than acknowledge irreversible decline at this particular moment while you’re transforming the society and the nature of your economic drivers, why not call it a ‘voluntary’ cut to accommodate the needs of the world for a better oil price.”

“Iraq, Iran and Russia all have more productive potential in my view on the margin from here than Saudi Arabia, but they are going to have to compete with what is truly the world’s swing producer at this point, because in most cases it will require as high or a higher price than what is needed in the U.S. on the margin. That’s a very different condition than we’ve seen in most of my career of 45 or so years.”

Petrie called Venezuela a “very, very tragic situation. It’s systemically impoverishing—a nation of 32 million people with the reserves that rival those of Saudi Arabia, also a nation of essentially 30 million people. … I can’t think of a stronger case where the legitimacy to govern is so fragile, so doubtful in fact.”

“The opportunities that I see for sustainable production cooperation between Saudi and Iran I think could continue all of this year and maybe well into next year. It’s a remarkable condition: you have a state of virtual cold war between Saudi and Iran on other issues, and despite that, they’ve actually come up with a way to accommodate something Iran wants but they don’t think Iran can achieve—3.9 million barrels per day of production. This is an agreement that has been put in place and I think the Saudis will work to try to keep it working because it’s an important prelude to the IPO that they are trying to orchestrate for Saudi Aramco.

“The lack of Russian support at the Thanksgiving surprise of 2014 was the entire basis upon which Saudi Arabia engineered the price decline. Their goal was to take $100 oil to $70. They overshot the objective and it’s taken a while to realize how costly that would be. But they’re at this point where both Russia and Saudi want and need higher prices than we have today. So therefore ongoing Russian support is also a fairly likely event at least for a while, but Russia’s ability to supply extra new supply into a market is greater than that of Saudi Arabia in my view and therefore there will come a time where Russia will take a different path, but I suspect it’s still a year or two away.”

Petrie discussed how last year’s 1.4 MMBOPD had probably 250,000 to 300,000 BOPD purchases for China’s strategic petroleum reserves in it. Petrie said that is probably not a sustainable condition. “China is close to filling the tanks they have.”

Petrie said that a stronger dollar is equivalent to a price increase for consumers of oil in the rest of the world. He said that the Fed getting serious about raising interest rates and a stronger growth rate for the U.S. economy also could be a contributor to a stronger dollar, and the combination of the two could have a limiting effect.

“Finally there’s a determined effort to bring Saudi Aramco public. … This really is transformational if they can pull it off,” Petrie said. “The deputy crown prince who is now 32 years old is beginning to put into place a dramatic set of changes: cutbacks in subsidies to the Saudi citizens, looking to instill the notion that work in itself is a worthy activity—that’s not part of the historic Saudi culture.” Petrie pointed out that this is not just the deputy crown prince talking to the royal family and the extended family of about 30,000-40,000 people but rather it’s talking to 19 million citizens of Saudi Arabia. “And we still have the last vestiges of ten sons of the founder of the country of almost 120 years ago, a number of whom are less than fully committed to the changes that the deputy crown prince is putting forth.

“That said they made the decision and they’re fully committed,” Petrie said. He said that when they first put forward the idea of selling a part of Saudi Aramco there was a lot of talk in the West about selling the downstream, selling the midstream, selling the tankers or the refineries, “and then it became clear—‘no, we’re talking about selling 5% of the company and by the way we think it’s worth $2 trillion dollars at the price we want to get for that 5%.”

Petrie said that valuation of the company will be center stage. “Wood Mackenzie has come out with a controversial report as far as the Saudis are concerned that [the 5% of Saudi Aramco] would be valued at far less than the $2 trillion.”

“They’ve picked the lead managers and it’s an interesting combination,” Petrie said. “Some important signals here that they want to be in a position to do this truly globally, but they certainly have not rejected the notion of two of their lead bankers being major U.S. banks, despite the fact that sovereign immunity right now has been eliminated for Saudi Arabia with respect to the 9/11 events. We will probably see if Congress is ready to re-examine that vote they had last year on the subject of sovereign immunity.

“Finally they’ve announced a new joint venture with Saudi Aramco—I take this as a symbol of the broader restructuring of the Saudi Aramco I came to know a decade or so ago. That’s important because when we were working on the gas initiative [in Saudi Arabia], the thing that ultimately took it off the tracks was how to create a competitive environment for Western companies to come in and collaborate with and compete with Saudi Aramco.” Petrie said that the advisory that went on for four years came to very little because of Saudi Aramco’s ability to resist it.

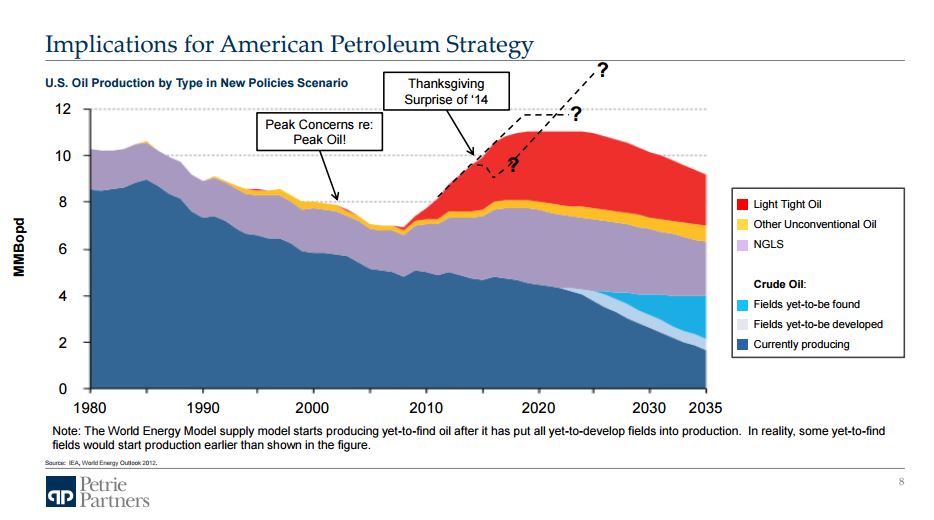

Petrie discussed how the Saudis and other members of OPEC said they were ready to bend the supply curve and they wanted to engineer it by saying ‘let’s embrace markets’ in 2014, with the intention of having oil move from triple digits to $70 per barrel, but the markets said ‘we’re ready for much more of a freefall than you may expect’.

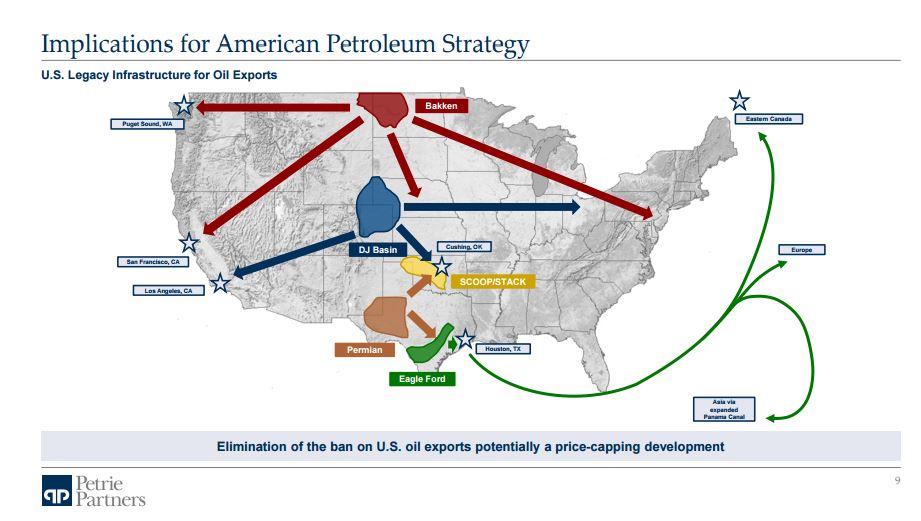

Implications for American petroleum strategies

“With the delay the U.S. began to roll over. The momentum was such that all of 2015 U.S. production was still growing and it rolled over and 9.7 million barrels a day became 8.4 million barrels.” Petrie recalled how 8.4 million barrels was the bottom, and “we’re on the way back.”

“The Permian was not even in the equation when we were talking about this. The Permian has really been a last 18-month event, even a last 12-month event it could be argued. It may take a couple of years to get there but the resource potential in the U.S. is quite amazing.

“The one great thing that happened in the Obama administration was the lifting of the export ban on crude oil. We were getting to the point where the physical capacity of the U.S. to refine light, sweet oil was about to be exceeded. Through a very interesting combination of events the export ban that was put in place back in 1973 was finally eliminated.

“But how do you move oil to a market that wants it and can handle it? That means you’ve got bicoastal movement of oil from the heartland of America, some of which will go to international markets.”

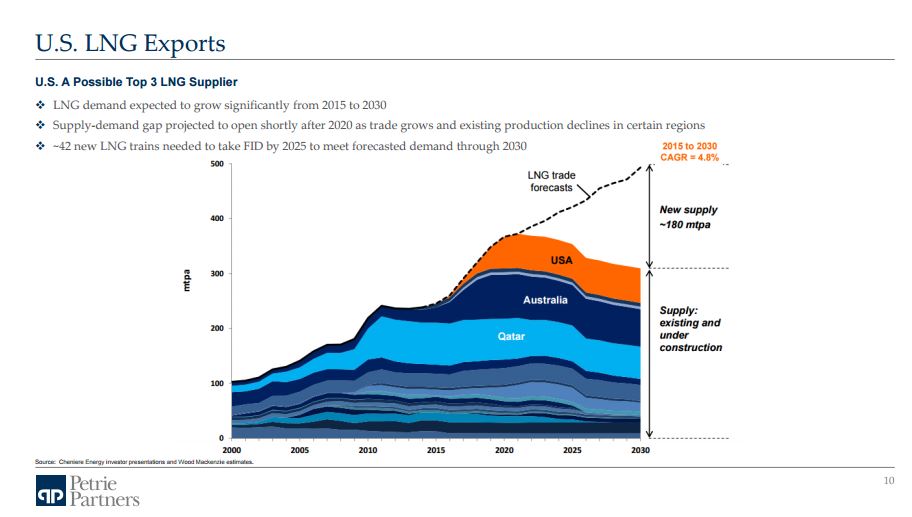

LNG exports

Petrie pointed out how the U.S. has 2 Bcf of natural gas moving through Sabine Pass to world markets.

“It’s not an ebullient market today, unlike times past when much of the gas was priced against much higher prices for oil, but it’s a workable market and it’s got a lot of geopolitical consequences and geopolitical utility for a U.S. administration.

“In all likelihood it will build from 2 billion cubic feet a day today to this year I think we’ll close well on our way to 3 billion cubic feet per day. Within another two years we’ll be at 5 Bcf a day and another two years beyond that probably 10 Bcf a day. So about 10 Bcf a day on a 65-70 Bcf/day U.S. consuming base is possible to imagine.

“Why? Because the markets in Europe will want some of this gas and to some degree markets in Asia will want some of this gas. And the physical ability to move it will be there with the [LNG export] projects that are completed, are about to be completed or are far enough along that you know they will be completed.

“It was a decade ago at this time that we still thought the U.S. was going to be one of the largest importers of natural gas because of the ‘peaking’ of natural gas. And then the sale of the Barnett shale reserves for $1 billion more than the $1.7 billion that the seller thought he was going to get began to transform the thinking and the pursuit of a dozen other plays followed in less than one year. Two years after that two thirds of those plays were qualified as technically feasible to produce given that natural gas has an effective price regime.”

What does this all mean?

“I think we’re at a time when actions speak louder than words. For the first time in its history OPEC is an effective balancing organization. It’s very fragile, it could be disrupted. But I think all the big players for the moment have a lot of incentive to play ball with each other, because whatever they’re cutting back they are going to get a bigger adjustment in revenues to be realized than if they try to fight for market share. I don’t think it’s a long term sustainable condition but I do think it could work this year, next year, maybe a little beyond that.

“Secondly, I think we’re going to see a major effort to bring Saudi Aramco public. My personal bet is it will end up being a hybrid deal and not just a straight IPO at $100 billion. That would be more than triple the largest one ever done. I think half might be with strategic players involving perhaps China, India and a European player who would take $15 billion to $20 billion apiece for special relationship with Saudi Aramco and the balance being the floating of the public piece.

“If it doesn’t happen, the challenge is for Saudi Arabia in the overall transformation of that society and that country in a part of the world where most of the neighbors have good reason not to like each other will be a challenge for this administration and whatever follows it.

“Finally these growing LNG volumes are really important and I think that that’s one of the great success stories coming out of the unconventional revolution.”