EOG targets 18% crude oil production growth

EOG (ticker: EOG) reported fourth quarter earnings and reserves today, showing a net loss of $142.4 million, or ($0.25) per share. Full year results were a loss of $1.1 billion, or ($1.98) per share. Both fourth quarter and full year results exceed2015 results, which were losses of ($0.52) and ($8.29) per share, respectively. Adjusting for impairments and other special charges gives an adjusted fourth quarter and full year loss of $6.7 million and $892.6 million, respectively.

EOG’s preliminary 2016 reserves show almost no overall change from 2015. Current total reserve estimates are 2,147 MMBOE while 2015 reserves were 2,118, representing growth of about 1.4%. About 55% of overall reserves are comprised of oil, while gas makes up 26% and NGL makes up the remaining 19%. EOG reports a total reserve replacement ratio of 114% for 2016, with reserve replacement costs of $6.52/BOE.

EOG estimates that its 2017 CapEx will be between $3.7 and $4.1 billion, which will be spent almost entirely on U.S. properties. The company will be focusing on its “premium drilling inventory,” which it defines as properties where wells can yield direct after-tax returns of at least 30% with crude oil prices of $40/bbl. EOG predicts that it will complete about 480 net wells in 2017, compared to 445 net wells in 2016. About 80% of these wells will be in premium locations, compared with 50% in 2016.

100 Eagle Ford wells to begin EOR

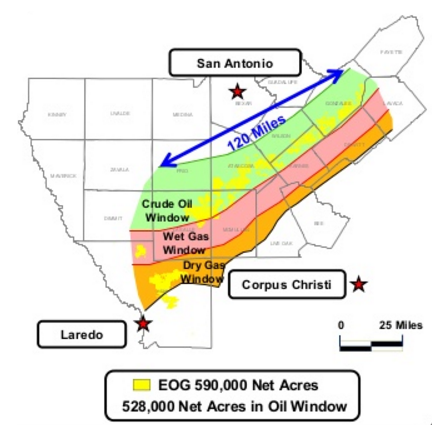

The Eagle Ford will be EOG’s main target play in 2017, with about 195 wells expected to be completed this year. The majority of the company’s acreage in the play targets crude oil, with 528,000 net acres in the oil window out of a total of 590,000 net acres. The enhanced oil recovery program tested by EOG in the Eagle Ford has seen success. The 32-well pilot program tested in 2016 generated 30%-70% improvements in recovery. EOG plans to significantly expand this program in 2017, with about 100 wells beginning EOR over six areas in the basin.

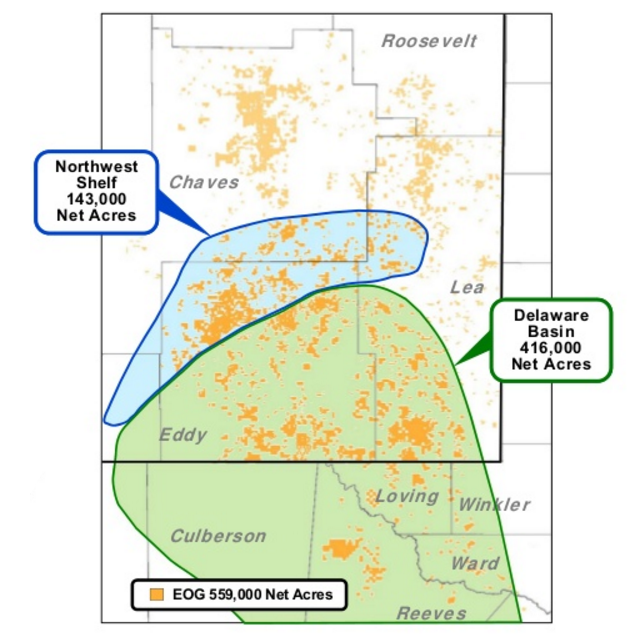

EOG will also target the Delaware basin in 2017, with an estimated 140 wells expected to be completed this year. EOG significantly increased its holdings in the Permian in September, when it acquired Yates Petroleum for $2.5 billion. This acquisition added a total of 1.6 million net acres to EOG’s holdings, including about 324,000 net acres in the Permian. In 2017 EOG plans to test downspacing and additional zone targets in the Wolfcamp.

Unlike many E&P companies, EOG expects well costs to be flat or even decrease in 2017. The company predicts that service cost inflation will be offset by continued efficiency improvements and service contract expirations.

Q&A from EOG Q4 conference call

Q: How de-risked does a new play need to be before you’ll disclose it? And outside of securing the acreage, what are key parameters necessary before you’ll show it to investors? And I raise it from the context of peers both U.S. and global that have unveiled unconventional plays in much earlier stages, raising the risks as data’s released.

EOG Chairman and CEO William R. Thomas: Well, the first thing is the play has to be premium quality. So it has to meet the investment hurdles that we’ve set for premium drilling. And then second of all, we like to have multiple tests, and we like to be really convinced that the play’s going to work up to our expectations and we have some consistency about it. We don’t want to drill a one- or two-well wonder, then come back and some of the other wells are not so good. So we do take a little bit more time. I think it’s because we’re just more thorough and we want to be more sure about it.

And then there’s always, in every one of these plays, you mention acreage. Acreage is the critical thing. And as we test them, we learn more about where the sweet spots could be in the plays. And so we’re only focused on tying up the sweet spots of that acreage. So we have a large number of plays in the company that we’re working on. We’re very decentralized in each one of our operating divisions and a full set of exploration folks and we’re spread out all over the U.S. And so we’re working multiple plays at the same time, and we’re quite optimistic about new plays providing additional premium inventory in the future.

Q: You guys are running 11 rigs and targeting 140 wells in 2017 [in the Permian]. Implied spud to spuds are up year over year. Any color there on maybe how many well completions in the 2017 program are being carried into 2018, or does the lower number of wells reflect a larger appraisal program? Or just some color around that sequentially would be helpful.

<EVP of Exploration and Production Lloyd W. Helms, Jr.>: So what we’re seeing there in the Delaware Basin is we’ve had a steady rig count, and we’re typically going be drilling longer laterals in 2017 than we did in 2016. So the drilling times are going increase slightly just as a result of that.

On the number of well completions, I believe we’re going to complete about 140 total wells in the Delaware Basin this year, most of those in the Wolfcamp. And we’re down to a normal level of inventory in all of our major plays, including the Delaware Basin. So we’re not really carrying over into 2017 an abnormally high amount of DUCs, you might say. So the rig count there has increased relative to last year. We will be going to longer laterals, but we’ll have about 140 net wells completed this year.