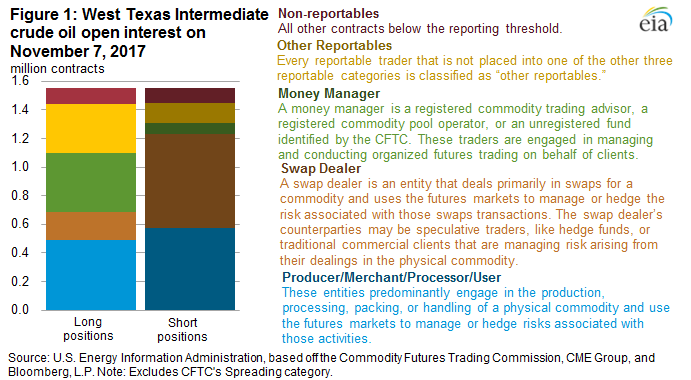

Money managers hold 31% of long positions

Exchange-traded funds (ETFs) are playing a growing role in oil futures markets, according to a recent release from the EIA.

ETFs can allow smaller investors access to the oil futures market, if indirectly. Funds can buy and sell oil futures to hold as underlying assets, and will issue shares for investors to purchase. Buying these shares allows investors to invest in crude without directly dealing with commodity contracts markets.

U.S. regulations require large holders of futures contracts to report their holdings, and classifies traders into several categories. The fund managers of a commodity ETF are classified as money managers because they “are registered commodity pool operators engaged in managing and conducting organized futures trading on behalf of clients.” Money managers hold about 31% of NYMEX long contracts, making them a sizeable player in the oil market.

The largest crude oil ETF, the United States Oil fund (USO), has about $2.2 billion in assets, with 200 million shares outstanding. For an ETF like this, creating shares has a direct effect on the number of contracts the fund holds. According to the EIA the USO has held as much as 20% to 25% of the open interest in front month futures.

The fund, and others like it, have contributed to the overall growth in open interest and trading volume in WTI contracts. While it is not always clear how this growth has affected oil prices, in some cases the effects are obvious. For example, before 2009 the previously mentioned USO fund conducted its sales and purchases of contracts in a single day. These trades became large enough that they were affecting price volatility, forcing the fund to conduct its trades over four days. Now that such concerns have been addressed, the effect of ETFs on prices are less certain.