On September 22, 2014, Siemens (ticker: SIE), an $84 billion market cap engineering and electronics conglomerate based in Germany, announced the acquisition of Dresser-Rand (ticker: DRC) for $7.6 billion (Euros). Dresser-Rand is one of the world’s largest equipment suppliers in the oil and gas industry and specializes in rotating equipment solutions. The deal involves $6.4 billion in cash and the assumption of Dresser-Rand’s debt, which is $1.2 billion. Siemens hopes to close the transaction in summer of 2015.

Dresser-Rand will retain its name but will operate as an entity of Siemens after the deal is final.

What Siemens Gains

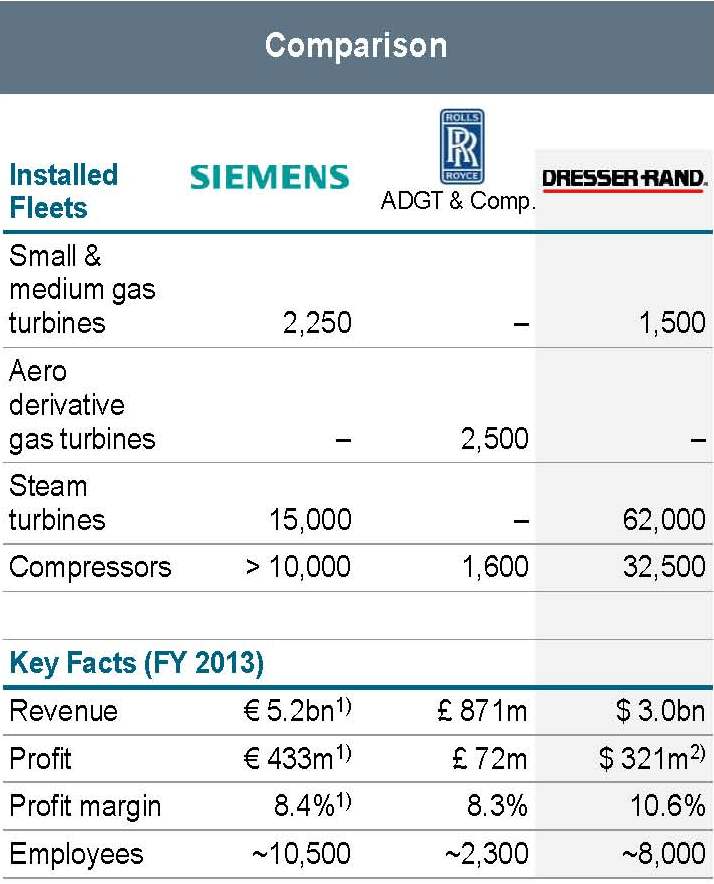

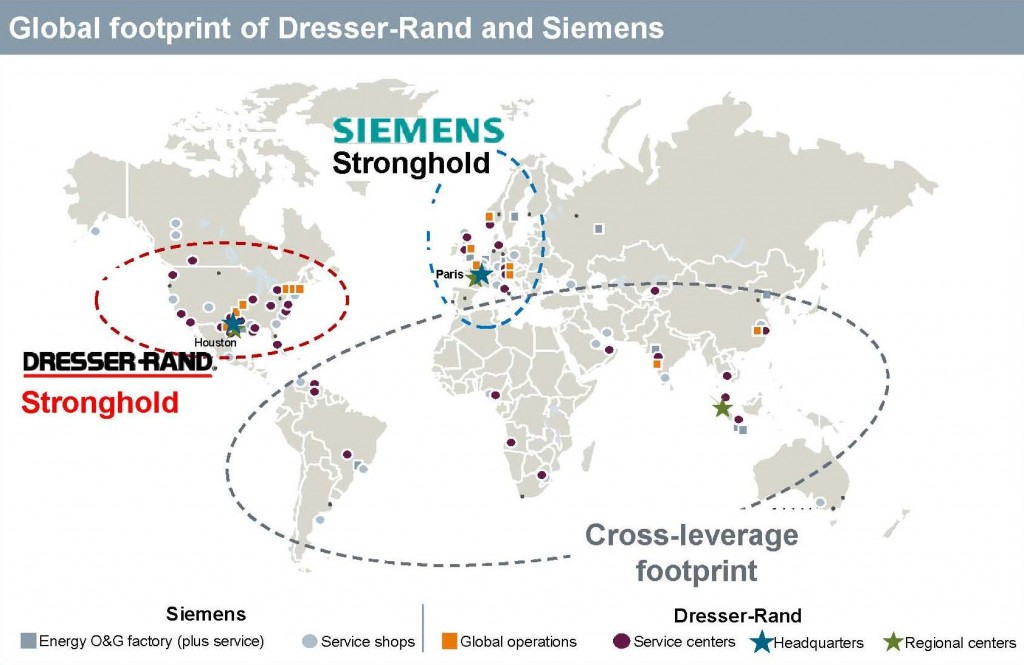

Siemens’ oil and gas segment acquires a multi-faceted position that covers all three levels of the industry. Dresser-Rand’s presence spans from gas lifts and power generation to transportation and sales, culminating in $3 billion of revenue in 2013. In a presentation covering the acquisition, Siemens identified Europe as its stronghold, while Dresser-Rand’s main operations are in the United States. At a Barclay’s conference on September 3, 2014, Dresser-Rand said 31% of its 2013 destination by revenue was from North America, while 26% was in Europe.

Dresser-Rand has a fleet of steam turbines and compressors at its disposal. The total number of units, once added to Siemens’ portfolio, will increase the company’s number of installed fleets to approximately 119,500 units from its current amount of less than 25,000. The Dresser-Rand deal comes on the heels of a $950 million (Euros) deal in May to boost Siemens’ presence in the gas turbine field.

“We do agree price has been on the high side,” said Josef Kaser, President and CEO of Siemens, in a conference call following the release. “But then again, it matters more what we have already created; we are absolutely clear that this is to be a major contribution to the further value creation within Siemens.”

Source: SIE Presentation (9.22.14)

Siemens, Pro Forma

Siemens’ main area of expertise is the production of gas turbines and equipment for natural gas extraction. Dresser-Rand’s specialty of compressors and turbines expands Siemens’ portfolio in the market, allowing Siemens to become a more streamlined entity.

The combination of the two companies will create additional cost savings thanks to bundling effects and access to field services. In the presentation, Siemens believes the efficiency will result in immediate savings of $180 million (Euros), and expanding to an additional $150 million (Euros) in realized annual savings by 2019.

Similar Case Study: General Electric

General Electric, now a competitor of Siemens, began its venture into oil and gas territory more than ten years ago, and its activity has increased simultaneously with the rising production rates in the United States. Rigs in operation are at the highest level since Baker Hughes began its rig breakdown in 1987. GE’s revenues have increased by 75% since 2009, which is the fastest rate of any segment of the conglomerate. A total of $17 billion in revenue was earned in 2013, and the company is developing new technologies to increase its footprint in the natural gas market.

GE forecasts an overall annual growth rate of 6% in all segments of oil and gas through the year 2017. Unconventional and LNG segments are expected to climb by 9% and 8%, respectively. Industry spending is already at a record, eclipsing the $700 billion mark this year.

GE has spent roughly $15 billion since 2002 in the creation of its oil and gas arm, including $11 billion on two separate deals in 2011. Among the acquisitions was $3.2 billion in the purchase of Converteam, an asset that helped GE build its case for energy efficiency, while another $2.8 billion was spent on a company specializing in hydrocarbon extraction from mature fields. Its landmark acquisition was in 2013, when Lufkin industries was purchased for $3.3 billion. GE was so convinced in the deal it sold its 49% stake in NBC Universal to finance it, ultimately providing the company with new access to pumping and power transmission technologies. GE management said as many as 94% of all wells will require an artificial lift at some point in their lifetime – an instrumental factor in the purchase.

Source: SIE Presentation (9.22.14)

At an oil and gas investor day on September 10, 2014, GE management noted its current revenue exceeds the money spent on previous acquisitions and emphasized the importance of entering the market early. The company believes energy demand will climb another 40% by the year 2035 and aims to “outpace” the market by innovating new technology and implementing its current market position.

Siemens Game Plan

Like its competitor, Siemens believes it is getting a jumpstart on a growing industry, with its main focus being on the use of compressors.

“If you look at just the number of opportunities in the upstream with many countries looking for more energy, the announcements around offshore installations, offshore field developments, the number of orders and such for FPSOs, all of those activity areas are very applicable for our current and new portfolio,” said Lisa Davis, Managing Director for Siemens. The company has historically used a 15% ratio in regards to cash return, and management believes it can achieve such a level in roughly three years, which is believed to be ample time to truly mesh the new business.

The company believes industry demand will flatten through 2015 before ramping up again as offshore developments and LNG projects progress. Siemens believes new business will account for 33% of income once the expected increase of offshore/LNG activity occurs, compared to Dresser-Rand’s current ratio of 25%.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

Capital One Securities (9/22/14)

Definitive merger agreement reached w/ Siemens. After nearly a quarter of being in utterly untouchable limbo we can now mercifully take the stock behind the barn and put it down. All-cash transaction valued at $7.6B (including assumption of ~$1.2B in DRC debt) or $83/share. Deal is expected to close in the summer of 2015. Additional per-share cash consideration of $0.55 will be applied on the first day of each month starting March 1, 2015, until closing occurs. Siemens will operate DRC as the company's oil and gas business utilizing the Dresser-Rand brand name, and apparently it will also retain the executive leadership team and Houston presence. Deal follows media reports of competing bidder Sulzer, which had indicated it had entered into discussions w/ DRC regarding a potential transaction early last week, and the mid July initial reports of potential Siemens interest/discussions. As indicated previously it's been a tiresome exercise over this period w/ underlying stand-alone DRC worth low $50s in our view w/ pedestrian low-double-digit % y/y EBITDA growth, continued working capital headwinds, and yet another upcoming round of unachievable 4Q guidance/downward forward year estimate revisions. Yet, w/ assumed synergies and the removal of corporate costs a defensible $75 - $85 takeout valuation hovered in the background and has now finally come to fruition.