The board of directors of Energy XXI (ticker EXXI) announced on March 12, 2014, the company acquired EPL Oil & Gas (ticker: EPL) for a total consideration of $2.3 billion, consisting of about $1 billion in cash (65% of total consideration) and about 23.4 million common shares of Energy XXI (35%). The per-share consideration for EPL is $39, a 34% premium to the close of business on March 11, 2014.

Proforma1 for the transaction:

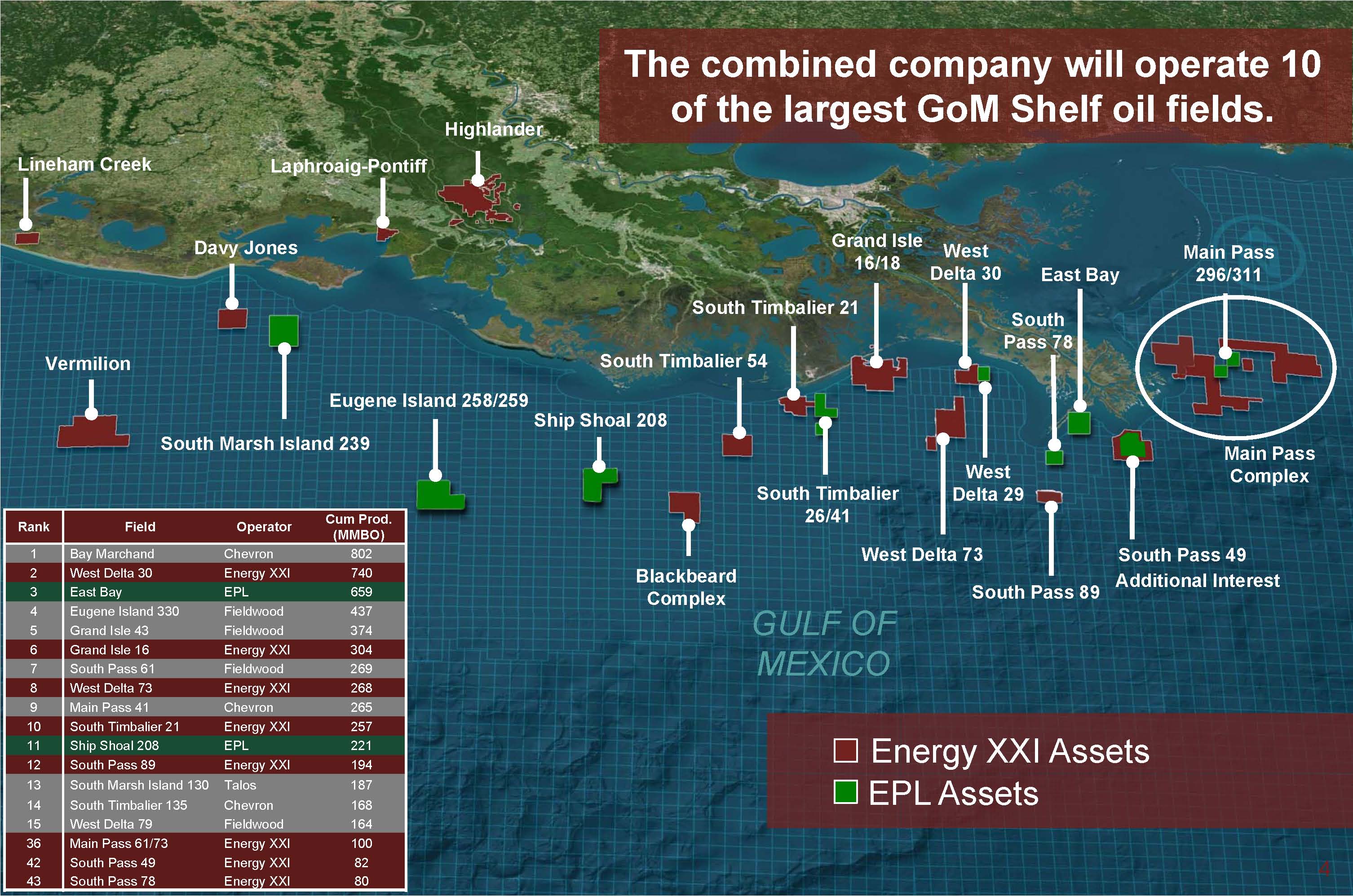

- EXXI will control 10 of the largest oil fields in the Gulf of Mexico (GOM) shelf;

- Total daily production is 65,500 BOE;

- Total proved reserves are 243 MMBOE;

- Total proved plus probable reserves (P1 + P2) are 325 MMBOE; and

- 12/31/13 proforma P1 + P2 PV-10 is $11.3 billion.

1EXXI reserves and production as of 6/30/2013 less production from 7/1/2013-12/31/2013 pro forma for divestiture of Eugene Island 330 and South Marsh Island 128 and acquisition of West Delta 32 (Black Elk) and South Timbalier 54 (Walter). EPL reserves and production as of 12/31/2013 pro forma for Nexen (Eugene Island 258/259) acquisition.

CNBC Interview Prior to the Acquisition

Click here for the full press release.

In a company news release, John Schiller, CEO, president and chairman of EXXI, said: “EPL’s assets and operations closely resemble our own, predominantly oil, with some of the highest margins in the industry and extraordinary opportunities for reserves and production growth through development and exploration activities.”

Schiller presented at EnerCom’s The Oil & Services Conference™ 12 on February 18.

EPL’s 2013 estimated proved reserves, prepared by Netherland Sewell & Associates, were 80.4 MMBOE, or 84 MMBOE including the unbooked assets associated with the Eugene Island 258/259 (EI 258/259) Field acquisition that was announced on January 2, 2014. EPL’s probable reserves were estimated to be 29.8 MMBOE. The company’s average full-year 2013 daily production rate was 16,938. EPL estimated having a March 2014 production exit rate of 22,700 BOE/D. Based on the total transaction consideration, Energy XXI is paying:

- $27.38 per total proved BOE, including the Eugene Island acquisition;

- $20.87 per BOE for total proved BOE, including EI 258/259, plus probable reserves;

- $135,789 per flowing barrel at year-end 2013; or

- $101,321 per flowing barrel using the estimated March 2014 exit rate.

)

Schiller said: “Energy XXI will be the only publicly traded pure play on the Gulf of Mexico shelf, with the highest concentration of large, mature oil fields ever owned by a single shelf operator. With a history of increasing acquired reserves, we have proven the adage that big oil fields get bigger, and we are excited at the prospect of continuing that trend with the addition of EPL’s properties.”

EXXI has a history of buying large positions in the GOM. On November 21, 2010, EXXI paid $1.05 billion to acquire properties with total proved and probable reserves of 66 MMBOE and producing 20,000 BOE/D from Exxon Mobil (ticker: XOM).

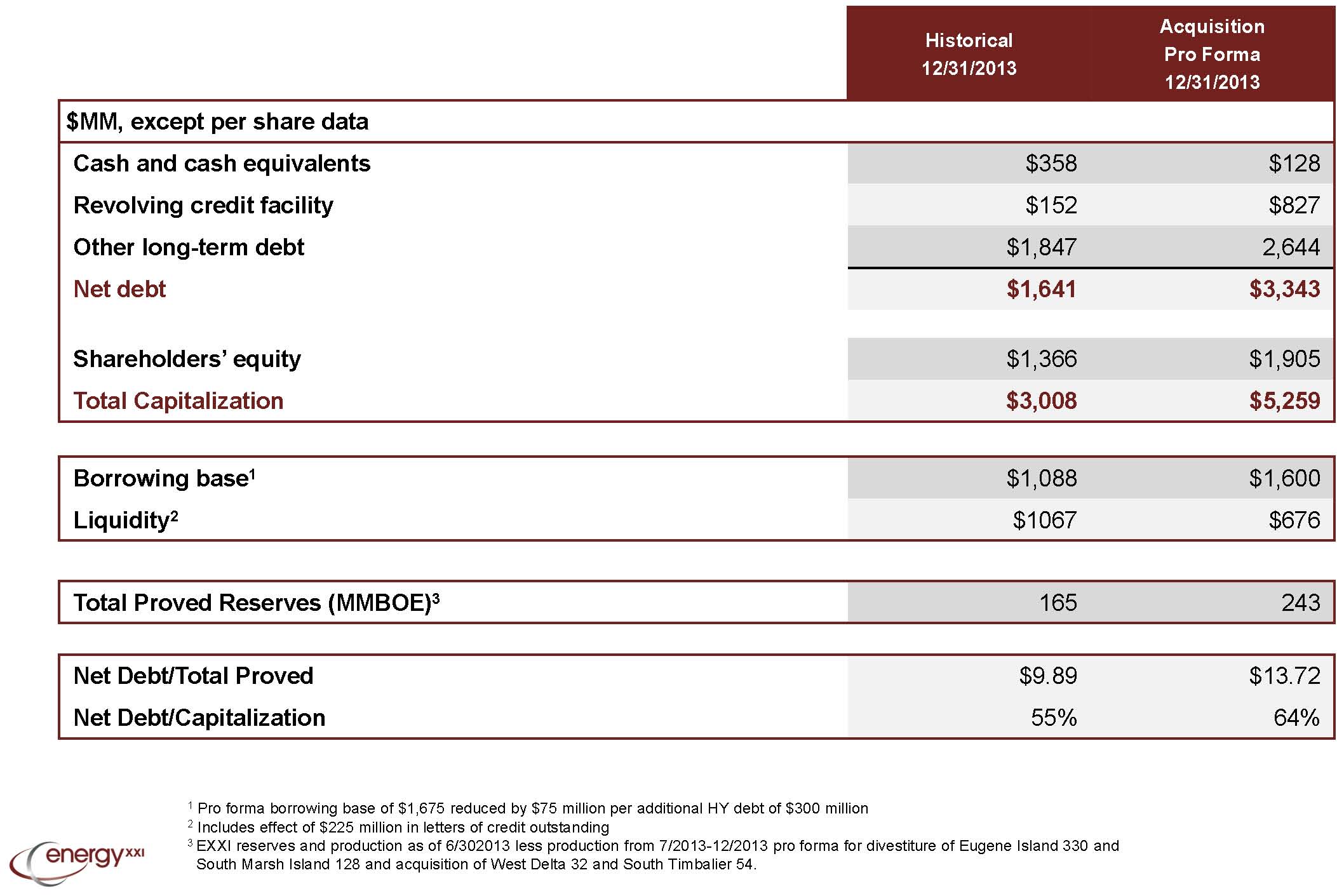

EXXI will finance 65% of the transaction drawing $545 million from its current credit facility, cash on hand, the sale of non-core assets and a $400 million unsecured bridge loan. EXXI anticipates taking out the bridge loan with high-yield financing. Net debt will be approximately 63.5% of total book capitalization. The company said it will shelve its stock buy-back program, seeking to return the balance sheet back to a range of 40% to 60%.

EPL stockholders will have the ability to elect either to receive 1) $39 in cash 2) 1.669 commons shares of EXXI or 3) $25.35 in cash plus 0.584 common shares of EXXI. All elections by shareholders will be subject to proration.

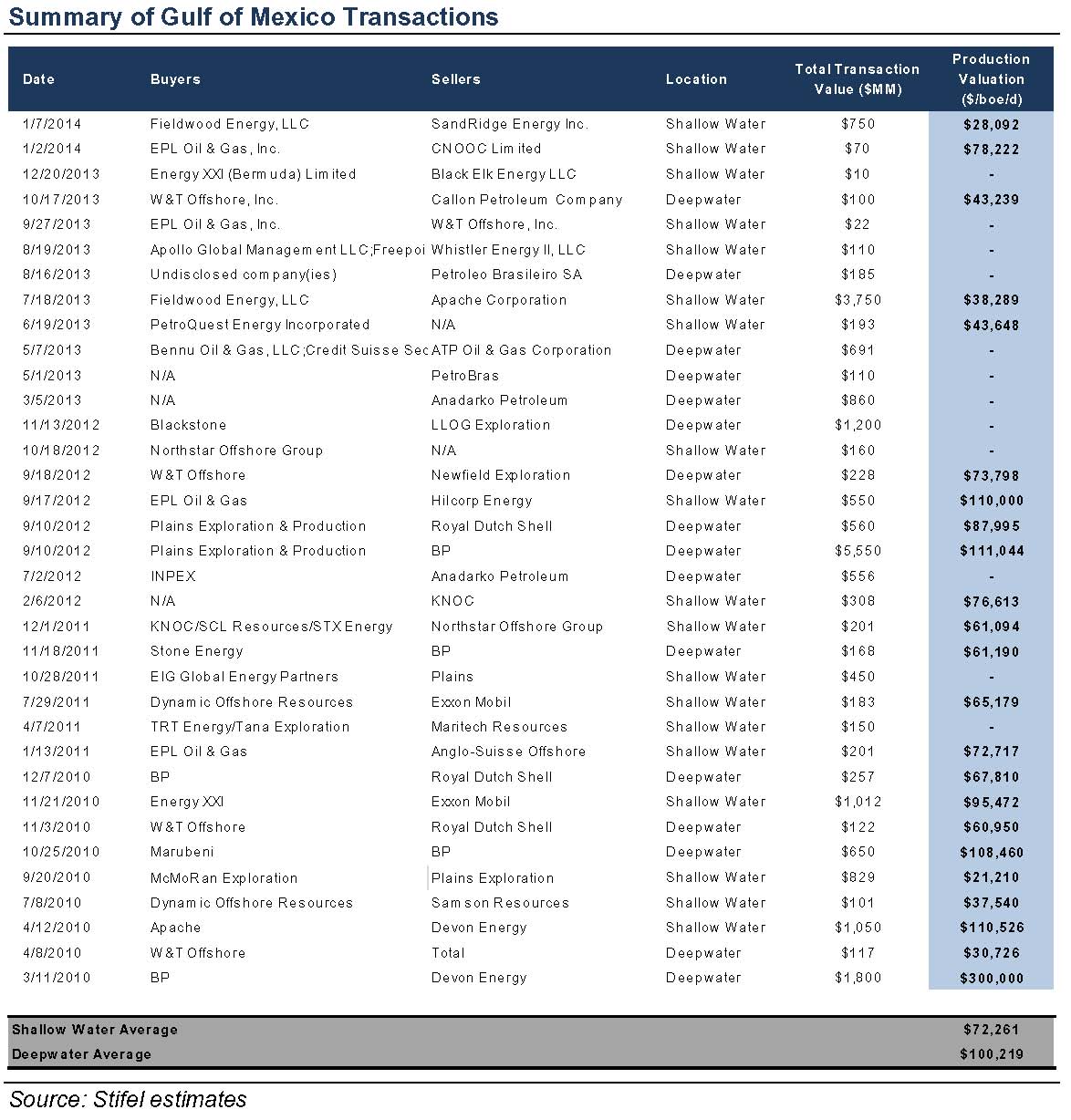

As evidenced by the table below from a March 12, 2014 note from Stifel, EPL had added GOM acreage from four separate transactions dating back to 2011 for a total of $843 million. Excluding EXXI’s purchase of XOM properties, EPL had spent more for shallow water acquisitions than any other publically traded company in the region.

Stifel said: “The key potential upside for the buyer in our view is the deeper shelf assets, which EPL has not been able to test in the past given its historical balance sheet and size. These deep shelf assets have the potential for $58/sh of unrisked upside, but carry higher exploration risk and technical production risk. Applying a 10%-20% risk factor on this number would yield $6-12/sh of upside with only $3/sh reflected in our risked NAV, meaning $3-9/sh of additional risked upside to our $31/sh risked NAV if capital is allocated to testing the leads.”

OAG360 Comments

We believe EXXI’s acquisition of EPL bolsters the company’s position in the Gulf adding assets and reserves and that over time, the valuation of the company will reflect this strategic advantage.

OAG360 examined the company’s valuation based on three valuation methodologies.

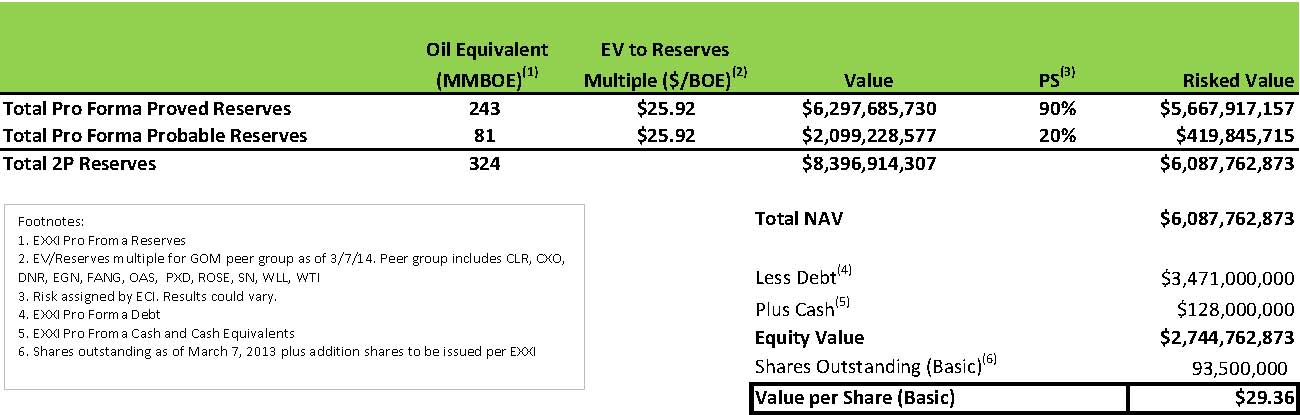

When the market closed on March 13, 2014, shares of EXXI were trading at $22.13. Based on two methodologies, we estimate that Energy XXI’s share value to be between $29.36 and $72.64 per share, with a composite valuation of $50.78 per share.

For calculating the per-share valuation, we used basic shares outstanding as of March 7, 2013. The company noted in its investor presentation their intent to issue 23.2MM new shares as part of the transaction financing. This would increase basic shares outstanding to 93.5MM shares.

For the proved reserve and production NAV values, OAG360 utilized a peer set of oily producers. Our rationale was that oil producers receive different valuations dependent upon operating area. OAG360 prescribes to an agnostic basin view looking to provide valuation metrics for oil-based companies regardless of basin location. We pulled companies that predominately produce oil regardless of operating region to create a multiple reflective of oil production in various parts of the country. This provided OAG360 with a multiple more reflective of oil production as opposed to just oil production in the Gulf of Mexico.

Pro Forma Net Asset Value: Proved Reserves

Following the transaction, EXXI provided Pro Forma projections for proved reserves of 243 MMBoe of proved reserves, and 81 MMBoe of additional probable reserves. As of March 7, 2014, the average enterprise value-to-proved reserves ratio from a group of Energy XXI’s peers was $25.92 per BOE. Adjusting for the company’s balance sheet items and assigning a probability of success of 90% to the proved value and 20% to the possible value, the result is a valuation of $29.36 based on proved reserves. The risk values have been set on the side of conservatism, while the 20% assigned to the probable reserves is low, this provides upside for the development of those assets.

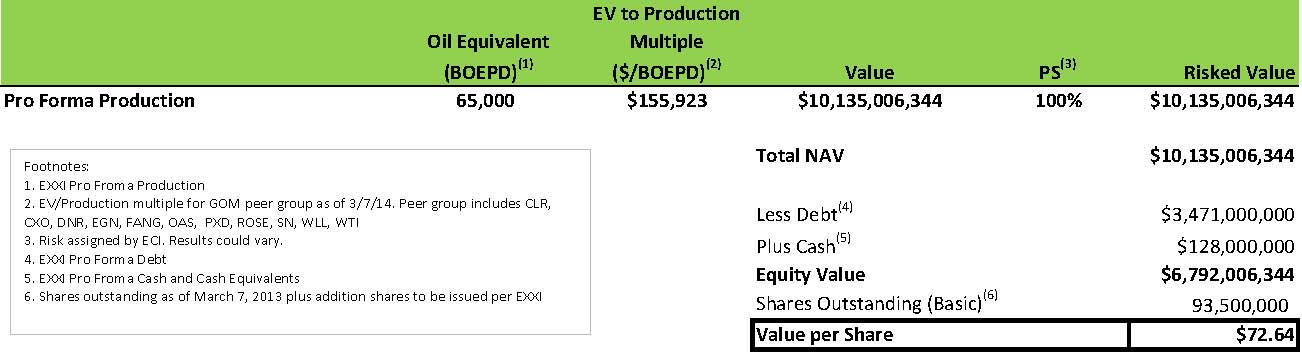

Net Asset Value: Production

EXXI provided a pro forma production number of 65,000 BOEPD. As of March 7, 2014, the average enterprise value to production ratio from a group of Energy XXI’s oil-weighted peers was $155,923 per BOE. Assigning a probability of success at 100% since production is ongoing the result is a valuation of $72.64 per share. This valuation is a result of a multiple attained from oil producers all over the country and is not limited solely to Gulf of Mexico production.

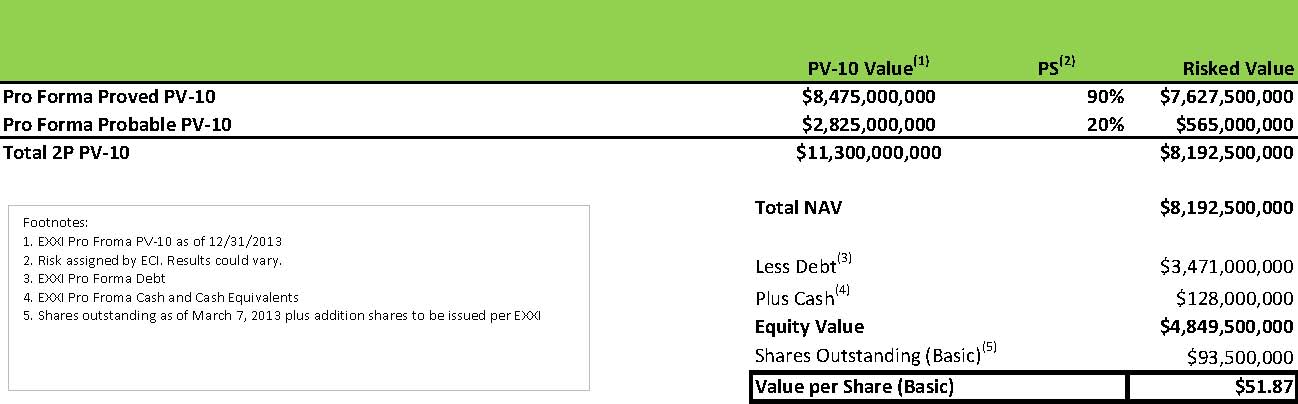

Pro Forma PV-10 Valuation

The PV-10 value is a metric utilized to predict future cash flows discounted at 10%. We utilized this metric for Energy XXI because the increase in reserves has significantly changed the PV-10 value for the company. 2P future cash flows for the company are estimated at $11.3 Billion. The SEC Standardized Measure of the company’s proved reserves, an after-tax measurement of the company’s proved reserves is $8.475 billion. Using the 2P figure for this particular valuation methodology, and adjusting for current balance sheet items, we derive a basic per-share valuation of $51.87.

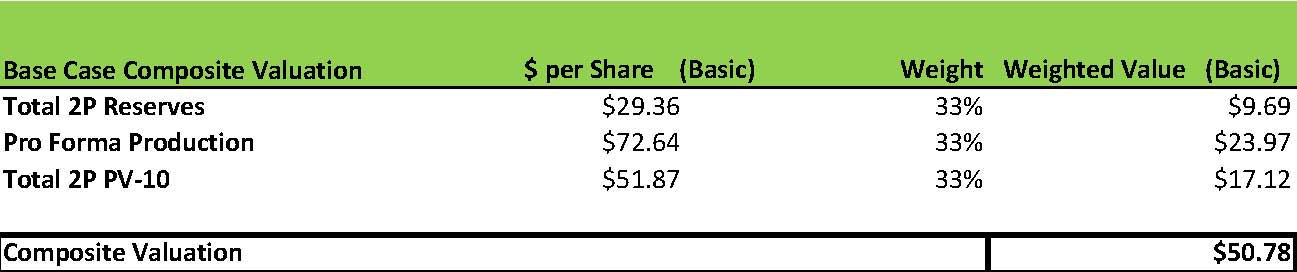

Composite Valuation

Assigning an equal weighted average of 33% to the three valuation methodologies – production, reserves and PV-10 – OAG360 estimates EXXI’s equity value could be worth $50.78 per basic share.

EXXI’s Future

Since day one, Energy XXI’s brand promise to the Street has been to acquire and exploit low-risk oil opportunities in the Gulf of Mexico to grow reserves and production. EXXI proved it could acquire a large asset package and apply its proven exploitation techniques to increase reserves and production (as witnessed back in 2009 when the company purchased a billion dollars’ worth of ExxonMobil assets). This new asset package should provide Energy XXI a new base to apply EPL’s existing knowledge and technical skills to increase production, as well as utilize its own horizontal drilling techniques and exploitation techniques to optimize production over the near and long term.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. A member of EnerCom, Inc. has a long-only position in Energy XXI.