For coal the damage is already done, plants are switching to natural gas

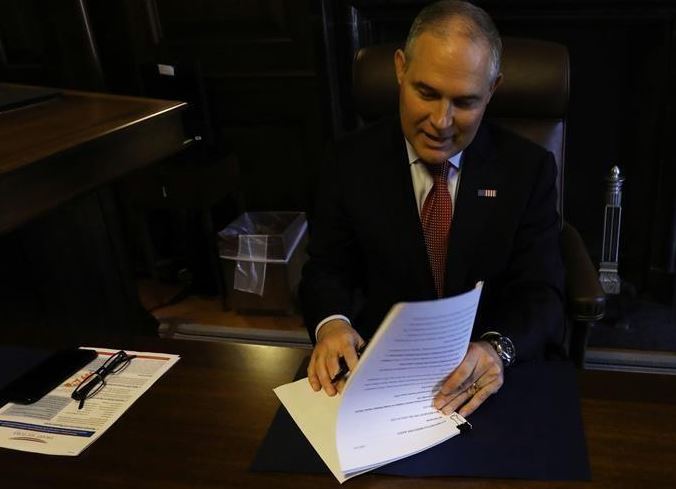

Today U.S. Environmental Protection Agency (EPA) Administrator Scott Pruitt issued a Notice of Proposed Rulemaking (NPRM) that proposes to repeal the prior administration’s Clean Power Plan (CPP).

“After reviewing the CPP, EPA has proposed to determine that the Obama-era regulation exceeds the Agency’s statutory authority,” the agency said in a press release today.

“Any replacement rule will be done carefully, properly, and with humility, by listening to all those affected by the rule,” EPA Administrator Scott Pruitt said in a statement.

EPA Chief Pulls Plug on Clean Power Plan: Administrator Scott Pruitt signs repeal rulemaking notice for the Clean Power Plan. Photo: EPA

The CPP was a product of the Obama administration that came about in 2014 and 2015, a few years after President Obama famously announced his intent to kill the U.S. coal industry. But the CPP was put on hold in February 2016, after the U.S. Supreme Court issued an unprecedented stay of the rule. “EPA will respect the limits of statutory authority,” Pruitt said in today’s statement.

Too late to save coal?

Many factors have found their way into the utility and power generation mix since the CPP was first proposed. Industry momentum is powerful when it points itself away from one fuel and onto another fuel to power the hundreds of generation plants that fuel the U.S. economy. It’s probably too late for coal to make a miraculous resurgence. Texas provides a great example.

Texas’s largest coal-fired power plant prepares to cease operations

Luminant, a power company subsidiary of Vistra Energy (ticker: VST), which has been powering Texas for more than 130 years, announced a week ago it will retire its Monticello Power Plant in Titus County, Texas. In the state where everything is big, Monticello is Texas’s largest coal plant.

The units at the power station—all coal fired—in total, represent 1,800 MW of power capacity that will be taken offline in January of 2018. That’s enough to power about 940,000 homes in normal conditions and 376,000 homes in periods of peak demand, the Dallas Morning News calculates.

The company said in a statement that between cheap natural gas overtaking coal and government air quality regulations upping costs to run such a plant, it’s going to be more cost effective to shut down the coal-fired units, which the Dallas Morning News calls “cost prohibitive relics.”

Luminant estimates that approximately 200 employees will be impacted by Monticello’s retirement. Some employees will be offered severance benefits and outplacement assistance and assistance to apply for open positions within the company. Multiply that by the hundreds of coal plants that are expected to close across the country.

It’s economics now: natural gas plants are a more economic way to produce electricity

The electricity industry is planning to increase natural gas-fired generating capacity by 11.2 gigawatts (GW) in 2017 and 25.4 GW in 2018, based on information reported to EIA.

If these plants come online as planned, annual net additions in natural gas capacity would be at their highest levels since 2005, according to the EIA.

According to data in GovTech, “A conventional coal plant spends $95.10 to produce a megawatt-hour of power — which can power 1,000 homes. A conventional natural gas plant with combined cycle turbines can do it for $75.20, according to a government analysis. A nuclear plant spends $95.20, a hydroelectric plant $83.50.

When extensive environmental controls are added the gap is wider., the GovTech analysts report. “A coal plant with carbon capture and storage features spends $144.40 to make a megawatt-hour, a gas-fired plant with such carbon capture features $100.20.”

Curt Morgan, Vistra Energy’s president and chief executive officer, said, “For more than 40 years, Monticello employees have generated reliable power for Texans, and we honor and recognize their service. But the market’s unprecedented low power price environment has profoundly impacted its operating revenues and no longer supports continued investment.

“This was a difficult decision made after a year of careful analysis. We are sensitive to the consequences of our decision on employees and members of the local community, with whom we have worked closely for decades. Luminant will be coordinating with civic leadership to prepare for the impacts of the transition.”

President Obama’s vow to kill coal has mostly come to be true, but not only because of government policy his administration put into place. There’s the fact that natural gas is cheap today and that it emits half the carbon of coal.

CPP not consistent with Clean Air Act: Pruitt

But, today Pruitt killed the CPP, on the grounds it is inconsistent with the Clean Air Act.

“The CPP ignored states’ concerns and eroded longstanding and important partnerships that are a necessary part of achieving positive environmental outcomes. We can now assess whether further regulatory action is warranted; and, if so, what is the most appropriate path forward, consistent with the Clean Air Act and principles of cooperative federalism,” said Pruitt.

In its press release, the EPA administrator said the CPP “was issued pursuant to a novel and expansive view of authority under Section 111 of the Clean Air Act (CAA). The CPP required regulated entities to take actions ‘outside the fence line’.”

Traditionally, EPA Section 111 rules were based on measures that could be applied to, for, and at a particular facility, also referred to as “inside the fence line” measures. Prior to the CPP being issued, every single Section 111 rule on the books obeyed this limit.

As the CPP departed from this traditional limit on EPA’s authority under an “inside the fence line” interpretation, EPA is proposing to repeal it.

EPA estimates $33 billion in avoided costs in 2030

The administration estimates the proposed repeal could provide up to $33 billion in avoided compliance costs in 2030, the EPA said in its press release.

EPA said it will continue its analysis and inform the public, as necessary, to get feedback on new modeling and other information. The final action on this proposed repeal will address the results of this ongoing work. Forthcoming is an Advanced Notice of Proposed Rulemaking (ANPRM) that will be reflective of a thoughtful and responsible approach to regulatory action grounded within the authority provided by the statute.

According to a report today from Utility Dive, Pruitt himself drafted an “inside of the fence” alternative to the Clean Power Plan in 2014. The narrower rule would focus on obtaining efficiency improvements through better heat rates at coal plants — an “inside the fenceline” regulation, rather than a sweeping change to the national power mix, meaning that the CPP reached beyond individual plant upgrades by allowing generators unable to meet its emission standards to offset their power from lower carbon-emitting resources, such as renewables.

Power companies argued that the CPP amounts to forcing coal plants to subsidize their competitors or shut down, Utility Dive reported. But the power generation industry is not interested in investing in older coal plants. It is already accelerating full steam ahead in a building spree of natural gas plants that are much more efficient, quick to cycle on and off, use what is today cheap natural gas, and they emit half the volumes of carbon dioxide into the atmosphere that coal plants emit.

In a press release Wyoming Gov. Matt Mead responded to the news of the repeal request for CPP.

“Under the CPP, Wyoming would have to reduce its carbon dioxide emissions by 44%. Last year, the U.S. Supreme Court granted a stay and stopped implementation of the rule while a lower court considered a lawsuit filed by Wyoming and 26 other states to strike it down. The states argued the EPA did not have the proper authority to issue the rule; the Clean Power Plan would take authority away from states to regulate in-state power generation and transmission.”

CPP background

The Clean Power Plan aimed to lower carbon emissions by 30% by 2030 from power plants, many of them coal-fired. While it only accounts for 37% of all energy in the U.S., coal is responsible for 75% of carbon emissions, making it the primary target for emissions regulations.

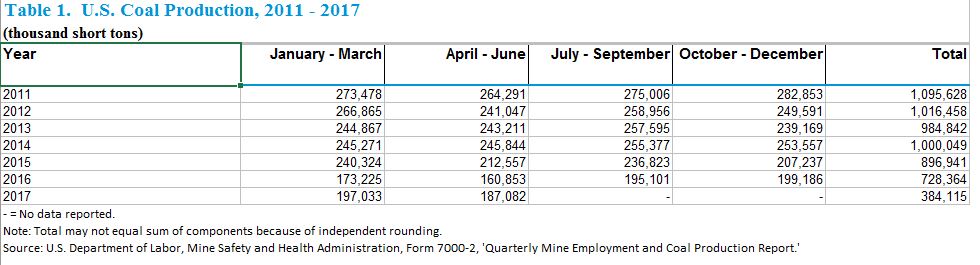

Those regulations will likely lower coal production throughout the United States, according to forecasts from the Energy Information Administration (EIA).

The EIA’s analysis of the impacts of the Clean Power Plan predicted back in 2015 that levels of coal production would fall to levels last seen in the late 1970’s, with coal production in the West being particularly hard-hit. In all cases, production recovers by 2040, but never reaches the same levels as the EIA forecasts without the Clean Power Plan.

The impact of the repeal of CPP on the power sector will be limited, Utility Dive believes, because the final rule was based on 2014 energy market projections, at which time the EIA projected modest increases to power sector carbon emissions from 2012.

The CPP was projected to have a significant impact. But a trend of lower natural gas prices, flat power demand and swiftly declining costs for wind and solar have changed the equation, Utility Dive reported.

The big emissions reduction potential of the CPP, according to the Rhodium Group, was not in the specific targets included in the 2015 final rule. “If [it had been] upheld by the courts and implemented by EPA, the CPP would have created a national regulatory framework and de facto emissions trading system that would have enabled target ratcheting as energy prices, technology costs and baseline emissions projections changed.

“That framework will be significantly eroded, if not completely undone,” Rhodium Group said in a statement yesterday. “Its fate is now in the hands of Scott Pruitt and team who, starting with the ANPR process could maintain some notion of a regulatory regime for CO2 from power plants or attempt to erase it completely. Either way, several years of regulatory process and subsequent litigation await.”

At a talk in advance of his repeal of the CPP, Pruitt said of the U.S. tax incentives for wind and solar, “I’d let them stand on their own and compete against coal and natural gas and other sources, and let utilities make real-time market decisions on those types of things as opposed to being propped up by tax incentives and other types of credits that occur, both in the federal level and state level,” according to The Hill.

Even if more gas-fired electricity capacity is in the works, if global LNG demand and U.S. manufacturing growth happen to converge, they could result in an increase in U.S. coal-fired generation, according to FBR Capital Markets’ coal analyst Lucas Pipes.

In a story called “For Coal to Come Back, Three Things Must Happen,” Oil & Gas 360® spoke to FBR & Company Senior Analyst Lucas Pipes in February 2017 to get his view as to the degree to which the new administration’s policies could have a meaningful effect on the coal industry, and what the Clean Power Plan would do to coal.

OAG360: How exactly will the new administration support coal?

It’s a question of electricity demand, Pipes said.

LUCAS PIPES: The coal-fired power plant fleet, even after all the retirements, is still underutilized. The ones that are left are not running as hard as they could be running.

Electricity demand since 2008, has been anemic at best. If you can make the case that [U.S.] manufacturing comes back, then you can make the case that electricity demand is going to grow, and arguably coal is the greatest beneficiary, because it is the source in the generating mix that has the greatest spare capacity.

I think that could be a way to bolster coal without throwing other sources of fuel or power generation under the bus, so to speak.

The rule of thumb I use every day in my conversations with investors very frequently is 1 Bcf per day of natural gas consumption in the power sector is equal to about 25-30 million tons of coal demand annually. So if you can push out 10 Bcfe/day through LNG or through pipes, that makes a big difference for coal.

Those are ways in which coal can be supported, maybe not directly, but it sure would help coal if more gas were to leave the nation. That would be very welcomed by the coal industry—greater exports of LNG.

I think what is perceived as a risk—more so from investors than the corporates—is the uncertainty of trade relations with Mexico. Right now we are exporting via pipe about 4 Bcfe/day [of natural gas] to Mexico. That’s almost the equivalent of 100 million tons of coal burn if [that natural gas] were to stay here in the country. That’s one area that [coal investors] feel a little bit uneasy.

The two things I’ve mentioned thus far have been really on the demand side of things. Where the administration can also make a difference is on the supply side—[if they get] moving pretty quickly there. For example, the Stream Protection Rule I think is in the process of being reversed. Compliance costs and permitting costs have increased under the Obama administration, according to the industry. I believe investors and the industry expect that to change under the Trump administration.

OAG360: What are coal company executives telling you anecdotally—what change do they see on the horizon from the White House?

PIPES: I would say across the executive ranks in the industry, the hope is that with the very challenging regulatory environment in the previous administration, I think the expectation is that not everything is going to be easy—we still have to compete with natural gas. There is still a very major cultural divide as it relates to environmental regulations in the place of coal—the Sierra Club is not going to go away; they still have a ‘Beyond Coal’ campaign. So there will continue to be major disagreements between the industry and certain parts of the federal government. But I think the view among executives is there is someone who understands what the industry is going through who will keep an open ear to what the industry needs in order to stay competitive.

The Clean Power Plan means ‘life or death’ for coal

The Clean Power Plan is tied to the U.S. commitments that were made by the prior administration under the Paris climate agreement. The CPP requires that by 2030 power plants will cut their carbon emissions by 32%. President Trump said before the inauguration that he planned to ignore the Paris agreement.

“I don’t want to sound like I’m exaggerating, and I’m paraphrasing some of the comments I’ve heard from [coal industry] executives: the Clean Power Plan [represents] ‘life or death’ for coal. I think that’s how it is often viewed, and I think the expectation in the industry is that the Trump administration will take this rule very seriously and do what it can to reverse it,” the analyst said.

U.S. coal production 2011 – 2017. Data: EIA