Tax-free separation creates two Appalachian-based energy companies

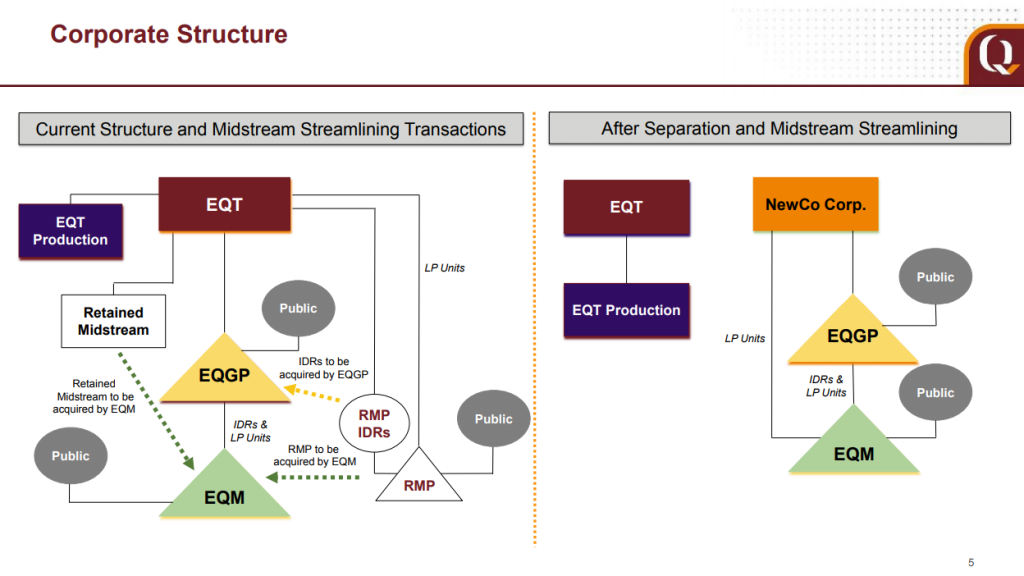

EQT Corporation (ticker: EQT) has approved a plan to separate its upstream and midstream businesses, creating a standalone publicly traded corporation (NewCo) that will focus on midstream operations. The separation is intended to qualify as tax-free to EQT shareholders for U.S. federal income tax purposes, and is expected to be completed by the end of the third quarter 2018.

Under the separation plan, EQT shareholders will retain their shares of EQT stock and receive a pro-rata share of the new independent midstream company. Both companies will remain headquartered in Pittsburgh, PA.

“The decision to build our midstream business in parallel with upstream growth has created one of the strongest midstream companies in the Appalachian Basin,” said James Rohr, EQT’s lead independent director. “We have taken many steps to highlight the value of our midstream assets through a series of transactions including, the initial public offering of EQM, midstream asset dropdowns to EQM and the initial public offering of EQGP. This transaction represents a new chapter for our business as we unlock the value created during the past 10 years.”

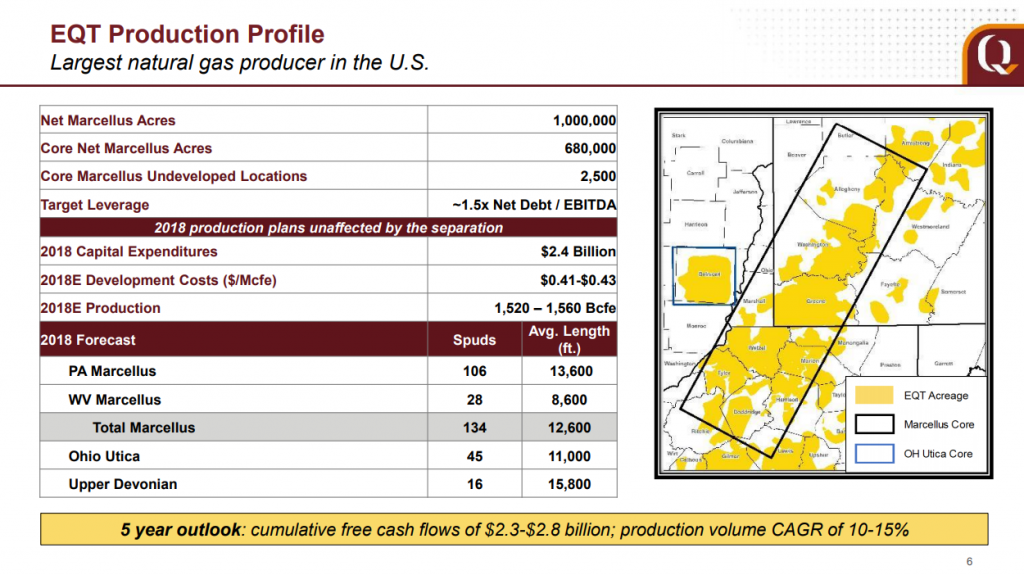

Steve Schlotterbeck, EQT’s president and CEO, said, “When we announced the Rice Energy acquisition, we committed to addressing the sum-of-the-parts discount in our shares. The Rice transaction accelerated the maturation of both our businesses, provided scale that significantly enhanced the standalone prospects of both companies and positioned us to further enhance value through separation. We are now the largest natural gas producer in the U.S. – with a strong and strategic midstream system in the best natural gas basin in the country. We will complete the separation with urgency, consistent with our commitment to shareholders.”

Midstream plan of action prior to separation

- A drop-down of the retained midstream assets in an accretive transaction to EQT Midstream Partners, LP (ticker: EQM)

- A merger of EQM and Rice Midstream Partners LP (ticker: RMP) in an accretive transaction

- A sale of the RMP Incentive Distribution Rights (IDRs) to EQT GP Holdings, LP (ticker: EQGP)

Under EQT’s plan, EQGP will retain the EQM IDRs, and EQGP and EQM will remain separate publicly traded entities after separation. According to EQT, the company does not intend to modify its existing gathering and transmission contracts with EQM in connection with the separation.

Additional details concerning the midstream transactions will be provided in the near future, EQT said, and completion of the midstream related transactions will not be a condition to completion of the separation.

EQT and NewCo

EQT

- 680,000 core Marcellus acres and 65,000 core Ohio Utica acres

- Averaging 13,600-foot laterals in southwestern PA in 2018

- $2.3-$2.8 billion of free cash flow over 2019 – 2023 (10% – 15% annual production growth)

- Expect to be cash flow breakeven in 2019, with a focus on returning cash in 2020+

NewCo

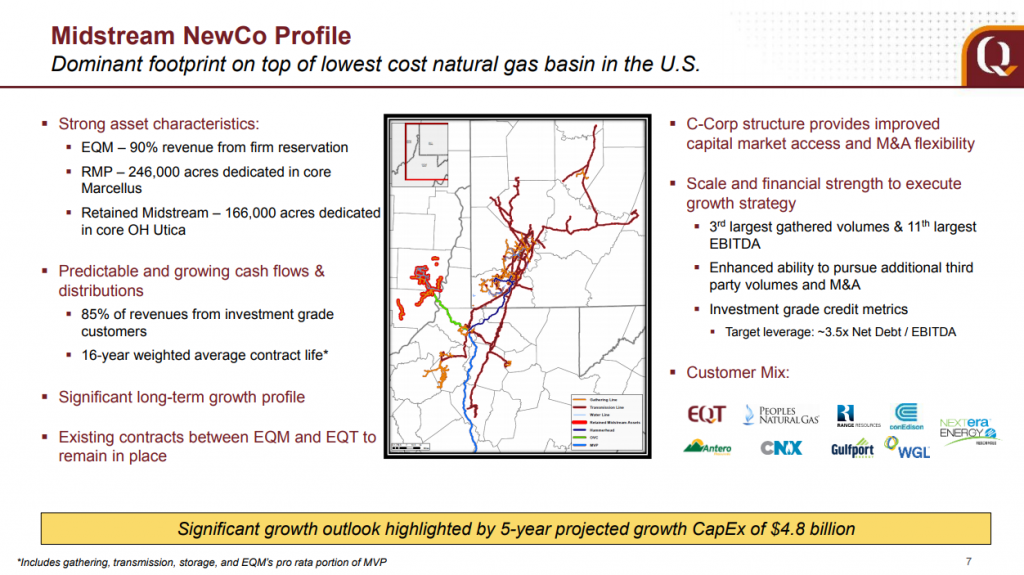

- Natural gas gathering is third largest in the United States (according to EQT)

- 16-year weighted average contract life

- 60% of revenue generated from long-term firm reservation charges

- 85% of revenue from investment grade counterparties

- $4.8 billion 5-year projected growth capital

- 246,000 acreage dedication in core Marcellus and 166,000 in core Ohio Utica

- Mountain Valley Pipeline extends pipeline network into the southeast markets

Leadership

Upon completion of the separation, Steve Schlotterbeck will remain CEO of EQT. Update: As of March 20, 2018, Schlotterbeck has resigned from his post.

SVP Jerry Ashcroft will lead NewCo as CEO. Ashcroft has more than 15 years of experience in the oil, gas and pipeline industries – and before joining EQT, he was CEO of Gulf Oil L.P.

Ashcroft has a distinguished military career with the United States Marine Corps and received a Bachelor of Science degree from the United States Naval Academy. Ashcroft has also held various roles of increasing responsibility at JP Energy Partners, Buckeye Partners, L.P. and Colonial Pipeline Company, L.P.