Reserves up 59% on Rice acquisition

EQT (ticker: EQT) released year end results and reserves today, showing fourth quarter earnings of $1.28 billion, or $5.83 per share. The vast majority of these earnings, $1.2 billion, are due to benefits from the new tax legislation, as deferred tax liabilities are assessed at lower rates. However, EQT’s adjusted net income is still $168 million, well above the company’s $44 million earned in Q4 2016.

The company now holds 21.4 Tcfe of reserves, representing a yearly increase of 7.9 Tcfe, or 59%. While most of this jump is due to the acquisition of Rice Energy, the company added 2.2 Tcfe from extensions, discoveries and other additions. These additions represent 245% production replacement.

EQT finished its acquisition of Rice Energy in Q4, finalizing the combination in November. The company estimates SG&A savings of about $110 million in 2018, and CapEx savings of $210 million.

175 new wells targeted

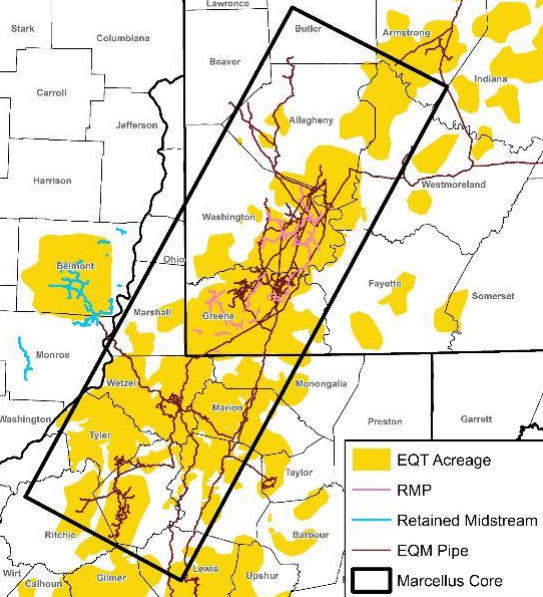

Pro forma for the Rice Acquisition, EQT holds 1 million net Marcellus acres. The company plans to drill a total of 175 net wells in the coming year, down from the 197 the company drilled in 2017. EQT expects to produce around 1.54 Tcfe in 2018, compared to the 887.5 produced last year. This will be accomplished by 8-10 rigs, and 9-11 frac crews. This activity will cost EQT a total of $2.4 billion, with $2.2 billion spent on well development.

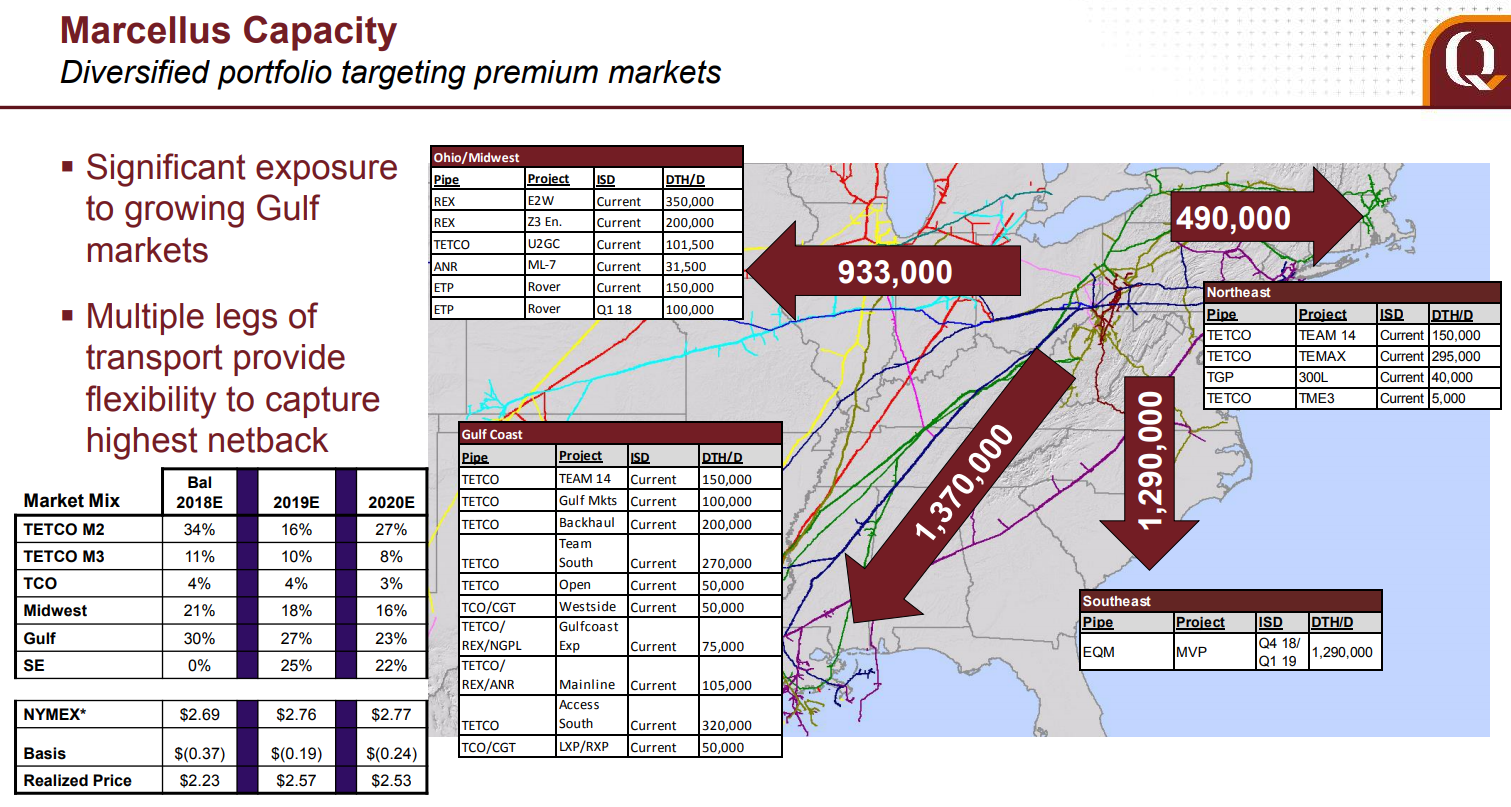

EQT is poised to significantly increase its transportation capacity, as FERC has approved the Mountain Valley Pipeline. The line has now begun construction, and is targeting a late 2018 in-service date. The $3.5 billion pipeline will transport gas south from the Marcellus. EQT has contracted nearly 1.3 DTH/D on the line, or 31% of its expected 2018 capacity.

EQT will address sum-of-parts discount in February

The company will likely be making significant moves this year as well, as it is currently trading below what might be expected from the sum of its parts. EQT’s plan to address this situation may involve many different measures, and will be announced before the end of the month. The company did not discuss it on the call.

Q&A from EQT conference call

Q: So it seems like your peers are starting to bifurcate on their school of thought a little bit on growth versus takeaway capacity. We’ve seen some of them provide some long-term guidance on growth beyond what their contracted capacity is and others who are more closely matching the two. You guys, obviously have a line of sight to Mountain Valley and the expansion potential there. And our model, what kind of give you a growth runway through 2020.

So, few questions kind of — come out of that. So first once you fill your pipeline capacity, how do you think about incremental growth? And then secondarily, what’s your appetite for contracting additional Greenfield takeaway capacity? And then last one, how much running room do you think there is basin-wise via Brownfield expansions or by adding compression?

Steven Schlotterbeck, Chief Executive Officer: I will take the first part of that, regarding growth. I think we feel pretty comfortable with our takeaway position a bit beyond 2020, so probably into 2022 or 2023 before we think serious consideration needs to be given to particularly Greenfield takeaway projects, but beyond 2023 for sure that’s going to be a big part of the focus. Obviously we have to start thinking about that years before that date, but I think at this point, we feel like we have got a little time to get the Rice integration done, get the sum-of-the-parts plan behind us, assess the situation and then take a hard look at what is the next wave of takeaway capacity out of the basin. But again I think from our perspective, we’re good for a few years beyond your 2020 date. Blue, do you want to add any color to that?

Blue Jenkins, Chief Commercial Officer: You had asked how much incremental might be available? When we look across the basin, from pipes that are in the ground or going in the ground, we would suggest there are probably 3 to 4 Bcf a day that could be incremental takeaway with capacity or a small looping project given the slate of pipes that have gone in or are going in.

And you also mentioned, you talked about Greenfield, I think Steve touched on that, I think the next wave of Greenfield presents a unique set of challenges from both the regulatory environment as well as the cost environment, but what is out there that we’re actively doing is we’re putting a portfolio in place with long-term markets to ensure that, that gas moves, as well as we are picking up pieces in the open market of available capacity, actively from current capacity holders who don’t have as much clarity as you get out in the future. So, we’re doing all of those things.

Q: I understand there are a number of possible outcomes from the ongoing strategic review, but it is sort of reasonable to assume that EQT’s interest in Midstream entities should probably get reduced over time. Does that change your hedging strategy at EQT in any way? Would you look to hedge more and — or longer term instead of hedging less and — will there be of any change in your hedging strategy going forward?

Steven Schlotterbeck, Chief Executive Officer: Well I am not going to answer in relation to potential outcome of the sum-of-the-parts, but I think regardless of that we are rethinking our hedging strategy given this shift to a business model, where we expect to live within cash flow and trying to take some volatility out of the business. So, we’re looking at how should we hedge on the commodity side, and also starting some discussions with our key suppliers about new ways to contract for the services we need that can potentially provide a cost hedge as well. So trying to find ways to lock in margin a little better than we’ve been able to in the past.