800 locations and 750 MMBOE of resource potential

EOG Resources (ticker: EOG) reported third quarter results today, showing net income of $100.5 million, or $0.35 per share.

EOG’s main focus in recent quarters is its “premium” locations, defined as locations with locations with at least a 30% after tax ROR at $40 oil. The company is shifting to developing these wells, and adding further premium locations.

EOG has added two plays to its Permian inventory, with a combined 800 net locations and 750 MMBOE of resource potential.

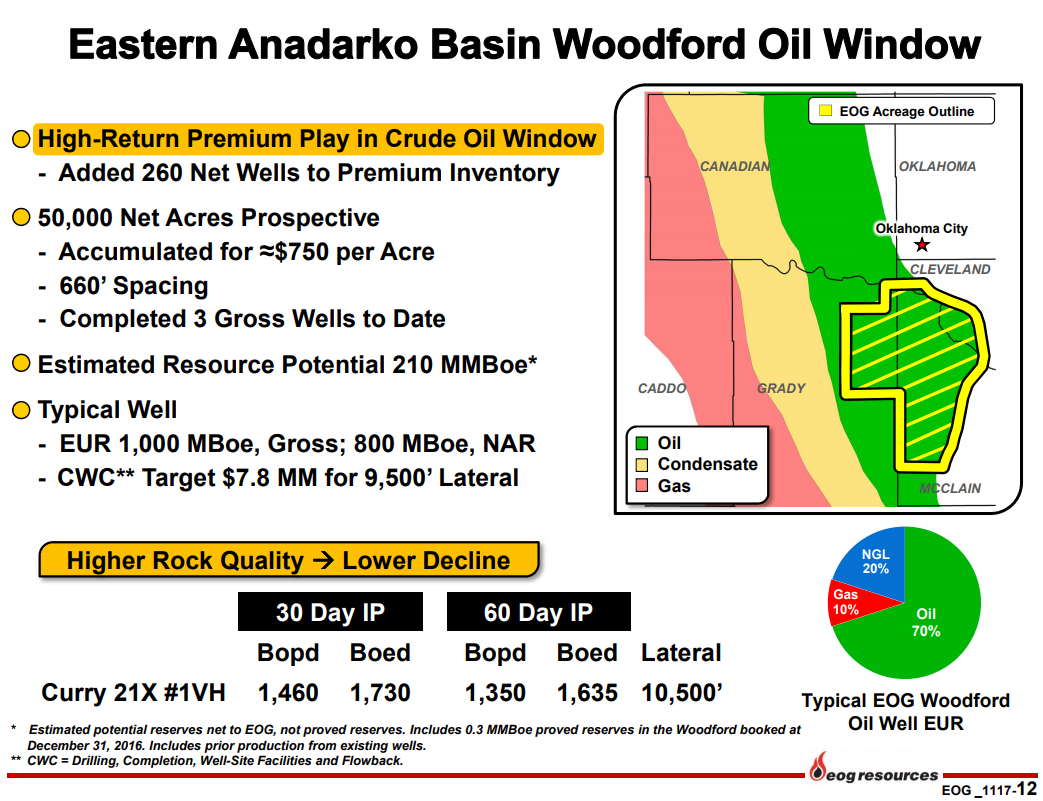

Woodford Oil Window

The first of these plays is the Woodford Oil Window, in the eastern Anadarko Basin of Oklahoma. EOG has amassed a 50,000 acre position in the play over the past four years, at an average cost of $750 per acre. The company’s most recent well in the play had a 30-day IP of 1,730 BOEPD, 85% of which was oil. EOG estimates a standard well in the play will cost $7.8 million, with a 9,500 foot lateral. The play has a shallow initial decline rate, so reserves per well are a net 800 MBOE. EOG has identified 260 net drillings in the area, with net resource potential of 210 MMBOE. Activity in the play will ramp up in 2018.

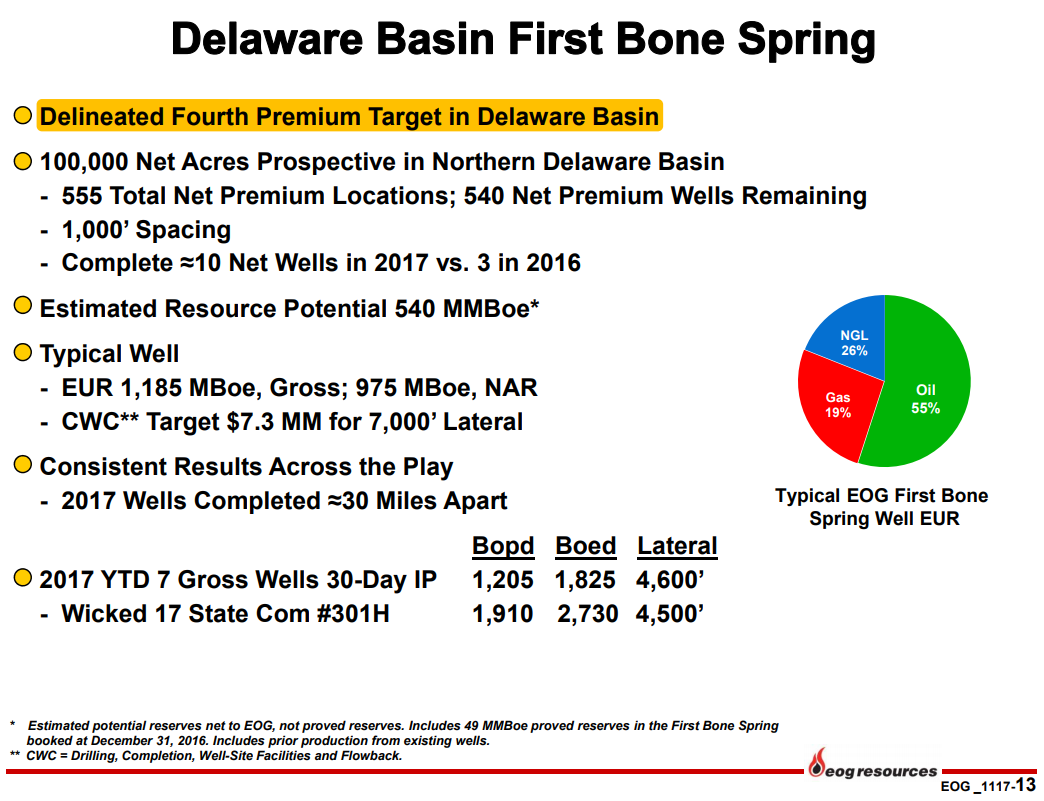

First Bone Spring

The second new premium play identified by EOG is the First Bone Spring in the Delaware Basin. About 100,000 acres of the company’s Delaware basin assets are prospective for the play. The company has drilled a total of 15 wells in the zone in the past three years, with seven in 2017. These seven have had an average 30-day IP of 1,825 BOEPD. The wells have been completed across a wide area, over 30 miles distance, so results are consistent across the play. EOG estimates that the average well has a net EUR of 975 MBOE, for a cost of $7.3 million. There are 540 remaining drilling locations, with a combined net resource potential of 540 MMBOE.

EOG Chairman and CEO Bill Thomas spoke on the company’s acreage strategy during the conference call today, saying “the most important point to understand about exploration is that not all rocks are equal. Every play has geologic sweet spots, with superior rock quality that drives well productivity. We do not want to own the whole play. Our focus is to capture only the best rock in the best plays.”

7,760 BOEPD from short Austin Chalk well

EOG estimates Hurricane Harvey had a 15,000 BOPD impact on the company’s Eagle Ford properties, but predicts the impact will be offset by increased completions in Q4. Offsetting the decline will be easy if EOG is able to replicate the results of one of its most recent wells in the Eagle Ford.

The Elbrus Unit 103 targeted the Austin Chalk with a lateral length of 3,700 feet, and had massive success. EOG reports the well had a 30-day IP of 7,760 BOEPD, 70% of which was oil. According to Exploration and Production EVP David Trice, the well paid out in less than one month.

Q&A from today’s Q3 earnings call

Q: On the Woodford, what drove the time of the reveal? I mean, is it that you believe you’ve acquired all you could? And you mentioned it as a sweet spot, yet how politically extensive do you see the Woodford with premium characteristics in the scoop?

EOG: The Woodford play, we’ve got a lot of confidence in it. We drilled three wells but we have a lot of data. And it’s a pretty simple play with the modeling we’ve done and the analysis we’ve done and the history we have in shale plays.

EOG: The difference with the Woodford and some of the other plays is that the Woodford is a shale play. So it’s fairly simple from a geological standpoint. And we started working this area back in 2012, 2013 and had a pretty good idea that it could be premium and so we begin collecting data. So we’ve got nearly 400 full petrophysical models built in and around our acreage that’s tied to core data. And what we’ve been able to do over the years drilling all of these horizontal oil plays is we’ve been able to collect the data and we’ve gotten very good at building some sophisticated reservoir models.

And so what we did on this particular play is we modeled it ahead of time. We took industry data. We took all the petrophysical models and compared it against, in this case, particularly the Eagle Ford. And compared the completions, versus the reservoir response. And so going into it, we felt very confident that we could make premium wells here in the Woodford. And so we were able to confirm that with the well results that we’ve had. And so we feel confident about the premium status of this. And then just the timing of it, it’s pretty tightly held acreage in this part of the world so we felt comfortable going ahead and releasing the results on it.

Q: Let me just follow up to your responses. I mean, is 50,000 acres sufficient scale to develop?

EOG: Yes. I think just like we talked about in our prepared remarks, our focus is on identifying sweet spots and drilling sweet spots but be that the Austin Chalk or the Woodford, we want to drill premium wells that are going to continue to lower finding cost over time and increase our ROCE. So for us, I mean this is a – as decentralized company it worked really well. This is an instance like Bill had said where we can allocate capital to a different play and develop it at the appropriate speed. So yes, we think it’s sufficient scale.

Q: Just quick question on the first Bone Spring here. Obviously, the Bone Spring’s been a target for a number of years out there in the Permian Basin. You guys have been active drilling wells here for a little while. Was there some dramatic change that happened recently that caused you guys to kind of move this up into a premium position? Maybe you could just discuss that a little bit.

EOG: For the first Bone Springs, it’s just yet another pay zone that we’ve been – certainly have been identified and we’ve been testing over the last several years. And most of our activity in the past year or two has been focused on, certainly, the Wolfcamp which is highly prolific and we’ve got multiple zones there. We’ve also previously announced the second Bone Springs resource estimates. So this is just the next step.

The first Bone Springs is certainly highly prolific and very competitive zone with those targets and we’ve now delineated the program with about 15 wells. Over a fairly extensive area and had confidence enough to come out and delineate the resource potential on our acreage there. So it was just the next step in the evolution of the Delaware Basin.