Company will pay to eliminate significant P&A commitments

Energy XXI Gulf Coast (ticker: EGC) announced a unique deal today, divesting much of the company’s non-core assets to privately held Orinoco Natural Resources.

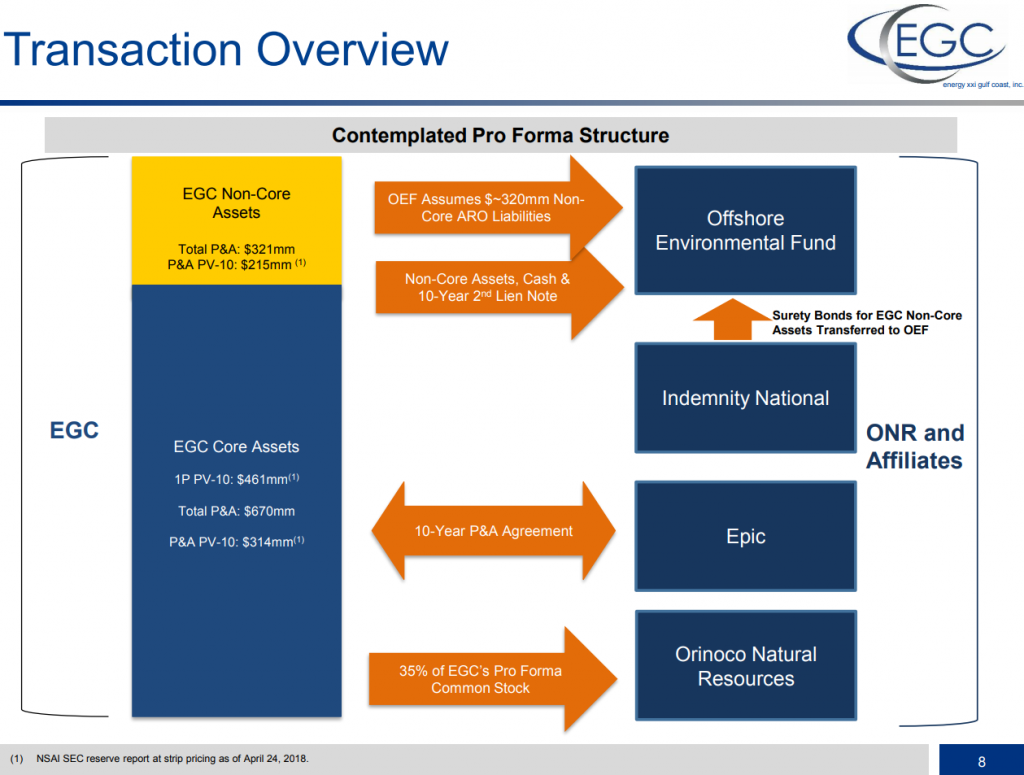

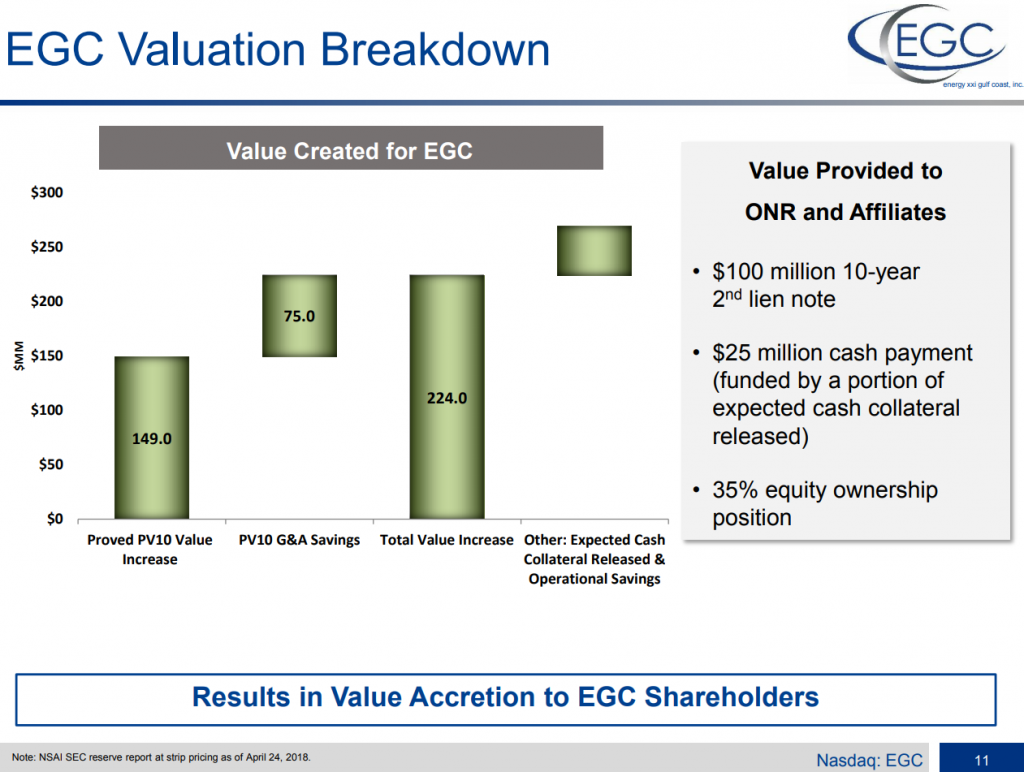

The properties eliminated are currently producing about 3 MBOPD and 9.5 MMcf/d, with 6.7 MMBOE of proved reserves. EGC will not receive any proceeds from the transaction, and will in fact compensate Orinoco instead. Orinoco will receive $25 million in cash, a 35% equity stake in EGC, and EGC will issue a $100 million ten-year lien with 9% annual interest to an affiliate of Orinoco. In addition, Energy XXI will sign a 10-year P&A service agreement for its remaining assets with EPIC Companies, an affiliate of Orinoco, on “commercially reasonable terms and at market-supported rates.”

This deal, paying a company to take assets, is uncommon in unconventional operations but sometimes seen in offshore assets. This is due to the significant cost involved in plugging and abandoning an offshore well, combined with stringent requirements to set aside money for this process.

EGC reports that even though its sold assets have 6.7 MMBOE of proved reserves, they have a negative PV-10 due to the associated P&A obligations. The company estimates that when P&A is included, the assets have a PV-10 of -$149 million. EGC’s required annual cash P&A spending will drop by about $30 million per year, while G&A costs will drop by $11 million per year.

Not the first GOM operator to move out certain assets

A similar transaction was announced in February this year, when PetroQuest divested its GOM assets for no proceeds. Like EGC’s transaction, PetroQuest divested assets that are currently producing but have significant abandonment costs upcoming. An affiliate of Orinoco acquired PetroQuest’s wells.

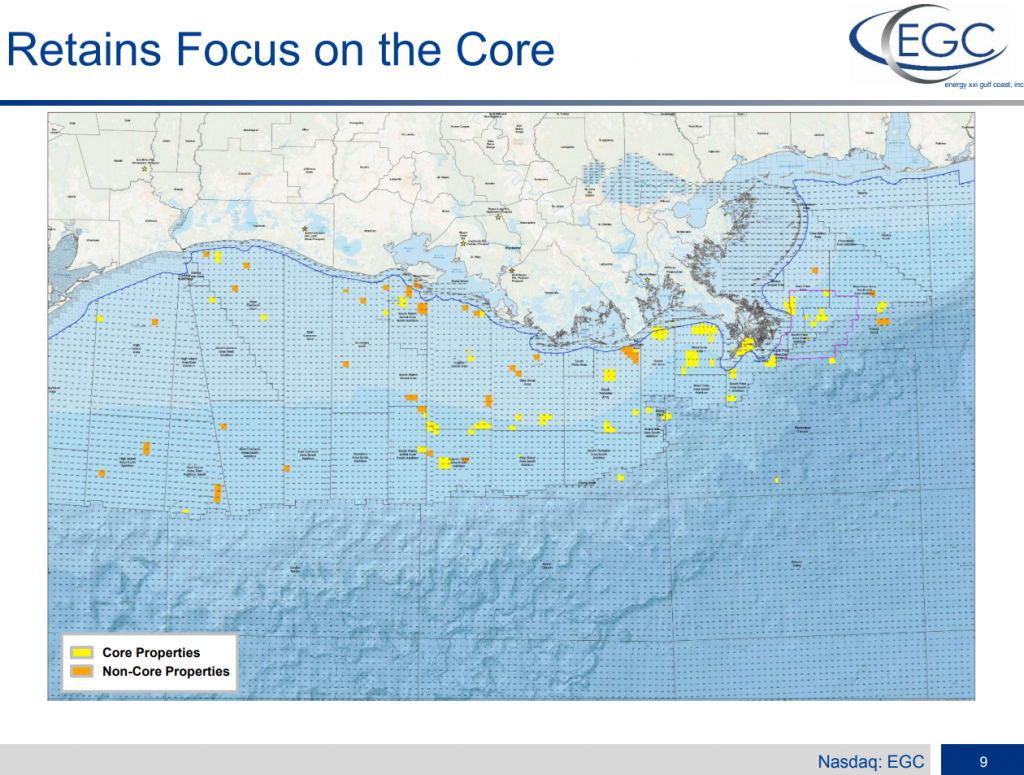

Energy XXI CEO and President commented on the transaction, saying “Through extensive evaluation of our portfolio over the last year, we identified several critical factors that could materially enhance the sustainability and valuation of EGC’s portfolio. We believe that this proposed transaction addresses many of these factors, including a significant reduction of EGC’s asset retirement obligations, meaningful reductions to operating costs, and a renewed operational focus on our most productive assets, which generate the majority of our cash flow and value. The successful execution of this transaction will leave EGC much better positioned to implement its strategy.”

Recent wells are coming in below cost estimates

Energy XXI also announced first quarter results today, showing a net loss of $33.1 million, or ($0.99) per share. The company produced 26.6 MBOEPD in the quarter, slightly above the midpoint of guidance. EGC expects production to fall slightly in Q2, due to shut-ins for facility improvements and pipeline issues.

Energy XXI spud and completed the first well of the 2018 drilling program in April, a development well that is expected to begin production this month. The company reports that the well cost less than expected.

The company’s High Tide well, which was drilled last year, is producing beyond expectations. The well was expected to produce at around 600 BOPD, but is currently achieving over 1,000 and is still rising. High Tide also cost less than expected, $8.9 million compared to a predicted $10.1 million.