Activity up for eighth quarter in a row

Oil and gas activity has continued to strengthen in 2018, according to the Federal Reserve Bank of Dallas, which released its quarterly Energy Survey today.

The Fed’s overall business activity index, which examines changes in conditions and activity, was 40.7 in Q1 2018. This means activity increased in the past quarter, as the index is positive, and exceeds last quarter’s index of 38.1, meaning activity growth is accelerating. This is the eight quarter in a row with activity growth, as operations have been expanding since Q1 2016.

While both E&P and service companies are seeing activity increase, service companies are growing more rapidly. The Fed’s oil and gas support-specific activity index is currently at 48.4, compared to 34.6 for E&Ps. Only 7.5% of oil and gas executives surveyed reported a worsening company outlook, while more than half reported outlooks improving.

All the Fed’s more specific indices were positive as well, indicating both the positive and negative sides of growth are taking place. Factors like employment, production, and prices received are up, but so are lag times in services, input costs and LOE.

Oil price expectations up, gas down somewhat

In addition to investigating firm-specific activity, the Fed also surveys executives on expected year-end 2018 oil and gas prices. Executives have become more optimistic regarding oil prices, and now predict an average WTI year-end price of $63.07/bbl compared to $58.98/bbl last quarter. Executives generally see $55/bbl as a floor for oil prices, and less than 10% expect WTI will end the year below this level.

Expectations regarding Henry Hub prices, on the other hand, have soured in the past quarter. The average respondent predicted Henry Hub gas would be at $2.91/MMBTU at year-end 2018, compared to last quarter’s prediction of $3.05/MMBTU.

LOE, breakevens up slightly

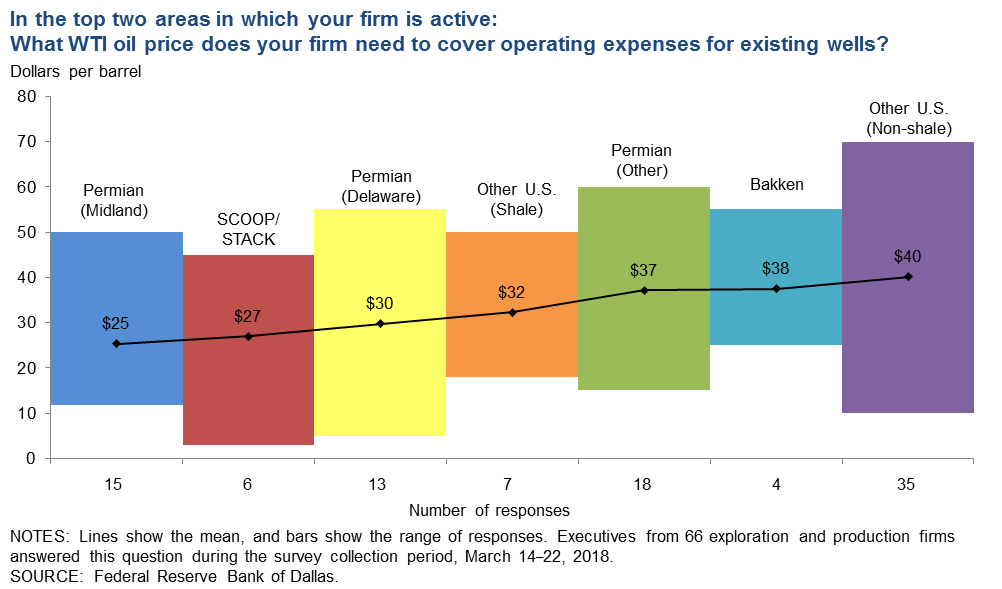

In addition to these standard questions, which the Fed asks in every survey, the Fed asked several questions about needed WTI price. The first of these addressed LOE, asking “In the top two areas in which your firm is active: What WTI oil price does your firm need to cover operating expenses for existing wells?”

Overall, responses showed slight increases from last year, when the Fed asked the same question in Q1. Most individual plays have seen needed prices increase by $1-$3, while the overall average was $35/bbl, compared to $33/bbl last year. The lowest responses were seen in the SCOOP/STACK and Delaware basins, where operating expenses of well below $10/bbl were reported.

The Dallas Fed also investigated new well costs, asking companies “What WTI oil price does your firm need to profitably drill a new well?”

The responses to this question, like the previous question, are very similar to results from last year. Average breakeven prices range from $47/bbl in the Midland to $55/bbl in non-shale basins, though individual companies reported prices ranging from $20/bbl to $75/bbl. One noteworthy development comes in the SCOOP/STACK, which dropped in the rankings of breakeven prices. Last year, the SCOOP/STACK was second only to the Midland basin with lowest breakevens. This year, however, the rest of the Permian and the Bakken show lower average breakevens. The vast majority of companies surveyed can drill at current prices, as only 12% reported breakeven prices above the March 23 spot price of $66/bbl.

Service companies expect significant hiring

The Fed also asked executives about predicted employment changes, “How do you expect the number of employees at your company to change in 2018?” Most companies expect the number of employees to increase in the coming year, with 51% predicting some level of growth. Another 46% expect employment to remain at or near 2017 levels. Only 4% predict a decrease in employment. Most firms predicting increases are service companies, as only 34% of E&Ps expect to increase employees, while 71% of service companies predict some growth.

New tax law likely moderately positive

Finally, the Fed asked executives “How will the new federal tax law, passed in December, affect your business on net?” Companies are likely to see a moderate boost from the law, as 46% of respondents predicted a slightly positive impact and 13% predicted a significant positive effect. 36% expect the tax law to have no net impact, though. Only 5% predict any negative net impact.

Executive comments show range of opinions

Executives were also able to make comments on the state of the industry, which showed a range of outlooks but were generally more positive than previous surveys.

- I feel that oil prices have a floor at $55 per barrel, which I did not sense six months ago. Also, I believe that there is a growing sense that the world cannot sustain nearly 100 million barrels per day of oil production with oil prices below $60 per barrel, regardless of the temporary oversupply.

- We continue to ramp up production at our company as we build out our operations. We have seen increased oilfield service costs and timing delays in the Permian. We expect a significant amount of production to come online in 2018, which will put downward pressure on West Texas Intermediate (WTI) crude oil prices. Our third-party hedging consultant has commented that their Permian operators are all expecting large production ramp-ups in 2018 and/or 2019, which is a cause for concern about takeaway capacity and oil prices.

- We are taking advantage of large company reassessments and buying production in areas where companies are divesting to focus on higher-profit areas they own.

- We are a private equity (PE)-backed company. Due to the lack of merger-and-acquisition activity in the public market, we, like many of the PE-backed companies, are seeing our sponsors curtail their capital commitments despite great well performance and economics. The few deals that are getting done are generally between PE firms, which is a new paradigm and, due to the incentive waterfall structure, one which is further exacerbating the bid–ask spread.

- My crystal ball has a crack in it. I never expected the Russians and OPEC, particularly Saudi Arabia, to abide by their agreement to curtail production. A recent article in the Wall Street Journal showed that Saudi Arabia needs around $70 per barrel to fund its national budget; however, the article did not say how many barrels it needs to sell at this price. So that is probably Saudi Arabia’s motive in supporting the price of crude worldwide. I still think that OPEC will tire of enabling the U.S. oil industry to drill expensive horizontal wells in shale formations and that we will resume selling more barrels at lower prices, driving down the domestic price and curtailing drilling activity.

- The U.S. onshore business has been improving quarter to quarter, and we expect the rest of 2018 to be the same. We have been hiring at a brisk pace, and the only thing restricting our growth is the availability of labor, especially in the Permian Basin.

- Uncertainty in steel tariff provisions is leading to uncertainty in cost outlook. Longer term, the tariff has the potential to impact many facets of the industry and could create additional inflationary pressures while it is in place. The new federal tax policy can help operators mitigate cost pressures from U.S.-based suppliers. Oilfield suppliers’ after-tax cost of capital equipment and expenditures decreases due to expensing provisions and time value of money.

- The labor shortage in West Texas is only getting worse. It’s not only affecting hiring, but also the availability of contract or third-party labor.