Debt involved in oil and gas company bankruptcies since 2015 totals $90 billion

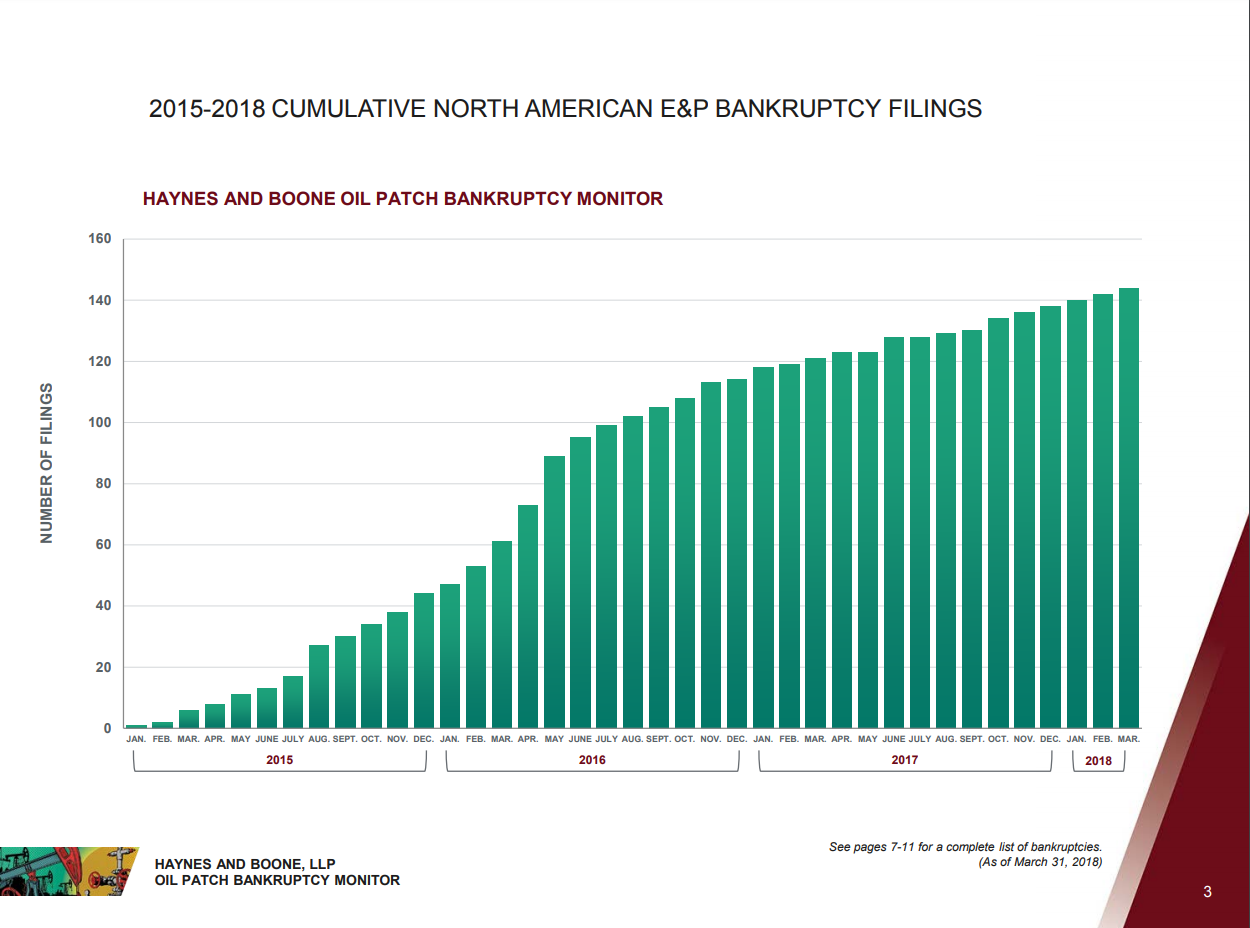

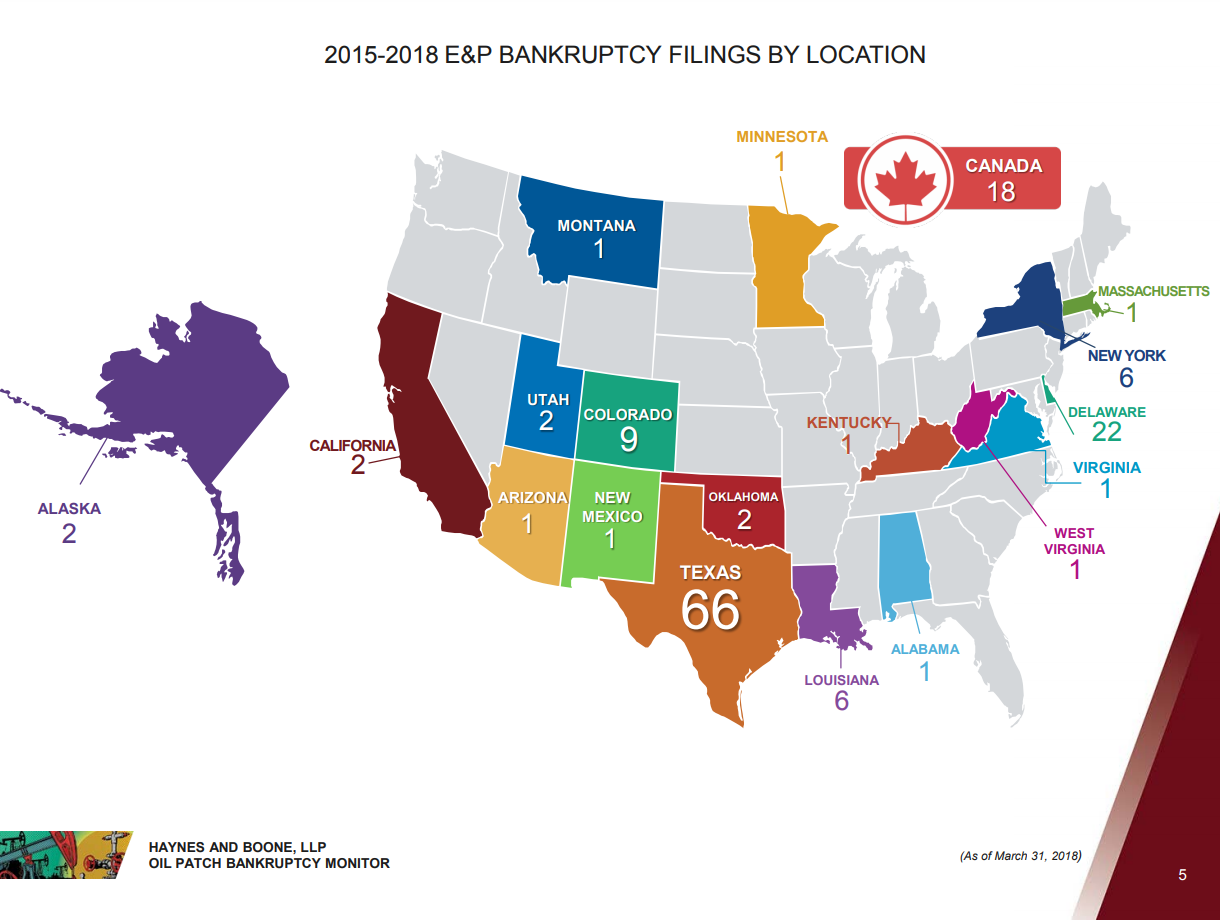

International corporate law firm Haynes and Boone has tracked 144 North American oil and gas producers that have filed for bankruptcy since the beginning of 2015.

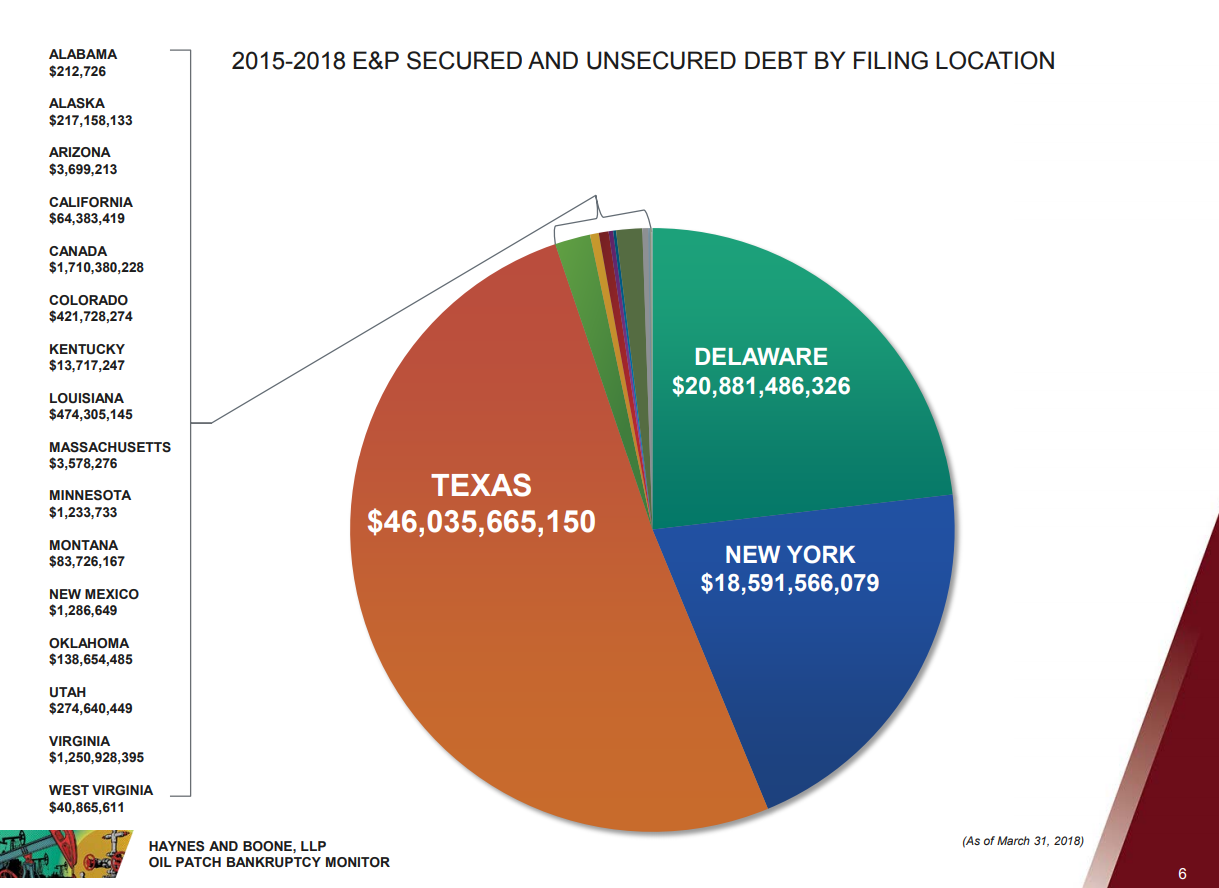

These bankruptcies, including Chapter 7, Chapter 11, Chapter 15 and Canadian cases, involve approximately $90.2 billion in cumulative secured and unsecured debt. 126 of the cases were filed in the United States.

Add six more in 2018

As of March 31, 2018, six producers have filed bankruptcy in 2018, representing approximately $7.5 billion in cumulative secured and unsecured debt:

- EXCO RESOURCES, INC.

- CHX ENERGY LLC

- ASCENT RESOURCES MARCELLUS HOLDINGS, LLC

- FIELDWOOD ENERGY LLC

- AUGUSTUS ENERGY RESOURCES, LLC

- GOLDEN OIL HOLDING CORPORATION

The full spreadsheet of bankruptcies begins on slide seven.

The number of E&P bankruptcy filings is on a decreasing trend, Haynes and Boone said, with 67% fewer filings in 2017 than 2016. However, the amount of debt administered in the recent filings is substantial.

The amount of debt being administered by the E&P debtors that filed bankruptcy in the first quarter of 2018 almost equals the debt administered by filings during the entirety of 2017. The debt level of the 2018 filers is also significantly more than the companies that filed during the first quarter of 2016, which was the worst year of the downturn from a bankruptcy-filing perspective, Haynes and Boone said.

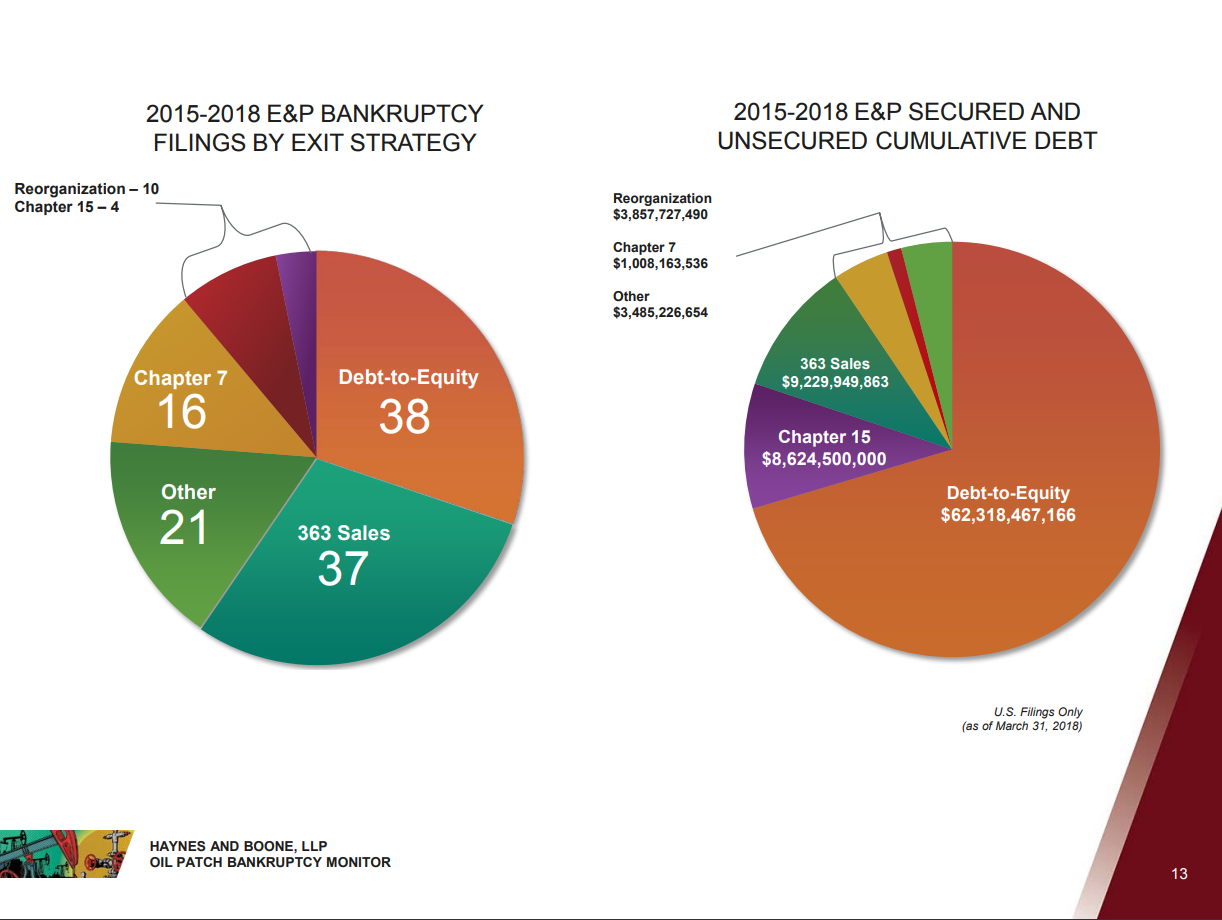

E&P bankruptcy exit strategies

From January 2015 through March 31, 2018, oil and gas producers filed 126 voluntary and involuntary petitions in the United States.

According to Haynes and Boone, these cases represent total secured and unsecured debt of approximately $88.5 billion, with prepetition claims ranging from as little as $10,000 to in excess of $8.26 billion. Haynes and Boone said it has tracked, proposed and confirmed bankruptcy exit strategies for each of these cases.

As for Section 363 sales, these represent approximately 29% of cases and have been more commonly employed for smaller debtors. Yet, debt-to-equity conversions, often through pre-packaged or pre-negotiated plans, (70% by cumulative debt) have been the exit of choice for the largest oil and gas exploration and production companies.