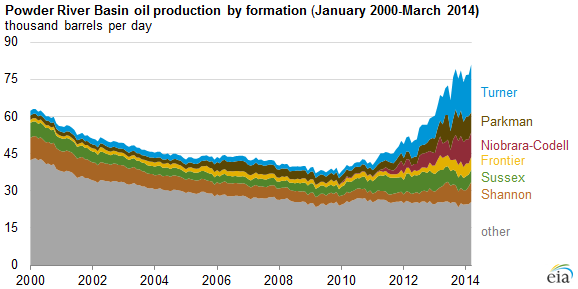

The Powder River Basin (PRB), an area in Wyoming traditionally exploited for its coal resources and coalbed methane gas opportunities, has more than doubled its oil output since 2009. The Energy Information Administration’s (EIA) Today in Energy segment for September 15, 2014, credits the rise in production to new drilling and completion practices, or largely the use of horizontal drilling and hydraulic fracturing. Approximately 590 PRB wells have been drilled since 2009 and production is currently 78 MBOPD – 105% higher than 2009’s output of 38 MBOPD.

Improving, but far from Perfecting

The Powder River Basin and other formations in the Rocky Mountain Region, including the Niobrara, Codell, San Juan, Piceance and Denver Julesburg, are receiving extra attention from improved drilling and well completion methods but their consistency is still an issue. Core Laboratories (ticker: CLB) is commissioning operators to submit rock results in order to conduct a regional study on the area. “This unconventional oil and gas reservoir has proved to be challenging in terms of reservoir characterization, predicting producibility potential, estimating ultimate recovery, and optimizing fracture stimulation techniques,” says the report from Core Lab. “Many companies either do not have or have limited rock property data that are crucial for understanding these reservoirs.”

A New Playing Field

Knowledge of the play at this point in time may not be complete, but new drilling practices have already changed the playing field. According to the EIA report, “The Niobrara-Codell formation was not a significant oil producer in the Powder River Basin before 2009, and oil production from this formation is entirely reliant on the application of current petroleum technology.”

Largest Gainer: The Turner Formation

The EIA singles out the Turner, Parkman and Niobrara-Codell formations as the largest contributors to the production growth. Volumes from the mentioned formations have increased to 36.3 MBOPD in Q1’14 from 4.7 MBOPD in 2009. The formations account for 46% of current production and are nearly equal to total volume from 2009.

The E&P Poker Game

The Powder River Basin has been mentioned as an emerging play by industry experts and analysts alike, and various E&Ps are carefully playing their cards as the play develops.

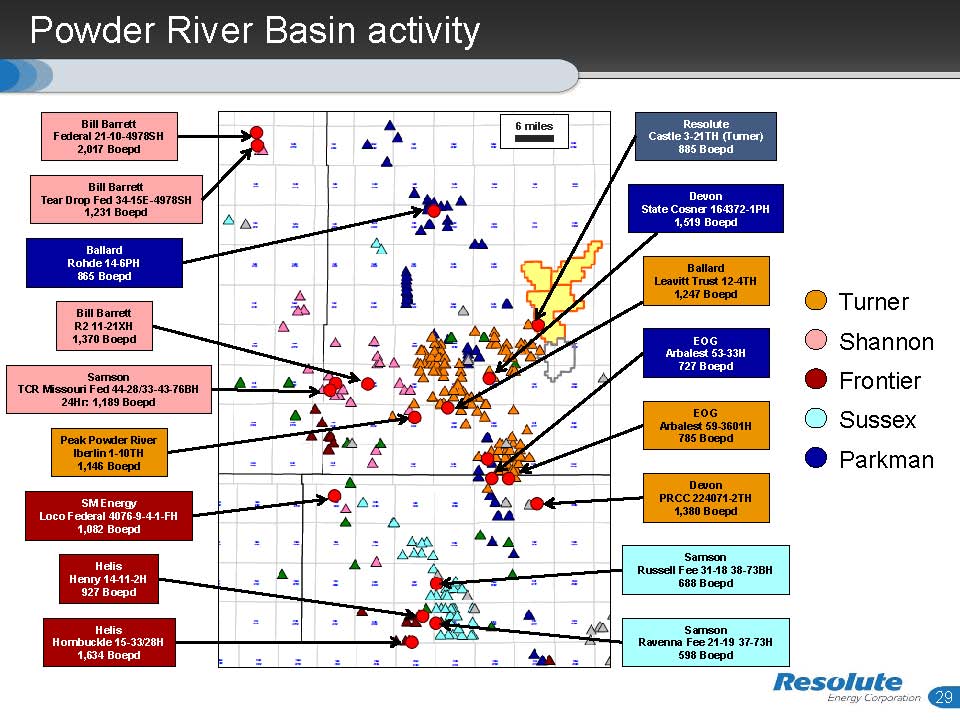

Resolute Energy (ticker: REN), a small-cap operator headquartered in Denver, Colorado, just recently kicked off production in the Powder River Basin. Its first well targeted the Turner and returned a peak 24-hour rate of 1,134 BOEPD (679 BOEPD for 30-day average) and two more wells are currently being drilled. The first well is 90% oil and is performing above the type curve. The company has identified 75 gross well locations to date and believes its acreage may be productive from the Parkman and Sussex formations in addition to the Turner. Well costs are expected to range from $6.5 million to $7.5 million with recovery estimated anywhere from 350 MMBOE to 500 MMBOE.

Source: REN September 2014 Presentation

Large-cap operators like EOG Resources (ticker: EOG) are playing their hand close to the vest. The company is currently targeting both the Parkman and Turner formations and plans on drilling 34 wells in 2014. Two Parkman wells returned 24-hour IP rates of 1,045 BOPD and 980 BOPD, respectively. The stacked formation wells are also being exploited with the Niobrara-Codell mix to the south of its Powder River properties. In EOG’s Q2’14 conference call, Bill Thomas, Chairman and Chief Executive Officer, said: “We’d like to get multiple patterns established and we would like to get long-term results to see how much sharing, if any sharing there is between the wells, and then we make appropriate adjustments as we go forward, so it’s a long-term process… These are just examples of some of the emerging things that could be happening and are happening today, and directionally, where we see the exploration potential for the U.S.”

Devon Energy (ticker: DVN) also completed two Parkman wells and returned an average of 950 BOEPD (95% oil) on a 30-day IP rate. The company will add a fourth rig by year-end 2014, and Parkman wells are currently costing only $5 million apiece. “I think has a lot of potential for the future,” said John Richels, President and Chief Executive Officer of Devon Energy, at a conference earlier this month. “Wyoming tends to be a little bit more difficult place to do business because we’re on federal lands, so the approval process is a little longer and there are wildlife steps. But we’ve been there a long time and we’ve had very active programs there for 20 years on the gas side. We know how to operate in this area. We know how to deal with the regulatory process and the permitting process, so this is very exciting area for us.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.