The town of Erie, Colorado, has decided against postponing drilling permits within city limits, The Denver Post reported today. The Erie Board of Trustees voted to not impose a moratorium by a 4-3 count. Citizens had filed noise complaints from a drill site being run by Encana Corporation (ticker: ECA) in an Erie neighborhood. The Calgary-based E&P agreed not to submit any permits for 90 days as the issue made its way to town hall. Anadarko Petroleum (ticker: APC), another E&P holding agreements with Erie, is also not expecting to submit permits for several months, according to a company spokesperson.

Colorado has been a major industry battleground in recent years. A 21-member oil and gas task force was formed in November in hopes of finding common ground between the two staunchly divided sides of the drilling debate. Initiatives from both parties were both pulled from voting ballots in the eleventh hour of election season. Anti-industry initiatives included imposing more restrictions and granting varying power to local governments, while pro-industry representatives countered with initiatives designed to prevent frac-ban towns from receiving any oil and gas tax revenue. Oil and gas groups had also filed lawsuits against the counties in question.

Source: Bloomberg

Frac Bans Have Come and Gone

Hydraulic fracturing bans have been enacted in five different Colorado counties in since 2012, but district judges have revoked three of those bans since the summer of 2014. The task force is expected to make recommendations by the end of February, but the Denver Business Journal reports that sources say the group is unlikely to reach a two-thirds consensus on major issues.

The issue of hydraulic fracturing has become more common nationwide as the shale boom continues to expand. The state of New York has been adamant on keeping hydraulic fracturing out of its borders, even though a report from the Manhattan Institute estimates lifting the ban would generate $1.4 billion in tax revenues. Cities throughout California have also enacted fracing bans. Even Denton, Texas, approved a ban in the latest election, saying the various drilling activities were a “public nuisance.” Lawsuits have already been placed against the town, located in the heart of the Barnett Shale.

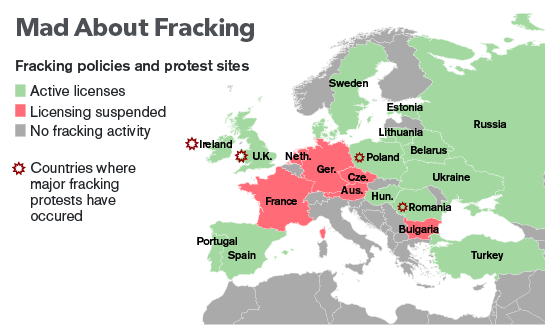

Europe is Another Story

Our neighbors across the Atlantic are even less forgiving of hydrocarbon development. The United Kingdom has outlawed fracing in national parks, but stopped short of issuing a full halt to oil and gas operations. The U.K. still enforces strict regulations and requires operators to “monitor” its drilling site for a full year before commencing operations. In 2013, the British Geological Survey estimated that shale deposits in the UK could supply the country with gas for up to 40 years. Scotland blocked fracing entirely in an announcement earlier today.

Germany upheld its general fracing ban in November (fracing is allowed but must be at depths greater than 3,000 meters), even though it is the largest energy consumer in Europe. Approximately 40% of its natural gas is imported from Russia. Other nations to ban the practice include France, Austria and the Czech Republic. The general opposition of fracing, especially among European Union countries, is best explained by a Bloomberg report:

“In most countries, private landowners don’t own the oil and gas in the ground: The state does. That means fracking won’t yield big financial rewards for local landowners. (In the U.S., the owner’s cut can be an eighth of production revenue.)… People are more than three times as densely packed on the land in Europe, fueling not-in-my-backyard protests like those in parts of the U.S. Some rural projects have been rejected because they would bring trucks and equipment onto picturesque roads dating to Roman times.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.