Erin Energy Corporation (ticker: ERN) announced unaudited financial and operational results for the year ended December 31, 2017.

Full year 2017 revenues were $101.2 million, increasing by approximately 30% from $77.8 million in 2016. Fourth quarter 2017, revenues were $21.7 million compared to $21.1 million for the same period in 2016.

Erin Energy reported a net loss of $151.9 million or a loss of $(0.71) per share for full year 2017 compared with a net loss of $142.4 million or a loss of $(0.67) per share for full year 2016.

Exploration expenses totaled $4.6 million for the full year. As of December 31, 2017 cash, cash equivalents and restricted cash were approximately $33.8 million.

Highlights from 2017

- Crude sales volumes of more than 1.8 million net barrels of oil;

- $101.2 million in revenue, a 30% increase over 2016;

- Total production of approximately 1.7 million net barrels of oil;

- Spudded successful Miocene exploration well in offshore Nigeria.

Operations

Stated in the company’s press release, the average net daily production for full year 2017 was approximately 4,900 BOPD compared to approximately 4,800 BOPD for full year 2016. For Q4 2017, net daily production was approximately 4,000 BOPD compared with 5,800 BOPD for the comparative period in 2016. The average price received for 2017 was $54.84 per barrel compared to $45.45 in 2016.

Net production volumes for full year 2017 were approximately 1.7 million net barrels of oil compared to approximately 1.8 million net barrels in 2016. Erin Energy’s crude oil inventory was approximately $3.6 million at December 31, 2017.

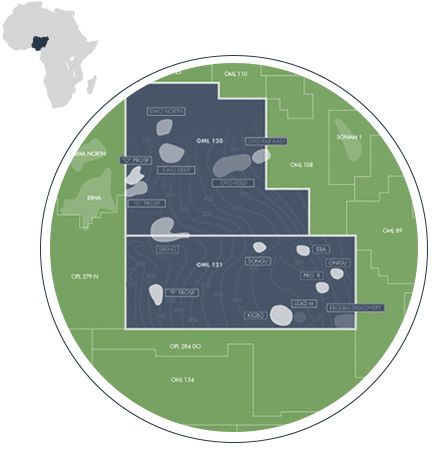

ERN announced early this year that it had successfully completed the drilling of the Oyo-NW exploration well, which discovered hydrocarbons in the Miocene Formation. The well is located approximately 9.5 kilometers northwest of the Oyo Central field on ERN’s offshore Nigeria block 120.

Oyo-NW was drilled to a total vertical depth subsea of 12,218 feet and penetrated multiple sand units with total gross thickness of 260 feet in the depth range from 7,052 – 10,873 feet TVDSS. These values were interpreted from wireline log data which includes approximately 115.2 feet of gross hydrocarbons in the two Miocene targets, U7.0 and U8.0.

Erin Energy is now planning an appraisal of the discovery for the second-half of 2018, subject to the availability of capital and drilling services.

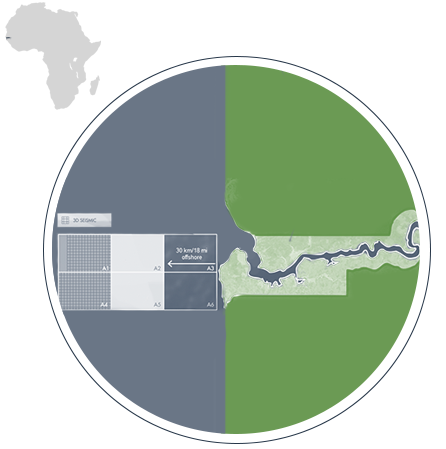

In Gambia, ERN completed a farm-in agreement in early-2017 with FAR Ltd., an ASX listed company, which has seen successful offshore activity in Senegal with its SNE field discovery and subsequent appraisal program. ERN recently announced that a subsidiary of Petroliam Nasional Berhad (PETRONAS) has also farmed into the Gambia blocks and that the joint venture plans to drill the Samo-1 prospect, which as reported FAR is estimated to contain unrisked mean prospective resources of 825 million barrels of oil.

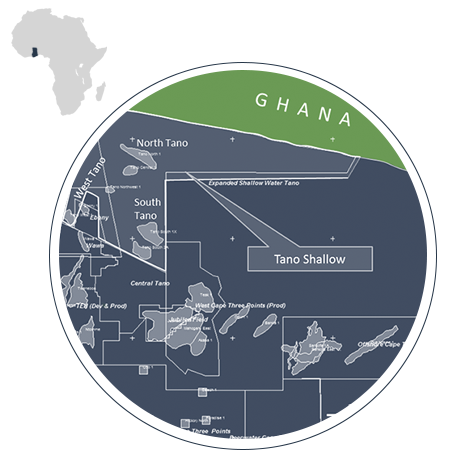

In Ghana, Erin Energy announced that the Final Judgement was issued by the International Tribunal of the Law of the Sea on Maritime Boundary Arbitration between Ghana and Côte d’Ivoire. The maritime boundary delimited by the Special Chamber’s decision ruled in favor of Ghana and had no material impact on ERN’s Expanded Shallow Water Tano block.

Erin Energy has re-commenced work with the Government of Ghana and its joint venture partners to progress operational activities and is planning a 3D marine seismic survey acquisition later this year. ERN plans to tender the 3D seismic survey once it receives government approval.

Erin Energy’s year-end 2017 SEC proved oil reserves were 7.1 million barrels (MMbbls).