Evolution Petroleum Corp. (ticker: EPM) has built its foundation asset in the Delhi field in NE Louisiana. Delhi is a unique, producing asset that delivers positive free cash flow—consistently.

The field is currently under CO2-EOR development. The company’s reserves report indicates that Evolution has approximately 10.8 MMBOE in total proved reserves as of June 30th, 2016.

The Delhi field production averaged 7,786 gross (2042 net) BOPD during Evolution’s March quarter—an increase of 25% since 2015. Evolution reports that the increase in production is largely a result of optimized CO2 flooding—wherein the company has selectively pumped its CO2 to higher yield zones in the reservoir.

During its March quarter, Evolution began production out of its NGL plant, which was responsible for the addition of approximately 200 BOEPD of natural gas liquids.

Optimizing EOR costs

Evolution has decreased its purchased CO2 volume from approximately 100 Mmcf per day in 2015, to 70 Mmcf per day currently. This has largely been a product of shutting off zones that show CO2 production, and more effective CO2 application.

The free cash flow story of Evolution

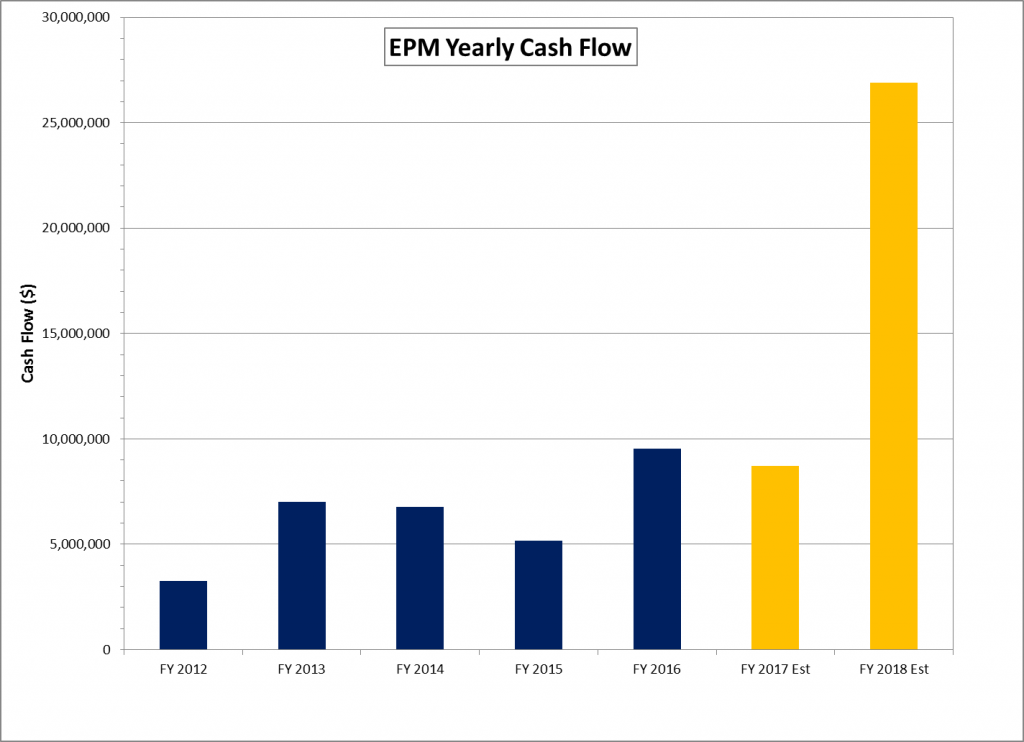

Evolution Petroleum has maintained a positive cash flow since 2012—also despite low commodity prices—and expects to increase its cash flow in 2018 to approximately $26.9 million.

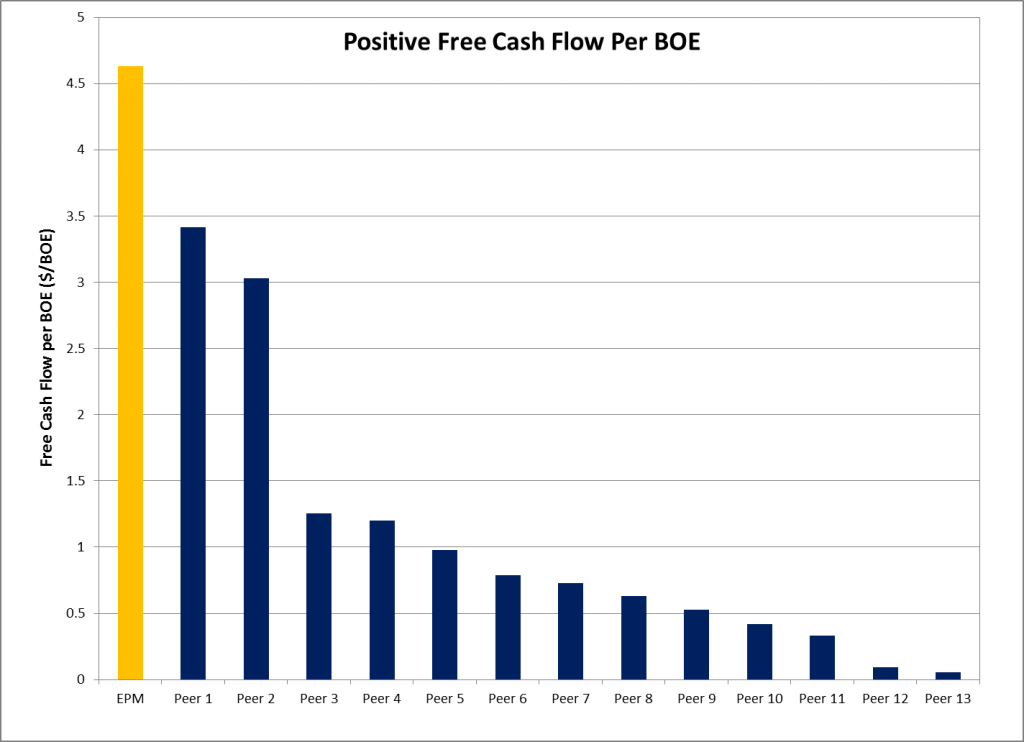

The amount of positive cash flow that Evolution generates, given its size, is substantial. The chart compares EPM to the other 14 cash-flow positive companies that achieved that enviable metric in 2016. EnerCom compared the companies on a cash-flow per BOE produced basis—to normalize the company sizes.

Dividend payouts

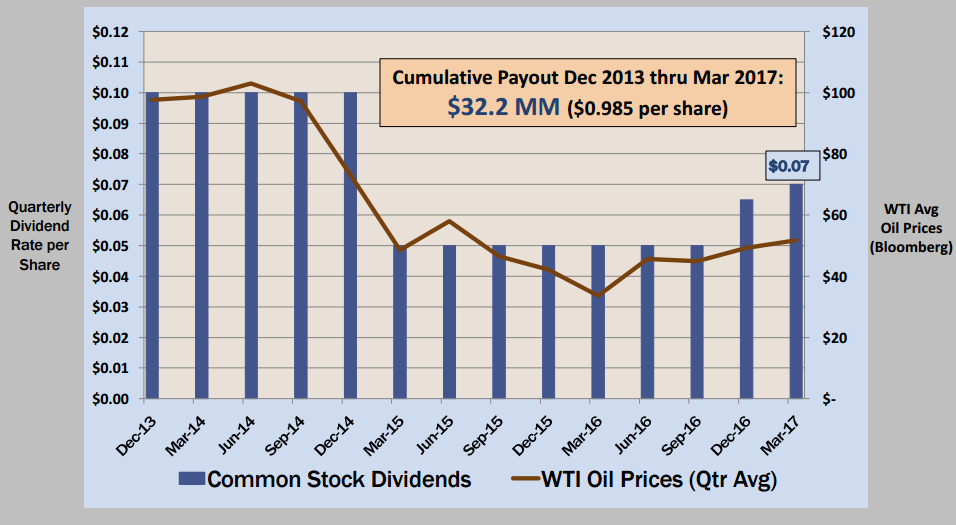

Evolution increased its dividend to $0.07 per common share, despite low commodity prices—and has totaled over $32 million in cumulative return to shareholders. Evolution has consistently paid dividends, despite low oil prices through the industry’s downturn. Since early 2015, when Evolution had to cut its dividend by 50%, it has gradually been growing its dividend.

Evolution Petroleum Corp. is presenting at EnerCom’s The Oil & Gas Conference® 22

Evolution will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.