$683 million Bolt-on Acquisition adds 59,600 net acres in Wet Gas Window

EQT Corporation (ticker: EQT), announced that it would acquire 59,600 net acres and 44 MMcfe of natural gas production in two related transactions in the core Marcellus. Both transactions are expected to close by year-end 2016 and will be financed with cash.

The company will acquire 42,600 net acres in West Virginia with current natural gas production of approximately 42 MMcfe per day for an aggregate purchase price of $513 million from Trans Energy, Inc. and entities affiliated with Republic Energy.

Following the completion of a tender offer by EQT to acquire all outstanding shares of Trans Energy’s common stock, Trans Energy will survive as a wholly owned subsidiary of EQT.

The acreage has an 85% net revenue interest and 89% is either held by production or with lease expiration terms extending beyond 2018. The acreage is located in the wet portion of the Marcellus and includes 42 wells, 33 of which are currently producing, four that have been completed but not turned online, and five DUCs. Also included are drilling rights to 29,000 deep Utica acres.

The company will also acquire 17,000 net acres in Pennsylvania with current natural gas production of approximately 2 MMcfe per day for $170 million from an undisclosed third-party. The acreage has an 85% net revenue interest and 96% is either held by production or with lease expiration terms extending beyond 2018. The Pennsylvania acquisition includes two currently producing Marcellus wells and drilling rights in an estimated 10,300 deep Utica acres.

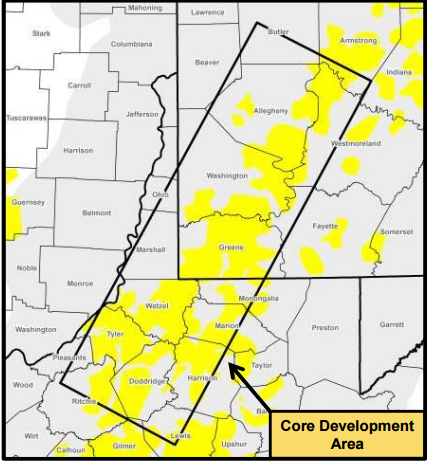

The acquisitions add to the company’s core development area, with much of the acreage contiguous with existing holdings in West Virginia and Pennsylvania. This will allow extended lateral lengths ranging from 2,750 feet to 6,000 feet for roughly 190 existing locations while also reducing overall costs and strengthening well economics.

Core Marcellus Acreage Doubles in Value with Rising Gas Prices, Transactions

A summary of the deal acreage by county is shown below:

| Net Acres | Undeveloped Acres | |

| West Virginia | 42,600 | 39,000 |

| Marion | 19,000 | 17,900 |

| Wetzel | 12,300 | 11,500 |

| Marshall | 11,300 | 9,600 |

| Pennsylvania | 17,000 | 16,800 |

| Washington | 13,100 | 12,900 |

| Westmoreland | 3,400 |

3,400 |

Year to date, the company has increased its core Marcellus position by 143,000 acres, or 55%, to a total of 400,000 acres, including their May 2 acquisition of 62,500 net acres in West Virginia from Statoil. Over the past four years, the company has acquired 186,000 net Marcellus acres, with 3,680 undeveloped core Marcellus well locations.

A map of the company’s current acreage positions is shown below. The Statoil acquisition included properties in Wetzel, Harrison, and Tyler counties in West Virginia. Antero Resources also acquired 55,000 acres in Wetzel and Tyler counties on June 9 for $450 million.

A summary of deal metrics for the most recent comparable acquisitions is shown below:

| $/Acre | $/Mcfe | |

| Current (Oct 2016) | $11,460 | $15,523 |

| West Virginia | $12,042 | $12,214 |

| Pennsylvania | $10,000 | $85,000 |

| Statoil (May 2016) | $6,512 | $8,140 |

| Antero (June 2016) | $8,182 | $3,928 |

The table indicates that transaction metrics for acreage in Southwest Pennsylvania and West Virginia Panhandle have almost doubled since May, when EQT’s acquisition from Statoil went through. This is thanks to a 70% rise in natural gas prices since May 2 as well as a rise in deal making in the region that has added a premium to Marcellus assets.