Natural gas production has increased aggressively over the last 10 years after the shale revolution unlocked the door to vast new resource potential.

In the U.S., marketed natural gas production has increased from 53.2 Bcf/d in 2006 to 78.9 Bcf/d in 2015, an increase of 48.3% according to EIA statistics. The increase in natural gas production has also created a rise in the production of natural gas liquids that are extracted through the same process. Over the same period, ethane production in the U.S. has increased from 676.1 MBoe/d in 2006 to 1,107.6 MBoe/d in 2015, a 63.8% increase. Propane, Pentane, normal butane, and isobutene have also experienced a similar increase.

This trend is not expected to subside any time soon, with the EIA projecting ethane production to increase from 1.1 MMBoe/d in 2015 to 1.4 MMBoe/d in 2017. Ethane alone will account for two-thirds of the growth in natural gas liquids over that time period.

“Over the past five or six years, the amount of ethane contained in domestically produced raw natural gas has exceeded the capacity to consume and export it. This oversupply kept ethane prices relatively low, hovering at or below the price of natural gas, leading producers to reject the ethane stream by leaving it mixed with the stream that is marketed as pipeline natural gas, which is mostly methane,” the EIA reported.

Uses for NGLs

Campers rely on butane to cook family meals on portable stoves. To power your outdoor bar-b-que grill, who hasn’t made a run to the store to refill the propane tank? Propane is also used for a wide array of consumer and industrial applications including providing home heat in remote locations and as fuel to run forklifts.

Goodbye Naphtha, Hello Ethane

Ethane is largely used in ethylene-cracking plants in the production of ethylene for plastic production.

The two major components of ethylene production are ethane and naphtha. EIA notes that there is a shift occurring in the production of ethylene through the shift from heavier naphtha to lighter ethane. EIA says, “Naphtha, a hydrocarbon that contains mostly molecules with 5–12 carbon atoms, is one of the lighter components produced by refining crude oil. It is a much heavier feedstock than ethane or propane, which respectively consist of hydrocarbon molecules with 2 or 3 carbon atoms. All ethylene projects currently planned for the United States are designed to consume light feed, predominantly ethane, for the production of ethylene.” Plastics manufacturing is a major global industry, and the U.S. plastics industry is expecting a sea change brought on by the emergence of shale gas production.

According to a 2015 report, “Resin producers locate close to the raw material extraction and feedstock. Initially the location focus was on the Texas and Louisiana crude oil fields. Until 2008 little new capacity was programmed; however, the emergence of shale-based natural gas has shifted the U.S. industry into a new production era, the effects of which are just beginning. Shale gas can be processed into ethylene, a key feedstock for many plastics, and resin manufacturers are swiftly deploying new steam cracker plants to capture this resource. Dow Chemical alone has a capital budget of $80 billion for new plant construction. Industry-wide activity includes: a potential 42 percent increase in ethylene production capacity over the next three years; by 2017 five new facilities are scheduled for the Gulf Coast region (adding 6,250 kt/year capacity); plus, the stage is set for the development of a second petrochemicals hub in the Marcellus basin, where new plants are proposed for West Virginia (Aither Chemicals), Pennsylvania (Shell Chemical), and Ohio (Appalachian Resins).”

Shale Gas Leading to a U.S. Plastics Boom?

U.S. chemical manufacturers that were struggling a decade ago are now thriving thanks to cheap natural gas. “Companies that once focused on diversifying their business away from producing bulk chemicals, like ethylene, are now finding success in bulk manufacturing,” according to an Engineering.com report.

“Ethylene itself is perhaps the most important raw material in the petrochemical industry. It is the basis of the three polyethylene (PE) plastics: high-density PE, linear low-density PE and low-density PE. Used primarily in packaging, polyethylene is the most common plastic in the world.

“Hence, a major investment in domestic ethylene production suggests that big changes could be coming to the North American plastics industry. The combination of low-cost feedstocks and major domestic projects like those above could significantly reduce the price of polyethylene and polyester in North America,” the report said.

Increase in Ethane Takeaway Capacity

Several companies have increased their focus on the extraction of NGLs from the production stream. One of the companies that has built their position to be one of the largest NGL producers in the Marcellus region is Range Resources (ticker: RRC). Range has been involved in the extraction and transportation of ethane from the Marcellus region through various projects. “Given the current level of NGL production and future expectations for growth in the liquids rich Marcellus, the company has sought to diversify its customer base and not rely solely on a single customer or transportation outlet for its NGLs,” the Range Resources website reports.

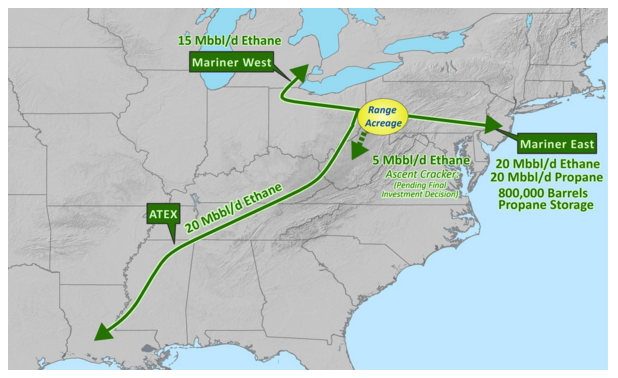

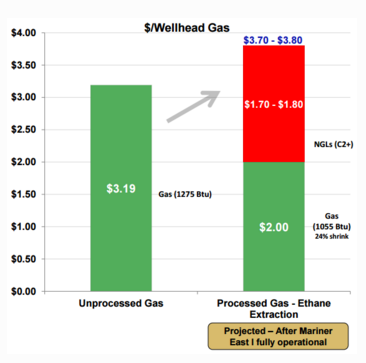

The Mariner East 1 pipeline became fully functional in February 2016 and has the capacity to carry roughly 40 MBbl/d of ethane and propane from the Marcellus. The Mariner East project focuses on the east coast, with the Mariner West project heading towards the Midwest and the ATEX project focusing on takeaway to the Gull Coast.

This gives Range the optionality to focus on the best pricing at hubs outside of Mont Belvieu in Texas. Chad Stephens, Senior Vice President of Range Resources, said the new routes provide ample flexibility and a wide ranging group of buyers. “We can use seasonality demand on the East Coast [or] focus on best prices, whether it be into Europe, or Asia or South America,” he explained in the company’s Q3’15 conference call. “We have a new contractual relationship with a global trader that has deep understandings of all the international markets and have relationships with Asian propane buyers and European propane buyers. They have a deep understanding of shipping and logistics.”

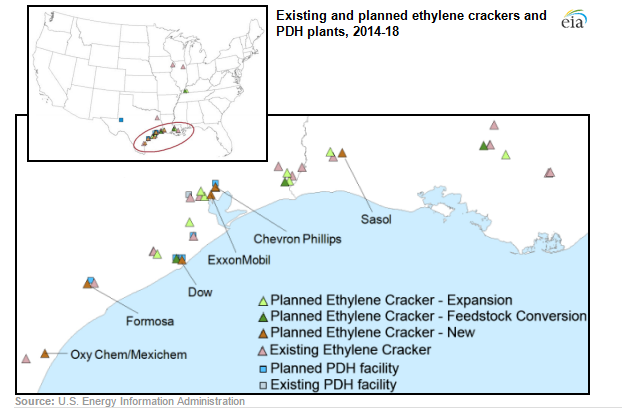

Ethylene Crackers

Plants designed to crack ethylene are expensive and take time to develop. Most of the ethylene cracker projects currently in development will not come online until 2017 or 2018, including six large-scale projects announced in 2011 and 2012. Four projects (from Dow, ExxonMobil, Chevron Philips, and OxyChem/Mexichem) are already under construction, and two projects (from Formosa and Sasol) have received permitting approval and commitments from investors.

These new facilities are expected to generate a 40% increase in ethylene production in the U.S., lifting the total to more than 37 million metric tons, accounting for more than one-fifth of the current global ethylene production capacity.

These plants will largely focus on the Gulf coast region which has become a hotbed of NGL and LNG activity. Cheniere energy has already set up shop there with an LNG plant that can be used for the exportation of liquefied natural gas to various corners of the globe. This positions both natural gas and the associated products such as ethane, propane, and butanes to become a major player in not only the U.S. market, but the world market.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.