The Wrath of Godzilla

Oil and gas companies have become wary of debt like the residents of Odo feared the wrath of Godzilla, rising up from the sea to wreak havoc at any moment and smashing buildings in a single bound.

In a highly capital intensive industry like oil and gas development, debt is a necessity. Bank debt and corporate bonds are a means of acquiring the capital required to drill thousands of wells to obtain the fuels that generate the energy and products on which modern society depends.

Since the downturn in commodity prices, banks have tightened their belts and reduced borrowing bases while the market has been less receptive to new debt offerings, making the funding of capital programs more difficult.

Despite these expected and anticipated measures to mitigate losses in the lending industry, the breadth of what many assumed would be a bloodbath of bankruptcies or a frenzy of M&A activity has yet to materialize to the extent which many experts prognosticated. This isn’t to say that there haven’t been acquisitions or bankruptcies.

According to law firm Haynes and Boone, and their Oil Patch Bankruptcy Monitor, as of February 7, 2016, 48 U.S. oil and gas companies have filed for bankruptcy since the beginning of 2015. These companies had total debt obligations of over $17 billion. We have also seen major acquisitions, Royal Dutch Shell and BG Group for one. However, this isn’t the only end game for oil and gas companies. Restructuring debt and pushing out maturity dates can function as short term fix in a depleted commodity environment.

Borrowing base determination and collateralized value

The borrowing base for an oil and gas company is determined by the banking institution that extends the line of credit. In almost all cases, this is a first lien loan with seniority for payback over other types of debt a company may issue. A borrowing base if often a reserve based lending agreement with the company’s oil and gas reserves acting as collateral.

To glean insight into the overall value of the reserves, or collateralized value relative a loan agreement, one can utilize a company’s PV-10 value. PV-10 assesses the present value of proved reserves discounted at a standardized 10%.

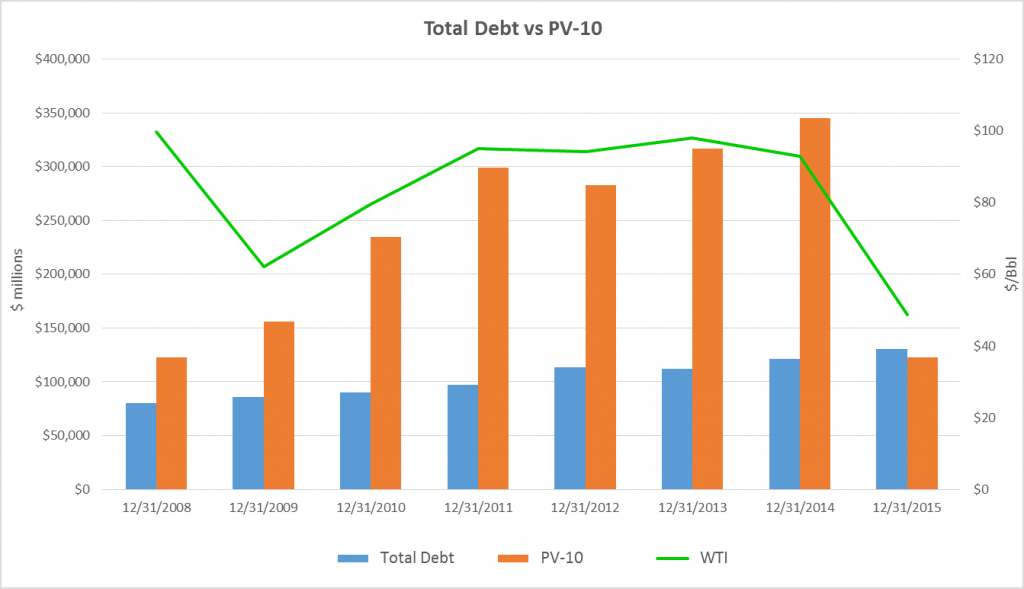

Oil & Gas 360® looked the total debt value for 19 large cap E&P companies and compared it to the PV-10 value for each company. We added in the average WTI average for each year as well.

As evidenced by the chart, the overall collateralized value of company assets has taken a sharp decline in 2015, largely due to the depletion of commodity prices. It is worth noting that several of these companies are heavier in natural gas as opposed to oil, however with the price for natural gas decreasing in a similar manner to oil prices, the overall effect is largely the same.

In 2014 the PV-10 value for the group was 2.85 times the amount of total debt, in 2015, that number shrinks to 0.94 times with debt levels reaching $130.4 billion for the group and PV-10 clocking in at $123.1 billion. Leaving roughly $7.3 billion worth of loans “uncollateralized.”

This does not mean that default is imminent, but banking institutions will take a harder look at the borrowing bases that are extended to these companies.

Bank covenants: bound to be broken and subsequently restructured

Banking institutions will place restrictions on loan agreements called covenants. These covenants act as a barometer for the company’s ability to generate cash and the consequent default risk. Typically these covenants will require a borrower to have sufficient EBITDA or cash flow to cover multiple of their interest payment or total debt.

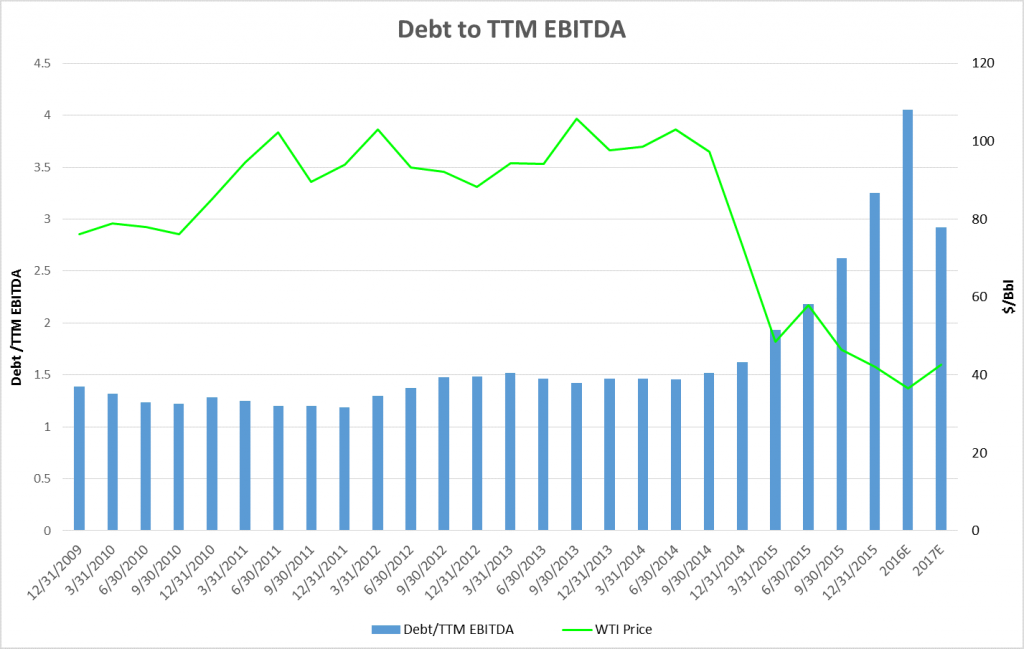

In our discussions with banking professionals over the last few months we have ascertained that falling EBITDA among oil and gas companies has led to regulators and banking institutions implementing lower covenants on loan agreements. Among the numbers we have heard is the belief that a restriction of 4.0 times total debt to EBITDA will now be the ceiling for lending institutions.

A Houston based lender who spoke with Oil & Gas 360® said: “The proliferation of second lien debt, subordinated debt, whatever outside debt sources have been used, have pushed the boundaries of loan covenants. While the banks remain the first lien and bankers view risk as minimalized in this position, covenants related to overall debt are bound to be broken and subsequently restructured.”

This chart is comprised of 48 companies of all market cap sizes, utilizing trailing twelve month EBITDA to total debt. The projections for 2016 and 2017 are based on Bloomberg analyst consensus estimates, and the total debt is assuming that there will be no change in debt from current levels.

The numbers behind this chart show that through the course of 2015, debt levels remained rather stagnant as a group. Total debt among the group of 48 companies at 12/31/2014 was $189.5 billion and actually fell to $192.6 billion by 12/31/2015. The rise in debt to EBITDA was largely attributable to the decline in EBITDA. For the group, TTM EBITDA fell from $116.9 billion to $59.2 billion. The decline in EBITDA is a predictable result of the downturn in commodity prices.

The prospective limit on debt to EBITDA in regards to lender covenants is likely to be capped at 4.0 times. The group of E&P’s ratio is expected to rise to above 4.0 on average in 2016. This could lead to a large group of companies running into difficulty with debt levels and negotiations with lending institutions.

Bank regulators hovering over energy lenders

Federal regulators have been hovering over the shoulder of oil and gas lenders watching and waiting to see if the need to jump in will arise. Certainly, regulators would like to avert any crisis similar to the mortgage crisis of 2008. While there isn’t an enormous market for packaged subprime debt, some banks are moving to get oil and gas debt off their balance sheets.

In November, the Federal Reserve put forward a Joint Press Release noting “Credit Risk and Weaknesses Related to Leveraged Lending” with particular emphasis on the oil and gas industry. This was an annual review of the Shared National Credits (SNC) exam, a Federal Reserve initiative to review and classify large syndicated loans. The review captures any loan bigger than $20 million that is shared by three or more supervised institutions. The SNC provides insight on so-called “classified loans,” or loans with unpaid interest and principal outstanding that are in danger of defaulting.

According to the results of the SNC, classified loans to oil and gas companies jumped four-fold. The Federal Reserve report said: “Oil and gas commitments to the exploration and production sector and the services sector totaled $276.5 billion, or 7.1 percent, of the SNC portfolio. Classified commitments – a credit rated as substandard, doubtful, or loss – among oil and gas borrowers totaled $34.2 billion, or 15.0%, of total classified commitments, compared with $6.9 billion, or 3.6 percent, in 2014. O&G classifieds rose to about 12% of total O&G commitments, well above the 5.3% ratio of classifieds for all other loan commitments. ”

1 in 7 loans edging toward default

That means around one in seven loans to oil and gas companies are edging toward default. The Federal Reserve SNC report noted: “Because of the growing volume of special mention and classified commitments, as well as the significant growth in the leveraged lending portfolio, the agencies will continue to monitor in particular the associated underwriting and risk-management processes in the leveraged lending and oil and gas sectors. The review also noted an increase in weakness among credits related to oil and gas exploration, production, and energy services following the decline in energy prices since mid-2014. Aggressive acquisition and exploration strategies from 2010 through 2014 led to increases in leverage, making many borrowers more susceptible to a protracted decline in commodity prices.”

Small, medium-sized E&Ps stuck in limbo

The oil and gas companies that are stuck in limbo are the small- and medium-size exploration and production companies that rely on credit lines as a source of capital to fund growth and operations. The majority of the capital comes from loans that use their proved reserves as collateral. With spring redeterminations either already under way or coming quickly on the horizon, there is cause for concern regarding the quality of the assets used as collateral and the economic viability of extracting the oil and gas.

Where can a company get some capital around here?

There are several logical conclusions that can be drawn from the findings presented here. One is that there will be an increase in bankruptcies as lenders pull borrowing capacities and companies become insolvent. Another option is that restructurings will be the norm and workout groups will have their hands full. A third option is the use of stock issuance to generate the necessary capital.

QEP Resources, Newfield Exploration, Rice Energy, Cabot Oil & Gas, and Devon Energy have all issued equity (or in Rice Energy’s case found a direct equity investor) in the last week. The option of piling up debt on their balance sheets is far less appealing, given covenant restrictions, and the equity markets have been receptive to these offerings thus far.

Like Godzilla stumbling through town, debt will become an issue through the course of 2016 for many oil and gas companies. Lending institutions increasing the scrutiny of debt and loan covenants, federal regulators looming and ready to step in, and the commodity price depletion will all play a role in the outcome. How severe it gets and if any work arounds remain is yet to be seen.